What is a natural monopoly? Definition and meaning

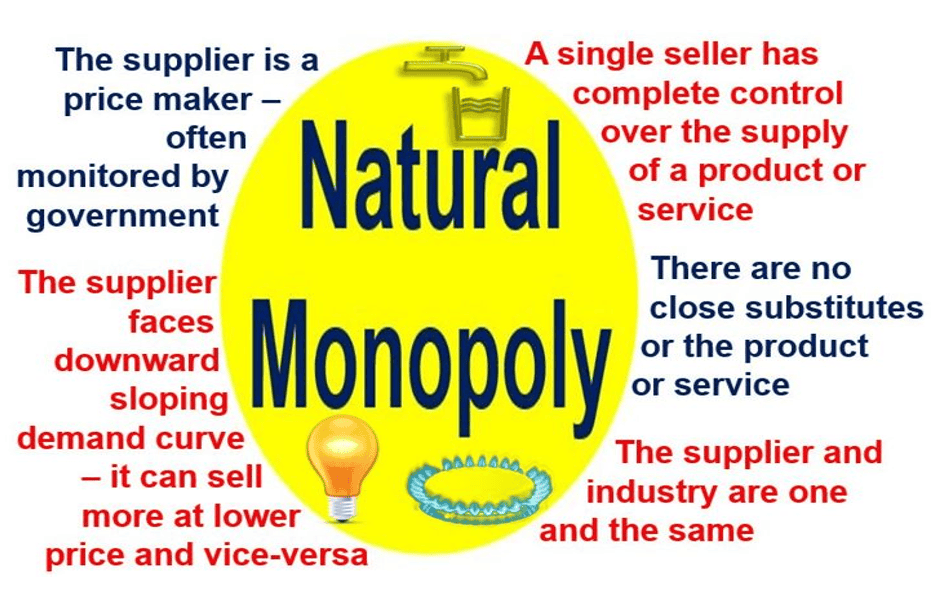

A natural monopoly exists when it makes more economic sense for just one company to supply the whole market compared to having two or more competitors, mainly because of the economies of scale that are available in that market. Natural monopolies are common where expensive infrastructure has to be installed and maintained. Water distribution, for example, requires digging up huge areas or ground and laying down a vast network of pipes to deliver water to people’s homes, businesses, golf clubs, parks, and other entities.

If there is just one water company in a town or region, the cost per customer is usually lower than would be the case if there were rival suppliers.

Natural monopolies exist where fixed costs and/or startup costs are extremely high. They may also arise in industries were unique raw materials and/or technology are required.

The Economist’s glossary of terms says that a natural monopoly occurs: “Because it is more efficient for one firm to serve an entire market than for two or more firms to do so, because of the sort of economies of scale available in that market. A common example is water distribution, in which the main cost is laying a network of pipes to deliver water.”

Natural monopoly – government oversight

Governments allow these natural monopolies to exist because they make economic sense and are in the best interests of its citizens. However, they are usually closely monitored to make sure there is no abusive monopolistic-type behavior in which consumers might fail to get a fair deal.

Natural monopolies do not exist as a result of hostile takeovers, consolidation or collusion. Capital costs (startup costs) as well as maintenance costs (fixed costs) are strong deterrents for potential competitors.

According to BusinessDicitonary.com, a natural monopoly by definition is:

“Situation where one firm (because of a unique raw material, technology, or other factors) can supply a market’s entire demand for a good or service at a price lower than two or more firms can.”

“Such situations occur usually in case of utilities or where a market can support only one producer (because the decreasing returns to scale make the optimum plant size large in relation to the demand) or where long-range average total cost is declining with higher output throughout the range of the possible demand.”

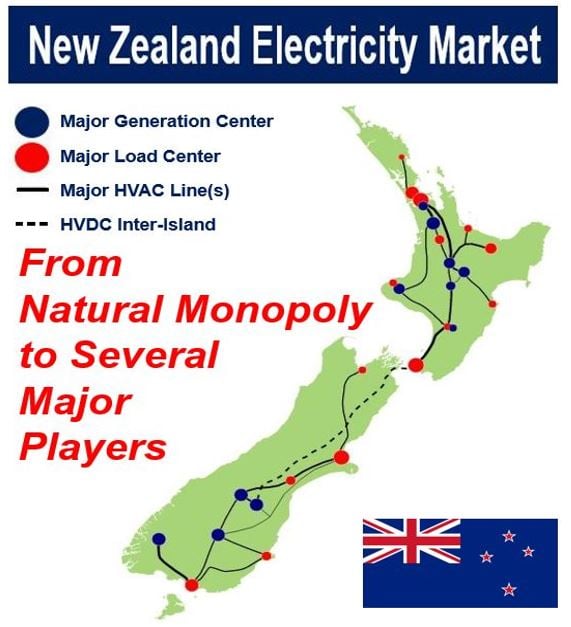

In New Zealand in 1946, electricity generation and transmission became state-controlled, under the SHD (State Hydro-Electric Department) and NZED (New Zealand Electric Department). The Electricity Division of the Ministry of Energy became responsible for electricity generation, transmission, policy advice and regulation in 1978. During the last 2 decades of the last century, the state-owned companies were sold off, and today the country’s power generation and distribution is dominated five companies. (Image: Adapted from Wikipedia)

In New Zealand in 1946, electricity generation and transmission became state-controlled, under the SHD (State Hydro-Electric Department) and NZED (New Zealand Electric Department). The Electricity Division of the Ministry of Energy became responsible for electricity generation, transmission, policy advice and regulation in 1978. During the last 2 decades of the last century, the state-owned companies were sold off, and today the country’s power generation and distribution is dominated five companies. (Image: Adapted from Wikipedia)

Most public utilities – companies that provide utilities such as natural gas, water, electricity, etc. – are natural monopolies.

Natural monopoly – legislation

A monopolist that achieved its position through natural monopoly effects is able to and might be tempted to abuse its market position. That is why governments have legislation and regulations and closely monitor them.

A business hoping to enter a market which is currently dominated by a natural monopoly may urge the government to introduce legislation.

Common reasons for having regulations include:

– Limiting a firm’s ability to abuse its market power.

– Facilitating healthy competition.

– Promoting system expansion or investment.

– Stabilizing markets.

This is especially true in cases where the natural monopolist provides a product or service that consumers cannot refuse – for which there is no substitute.

If there is just one supplier of water, electricity or cooking/heating gas, consumers must continue buying from the monopolist, regardless of prices.

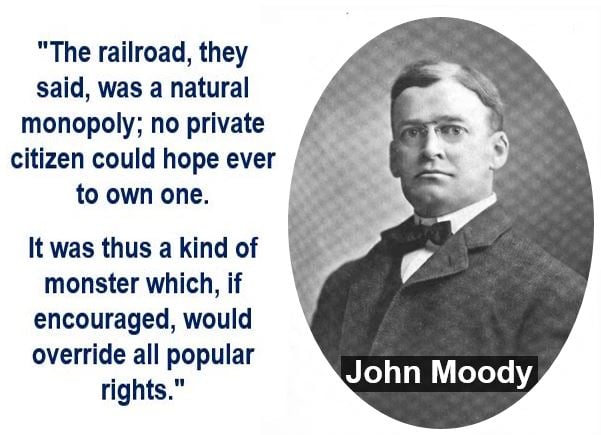

John Moody (1868-1958) was an American businessman, financial analyst and investor. He was the first to rate bonds and founded the Moody’s Investros Service. (Image: Adapted from Wikipedia)

John Moody (1868-1958) was an American businessman, financial analyst and investor. He was the first to rate bonds and founded the Moody’s Investros Service. (Image: Adapted from Wikipedia)

Nationalizing natural monopolies

One way to make sure that a private natural monopoly cannot abuse its market power is to nationalize it – for the state to provide the good or service.

After WWII, there was a nationalization wave across Europe, with state-owned companies taking over the provision of electricity, water, gas, mass-transportation, postal services and telecommunications.

However, having the state as the provider of a product or service is no guarantee that the public interest is protected and no abuse or unethical behaviors occur. Governments can use their utility services as a source of money for funding other activities, or even as a means of gaining hard currency. In some countries, public officials steal money from these companies for their own personal gain.

Many state-owned companies across some emerging economies today have been literally ‘milked’ dry by their governments, and currently have obsolete and inefficient infrastructures.

For example, Petróleos de Venezuela, S.A. (Petroleum of Venezuela), also known as PDVSA, is unable to pump anywhere near as much oil today as it did ten years ago because of a serious lack of investment in infrastructure and equipment.

A combination of nepotism, corruption, incompetence and lack of investment has led to serious inefficiencies and accidents in PDVSA’s installations. According to the International Energy Agency, Venezuela was pumping over 3 million barrels of oil per day in 2009, and only managed 2.4 million per day in 2015.

In a CNN Money article – Crisis-stricken Venezuela has another big problem – Matt Egan wrote:

“Analysts have long warned that Venezuela wasn’t investing enough money into its oil industry. That’s a problem because oilfields naturally deteriorate over time, and so do the facilities that service the fields.”

“These issues were masked by high prices. But with crude oil prices down by 50% from two years ago the issues are being amplified.”

Another reason for the decline in oil production in Venezuela is electric power generation, which is also state owned. Lack of investment and incompetence mean that electricity generation and distribution is failing miserably.

Venezuela is riddled with daily blackouts across the country. When oil installations have no electricity, work has to stop or slow down considerably if the only available power comes from back-up generators.

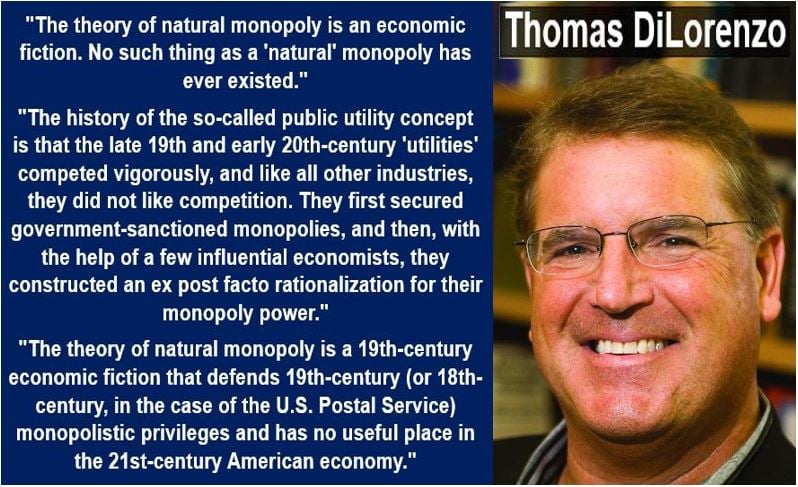

Thomas James DiLorenzo (born: 1954) is an American economics professor at Loyola University Maryland Sellinger School of Business. He is an ardent believer of the free market, and identifies himself as a follower of the Austrian School of Economics. He started to study libertarianism in college, where he claims he gained perspective on his developing ideas. He frequently speaks at von Mises Institute events, and writes for the blog LewRockwell.com. (Image: Adapted from mises.org)

Thomas James DiLorenzo (born: 1954) is an American economics professor at Loyola University Maryland Sellinger School of Business. He is an ardent believer of the free market, and identifies himself as a follower of the Austrian School of Economics. He started to study libertarianism in college, where he claims he gained perspective on his developing ideas. He frequently speaks at von Mises Institute events, and writes for the blog LewRockwell.com. (Image: Adapted from mises.org)

Privatization of state-owned natural monopolies

During the last two decades of the 20th century, many European countries sought other solutions for their inefficient, state-owned natural monopolies – namely, allowing the provision of goods and services on a commercial basis through private participation, but with clear and comprehensively-enforced regulations and close supervision.

Margaret Thatcher (1925-2013), who was the British Prime Minister from 1979 to 1990, initiated the privatization boom, which was copied across the globe. In her memoirs Mrs. Thatcher wrote, regarding privatization of state-owned companies:

“It was one of the central means of reversing the corrosive and corrupting effects of socialism. Just as nationalization was at the heart of the collectivist program by which Labour governments sought to remodel British society, so privatization is at the center of any program of reclaiming territory for freedom.”

Mrs. Thatcher’s policy led to over fifty companies being sold or privatized.

According to NetMarketShare.com, Windows has virtually total dominance in the world’s operating systems market. Windows 7, 10, XP, 8.1, 8, Vista, NT, 98 and 2000 represented 91.7% of the global market in December 2016. The astronomical startup cost means that the natural monopoly phenomenon in this market won’t change for a very long time. Windows Vista, which came out a decade ago, cost an estimated $6 billion to create.

According to NetMarketShare.com, Windows has virtually total dominance in the world’s operating systems market. Windows 7, 10, XP, 8.1, 8, Vista, NT, 98 and 2000 represented 91.7% of the global market in December 2016. The astronomical startup cost means that the natural monopoly phenomenon in this market won’t change for a very long time. Windows Vista, which came out a decade ago, cost an estimated $6 billion to create.

Software market – a natural monopoly?

Many people say that natural monopoly is a phenomenon that exists in the software industry. Creating the software – software development – is extremely expensive, but duplicating it as soon as it is completed is incredibly cheap.

Windows 95, for example, cost hundreds of millions of dollars to create – while the cost of producing each Window 95 box was virtually zero.

As Microsoft’s market share rocketed, its average costs plummeted, which in turn meant lower prices for the consumer.

So, should we be cheering and encouraging such software monopolies and welcoming their economic benefits? An article in Stanford University’s Engineering Department’s website has the following comment:

“Not exactly. The world is not so simple and businesses are not so fair. First of all, there is a good reason why natural monopolies are regulated by the government. Because the electric company has a monopoly, consumers are unresponsive to price changes; if a company doubled the price of electricity, people would have to pay it because they have no one else to buy it from. Only strict government regulation keeps the corporate greed in check.”

“The price of software like Windows 95 is determined, not by how much it costs to make, but by how much people are willing to pay for it. Bill Gates would probably not be happy about putting his company’s pricing into the hands of Washington.”

“Another problem with software natural monopolies is the suffocation of innovation which would accompany it. Innovation in electricity production may not be of vital concern, but in the software industry, innovation is everything. A company with a monopoly, natural or otherwise, has little incentive to improve its product. Only the possibility of real competition can keep a software company on its proverbial toes.

Video – Natural Monopoly Diagram Meaning

In the video, the speaker explains how to draw one of his favorite diagrams – The Natural Monopoly Diagram.