Monetarism is a school of thought that believes that if you control the money supply, the rest of a country’s economy will take care of itself – the money supply is the main determinant of economic activity. Monetarism grew in opposition to the Keynesian policies of demand management that emerged during the Great Depression of the 1930s and grew in popularity after World War II.

The money supply is the total amount of money that is currently present in a country’s economy, i.e. all its money.

Supporters of monetarism are called monetarists. They believe that inflation is nearly always traced back to the government printing too much money – printing more money at a rate faster than GDP (gross domestic product) growth.

Monetarists claim that variations in the money supply are major drivers of national output in the short-term and on prices over the long-term.

According to The Street’s dictionary of financial terms to define Monetarism as follows:

“Monetarism is a school of economic thought that holds that the money supply is the main determinant of economic activity. In other words, if the money supply is growing, the economy will grow, and if money-supply growth is accelerating, so will economic growth. Monetarism’s leading advocate is the economist Milton Friedman.”

Monetarism and Milton Friedman

Milton Friedman (1912-2006), an American economist who received the 1976 Nobel Memorial Prize in Economic Sciences, argued that governments should keep the supply of money fairly steady, increasing it annually to allow for the natural GDP growth.

If governments managed to stick to this, Prof. Friedman added, market forces would on their own solve the problems of recession, unemployment and inflation.

Prof. Friedman and Anna Schwartz (1915-2012), an American economist at the National Bureau of Economic Research, considered as one of the world’s greatest monetary scholars, co-authored an influential book – A Monetary History of the United States, 1867-1960. In the book they wrote that ‘inflation is always and everywhere a monetary phenomenon’.

Prof. Friedman was against the existence of the Federal Reserve. However, given that it existed, he said that the policy of a central bank should be to keep the supply and demand for money at equilibrium, measured by growth in demand and productivity.

Monetarists are against the gold standard. Prof. Friedman believed that a pure gold standard was impractical. He accepted that one of the benefits of the gold standard was that it limited inflation.

However, if a country’s population or volume of trade outpaced the money supply, there would be no way to counteract reduced liquidity and deflation, except for the mining of more gold.

Monetarism gained prominence after it brought down the high inflation rates of the 1970s in the United States and United Kingdom. In 1979, inflation in the US peaked at 29%.

When President Ronald Reagan and Prime Minister Margaret Thatcher headed the governments of the US and UK respectively in the 1980s, monetarism spread across the world rapidly.

Monetarism greatly influenced the US Federal Reserve’s decision to stimulate the economy during the global financial crisis of 2007/8 and the Great Recession that it triggered.

What is the Monetarism equation?

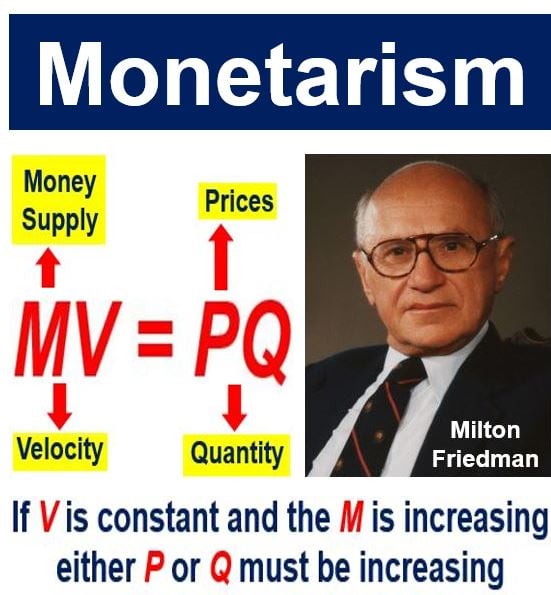

Central to the monetarism is the Equation of Exchange, which is expressed in the following equation:

MV = PQ

‘M‘ stands for the money supply, ‘V‘ is velocity or how often each year the average dollar is spent, ‘P’ represents the prices of products and services, and ‘Q’ is the quantity of goods and services.

The equation suggests that if V is constant and the Money Supply is increasing, either P or Q must be increasing.

Accordingly, monetarists argue that policymakers are able to control inflation by not allowing M to grow faster than the desired rate of GDP growth (Q).

Monetarism vs. Keynesianism and what it means?

Although monetarism grew in importance in the late 1970s, it was criticized by the school of thought that it sought to replace – Keynesianism. Keynesians believe that the key to economic output is demand for products and services.

Followers of Keynesian economics contend that monetarism fails as an adequate explanation of the economy because V is inherently unstable, and attach virtually no significance to the Quantity Theory of Money and the monetarist call for rules.

As the economy is subject to steep fluctuations and periodic instability, making the central bank stick to a preordained money target is dangerous, Keynesians argue. Central banks should have some ‘discretion’ (leeway) in implementing policy.

Keynesians claim that markets do not adjust to disruptions and rapidly return to a full employment level of output.

Keynesianism ruled during the first 25 years after WWII. However, monetarism strengthened considerably during the 1970s – a decade when inflation was high and GDP growth was slow. During the 1970s, Keynesian economics had no appropriate policy responses, while the monetarists – led by Prof. Friedman – argued convincingly that the high inflation rates were caused by steep spikes in the money supply, making the control of M (money supply) the key to good policy.

Paul A. Volcker became chairman of the Federal Reserve in 1979, and made combating inflation the central bank’s top priority. The Fed restricted the money supply to reduce inflation. Inflation declined considerably, however, it was followed by a major recession.

When Margaret Thatcher became Prime Minister of the United Kingdom in 1979, the UK had endured a decade of high inflation. Thatcher used monetarism as a weapon against high inflation, and managed to reduce it to less than 5% in 1983.

In an article published by the International Monetary Fund, Sarwat Jahan and Chris Papageorgiou wrote:

“Although most economists today reject the slavish attention to money growth that is at the heart of monetarist analysis, some important tenets of monetarism have found their way into modern non-monetarist analysis, muddying the distinction between monetarism and Keynesianism that seemed so clear three decades ago.”

“Probably the most important is that inflation cannot continue indefinitely without increases in the money supply, and controlling it should be a primary, if not the only, responsibility of the central bank.”

Video – Monetarism – Definition and Meaning

In this video, Roger Strickland explains how monetarists used the equation of exchange to determine the appropriate rate of growth of the money supply to control prices (inflation).