What is a minimum-variance portfolio?

A minimum-variance portfolio is a spread of investments with the lowest volatilities, i.e. those that are least likely to fluctuate in price because they have the lowest sensitivities risk.

The spread of investments taken together have a lower resultant risk level compared to the individual risk level of each stock.

People who are unwilling to take on any large risks should consider taking on a minimum-variance portfolio.

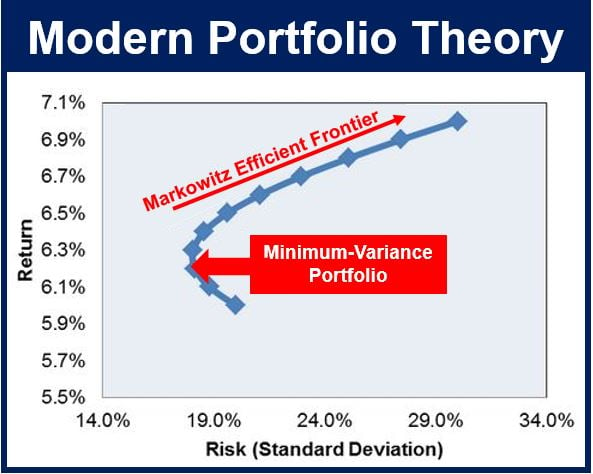

A minimum-variance portfolio is at the turn of the curve, where variance (price fluctuation likelihood) is at a minimum.

A minimum-variance portfolio is at the turn of the curve, where variance (price fluctuation likelihood) is at a minimum.

This type of portfolio is typically the ideal choice for individuals who are entering their sixties and seek a safer investment they can rely on for retirement.

Investors will generally shift from an ‘efficient portfolio’ (highest expected returns for a given risk) to a minimum-variance one as they approach retirement age.

Lowest risk level for rate of expected return

Minimum-variance portfolio refers to assets which are individually risky, but when taken together result in the smallest possible risk level for the expected rate of return.

With this type of portfolio, the investor hedges each investment with an offsetting investment. How much to offset investments depends on what level of risk the individual investor is willing to accept, plus his or her expected return.

The term was coined by American economist Harry Max Markowitz (born 1927), who received the 1990 Nobel Memorial Prize in Economic Sciences, in his Modern Portfolio Theory (MPT). In his MPT, volatility is used as a replacement for risk, in which less variance in volatility correlates to a lower risk in investment.

Video – Minimum-variance portfolio

This video explains how to solve for weights when constructing a minimum variance portfolio with 2 assets. After finding the weights of both assets, the speaker uses them to estimate expected return and volatility of the minimum variance portfolio.