Markup – definition and examples

The Markup is the amount a seller adds to the cost price of a product to cover overheads as well as profit. The term also refers to the process of correcting text in preparation for printing, as well as the end result. In budgeting, the term refers to a line-by-line review of a budget by a committee. The committee either approves, disapproves, or modifies the budget.

In the United States, a markup is a Congressional committee session at which a bill is put into final form before it goes out.

This article focuses on the meanings of the term when we use it in a business context.

The Cambridge Dictionary has the following definition of ‘markup’:

“The amount by which the price of something is increased before it is sold again.”

In other words, it is the difference between the wholesale price and the retail price.

A wholesaler is a business that sells to shops and other businesses; it does not sell to individual consumers. Retailers, on the other hand, sell to individual consumers.

We can express the markup figure as a fixed amount or as a percentage of the selling price.

Keystone markup

When the seller adds 100% to the wholesale price, we call it a keystone markup.

Markups are crucial for businesses not just to turn a profit, but also to cover variable costs such as labor, materials, and utilities that fluctuate with the volume of production or service provision.

Additionally, markups are strategically set to allow for discounts and promotions, giving businesses the flexibility to attract customers with special offers without incurring losses.

Markup vs. margin

Some people think the term means the same as margin. This is a mistake because their meanings are different.

Margin equals sales minus the cost of the goods that you sold.

Markup, on the other hand, is how much you raised the cost of the product in order to derive its selling price.

Accounting Tools makes the following comment regarding what can happen if we use these terms incorrectly:

“A mistake in the use of these terms can lead to price setting that is substantially too high or low, resulting in lost sales or lost profits, respectively.”

Markup – example

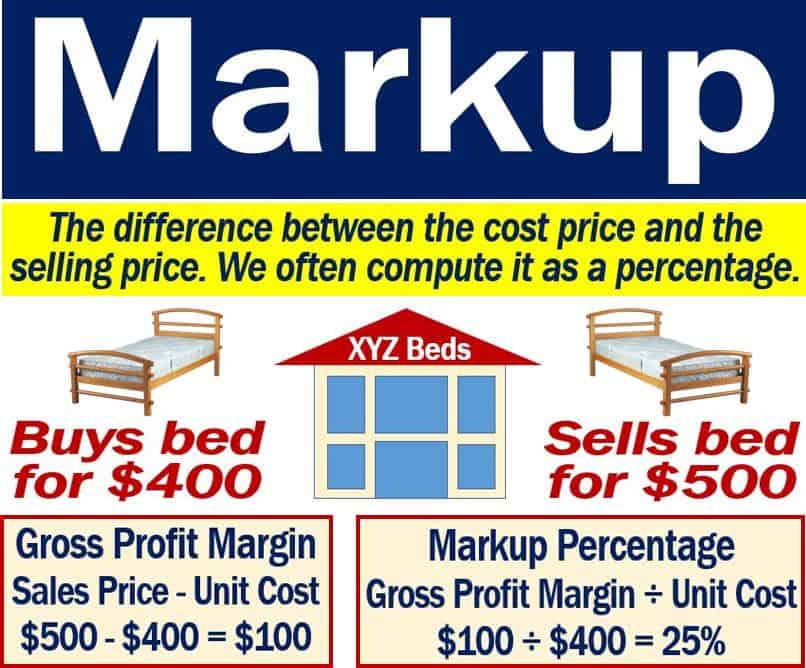

Let’s suppose XYZ Retail sells beds, i.e., it is a bed shop. It buys a bed from the wholesaler for $400 and then sells it to shoppers for $500. XYZ has a gross profit margin of $100.

To find out what the gross profit margin is, see the calculation below:

Gross Profit Margin = Sales Price – Unit Cost = $500 – $400 = $100

To determine what the markup is, in percentage terms, see the calculation below:

Markup Percentage = Gross Profit Margin ÷ Unit Cost = $100 ÷ $400 = 25%

The purpose of working out the percentage is to determine the ideal sales price for XYZ’ beds.

Meanings of compound words with ‘markup’

There are many compound words, especially in the retail sector, that include the term ‘markup.’ Let’s have a look at some common ones:

-

Cost-Plus Markup

A pricing strategy where a fixed percentage is added to the total cost of a product to determine its selling price. As in:

“The furniture store applies a cost-plus markup of 20% to all its items to ensure a profit margin while covering operating expenses.”

-

Retail Markup

The difference between the retailer’s cost for a product and the price at which they sell it to consumers. For example:

“The retail markup on the latest smartphone model could be as high as 50%, reflecting both the demand for the product and the retailer’s brand positioning.”

-

Variable Markup

Adjusting the markup on products based on factors like demand, seasonality, or competition. For instance:

“A variable markup is used on winter coats; it increases as the season approaches and decreases towards the end of the season during clearance sales.”

-

Gross Margin Markup

A method where the selling price of a product is derived by adding a specific gross margin percentage to the cost of the product. As in:

“If a retailer sets a gross margin markup of 30% on a coffee maker that costs $50, the selling price would be $65.”

-

Tiered Markup

A pricing structure applying higher or lower markups based on purchase volume or customer segment. For example:

“In a tiered markup system, a wholesaler might charge a 10% markup to retailers ordering 100 units, but only a 7% markup for orders exceeding 500 units.”

Vide – What is Markup?

This interesting video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Markup’ is using simple and easy-to-understand language and examples.