Monetary policy is the main focus of a central bank, it involves regulating the money supply and interest rates. The US Federal Reserve, the Bank of England, the European Central Bank, the Bank of Japan, the Bank of Canada, The Reserve Bank of Australia and other central banks manage monetary policy to control inflation, stabilize their country’s or region’s currency, and make sure the economy is moving in the right direction.

By regulating what effectively is the cost of money, a central bank can affect the amount of money that is spent by businesses and individuals.

Maintain stability and confidence

Monetary stability means confidence in the currency and stable prices. Stable prices are defined by the inflation target set by the government, which the central bank seeks to meet through the decisions made.

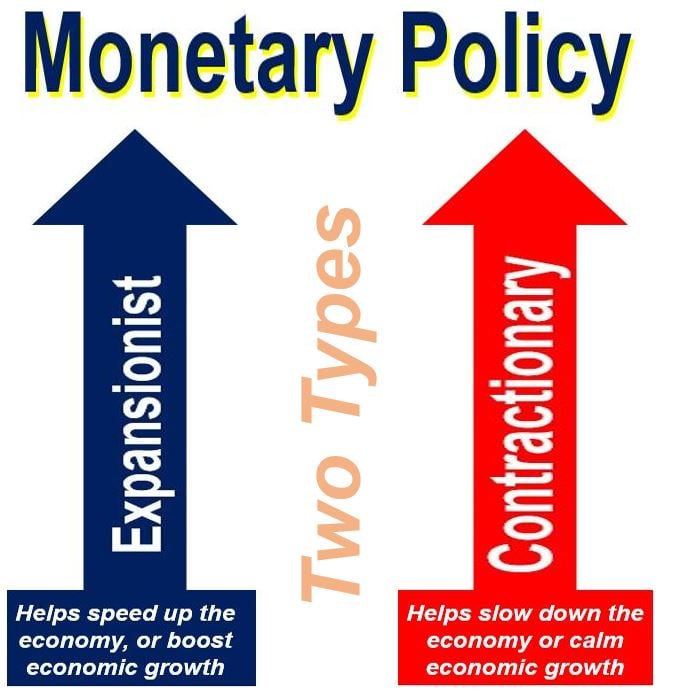

When the economy is sluggish central banks tend to go for an expansionist policy. However, if prices start rising too rapidly – if the economy is overheating – they will opt for a contractionary policy.

When the economy is sluggish central banks tend to go for an expansionist policy. However, if prices start rising too rapidly – if the economy is overheating – they will opt for a contractionary policy.

The US Federal Reserve System (Federal Reserve), America’s central bank, says the term refers to the actions it takes to influence the availability and cost of money and credit to help promote national economic goals.

The Federal Reserve Act of 1913 gave America’s Central Bank responsibility for setting the country’s monetary policy.

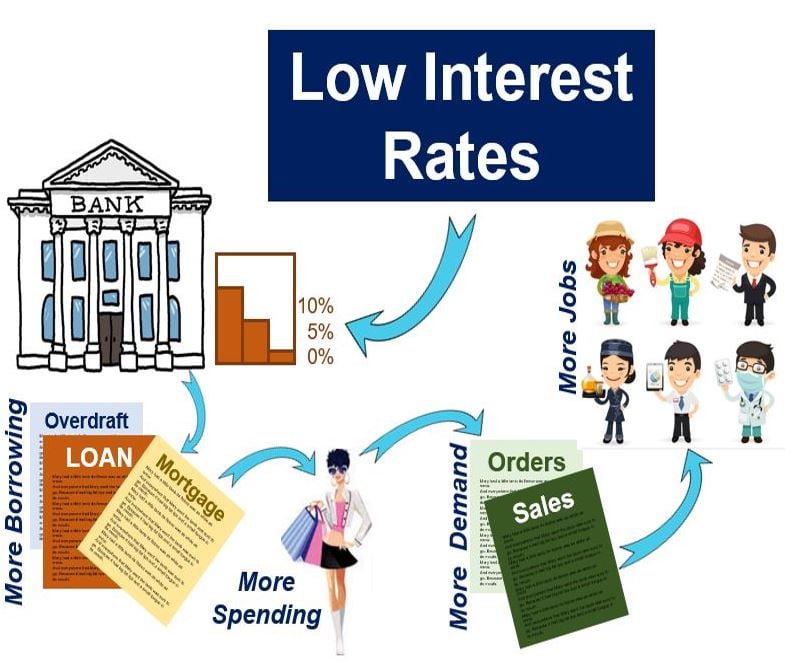

During a recession, the central bank adopts an expansionist monetary policy, initially by lowering interest rates in the hope that consumers and businesses borrow more, and so spend more, which eventually boosts the economy and creates more jobs.

During a recession, the central bank adopts an expansionist monetary policy, initially by lowering interest rates in the hope that consumers and businesses borrow more, and so spend more, which eventually boosts the economy and creates more jobs.

Three tools of monetary policy

The Federal Reserve, like most other central banks, controls three tools of monetary policy:

– Open market operations: this is the responsibility of the Federal Open Market Committee.

– The discount rate: responsibility of the Board of Governors of the Federal Reserve System.

– The reserve requirements: also the responsibility of the Board of Governors of the Federal Reserve System.

Using these three tools, the US central bank influences the demand for and supply of balances that depository institutions hold at the Federal Reserve Banks, and in this manner alters the federal funds rate.

Changes in the federal funds rate generate a chain of events that affect several short-term interest rates, as well as long-term rates, foreign exchange rates, the amount of money and credits, and ultimately a series of economic variables including the prices of goods and services, output and employment.

The Federal Reserve says the following regarding the Federal Open Market Committee:

“The Federal Open Market Committee (FOMC) is firmly committed to fulfilling its statutory mandate from the Congress of promoting maximum employment, stable prices, and moderate long-term interest rates.”

“The Committee seeks to explain its monetary policy decisions to the public as clearly as possible. Such clarity facilitates well-informed decision-making by households and businesses, reduces economic and financial uncertainty, increases the effectiveness of monetary policy, and enhances transparency and accountability, which are essential in a democratic society.”

In the UK, the Bank of England’s (BoE’s) Monetary Policy Committee (MCP) makes monetary policy decisions, including the setting of interest rates. It sets an interest rate it judges will make sure that the inflation target is met.

The MCP consists of nine members: the Governor; the three Deputy Governors for Markets & Banking, Financial Stability, and Monetary policy; the BoE’s Chief Economist, plus four external members appointed directly by the Chancellor of the Exchequer.

Monetary Economics

Monetary Economics: this is a division of Economics that looks at monetary theory, the effects of monetary variables on the macroeconomic system, the role of the Central Bank, and the conduct of monetary policy.

In the London School of Economics, for example, it may be part of several degree courses, including BSc in Business Mathematics and Economics, BSc in Economics and Economic History, BSc in Mathematics and Economics, BSc in Philosophy Politics and Economics, and BSc in Social Policy and Economics.

Expansionary and contractionary monetary policy

Monetary policy is referred to as being either contractionary or expansionary. A contractionary policy expands the money supply slower than usual, and even sometimes shrinks it.

An expansionary policy, on the other hand, expands the total supply of money in the economy more rapidly than usual.

Traditionally, expansionary policy is used to try and bring down unemployment during a recession by lowering interest rates in the hope that businesses will borrow more and thus expand.

When inflation picks up, a contractionary policy may be used in order to avoid resulting distortions and declining asset values.

Monetary policy is not the same as fiscal policy, which refers to government spending, taxation and borrowing related to government spending.

Quotes using the term ‘monetary policy’

“Monetary policy cannot do much about long-run growth, all we can try to do is to try to smooth out periods where the economy is depressed because of lack of demand,” (Ben Bernanke – an American economist and former Chair of the Federal Reserve).

“Domestic inflation reflects domestic monetary policy,” (Martin Feldstein – a well-respected American economist, currently the George F. Baker Professor of Economics at Harvard University, and president emeritus of the National Bureau of Economic Research).

“My bottom line is that monetary policy should react to rising prices for houses or other assets only insofar as they affect the central bank’s goal variables – output, employment, and inflation,” (Janet Yellen – an American economist, current Chair of the Federal Reserve).

“However, in spite of the general perception that monetary policy should be conducted so as to avert deflation, a central bank cannot lower interest rates below the zero lower bound,” (Toshihiko Fukui – Japanese economist, former Governor of the Bank of Japan, former Director of the Bank for International Settlement).

“Any debate among politicians about monetary policy is counterproductive,” (Gerhard Schroder – Chancellor of Germany from 1998 to 2005).

“Poland is one of the few countries that can afford to conduct a conventional monetary policy and that means we have to act against the buildup of imbalances in the economy,” (Marek Marian Belka – Polish professor of Economics, former Prime Minister and Finance Minister of Poland).

“There is always the potential for a central bank to engage in discretionary monetary policy and to break the one-to-one link between changes in foreign reserves and changes in the money supply,” (Steve Hanke – an American applied economist at the Johns Hopkins University in Baltimore).