What is the natural rate of unemployment? Definition and meaning

The natural rate of unemployment is the difference between those who would accept a job at the current wage rate and those who are able and willing to take a job – it is the rate of unemployment when the labor market is said to be in equilibrium. It is a controversial phrase that basically means the lowest rate of unemployment at which the employment market can be in stable equilibrium – when there is no tendency for inflation to go up or down.

The natural rate of unemployment is also known as the constant inflation rate of unemployment or the non-accelerating inflation rate of unemployment.

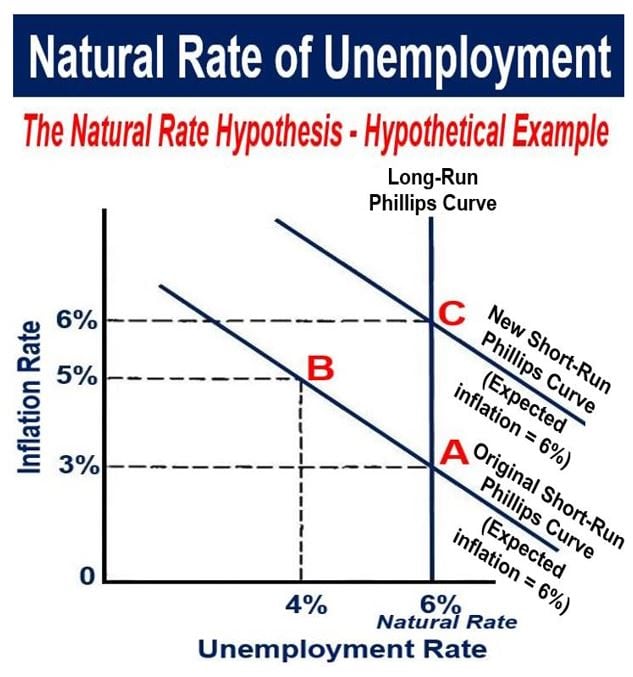

Encouraged by the Phillips Curve (see image below), Keynesian economists assumed that a government could reduce the unemployment rate if a little more inflation were acceptable.

In an article published by the Federal Reserve Bank of Kansas City, former Vice President and Director of Payments System Research at the Fed, defines the natural rate of unemployment as:

“That rate of unemployment at which there is no tendency for inflation to accelerate or decelerate. When the economy is at the natural rate, inflation is constant from one year to the next. Workers and firms come to expect this inflation rate and base their decisions on it.”

Read the explanation below regarding this image. (Source: kansascityfed.org)

Read the explanation below regarding this image. (Source: kansascityfed.org)

Natural rate of unemployment – explanation with illustration

To gain a more comprehensive understanding of why and how an economy eventually settles at the natural rate of employment, consider the example (hypothetical) depicted in the illustration above.

Suppose the economy starts off at Point A (in the image), with inflation at 3% and the natural rate of unemployment at 6%. As unemployment is at its natural rate – with employees and companies getting and expecting 3% inflation – pressure for change is minimal. Consequently, the economy will remain at Point A.

Imagine that policymakers raise aggregate demand to try to reduce unemployment below the 6% rate – perhaps they’ll borrow more or initiate a more expansionary monetary policy. With the growth in aggregate spending in either case, employers will want to take on more workers. They may have to bid up wages to attract the employees who are in short supply.

Higher wages will lead to price increases. Hence, the first effect of the expansionary policy will be a reduction in the unemployment rate and higher inflation. The economy will move to Point B.

Many politicians say that Point B is better than Point A, because even though inflation has gone up a bit – from 3% to 5% – unemployment has declined – from 6% to 4%.

Economists Stuart Weiner and Milton Friedman both warned policymakers to resist the temptation to get government to spend its way to lower unemployment rates, because the higher inflation does not go away, while the reduction in the unemployment rate is only temporary. (Images: Stuart Weiner – economics.dartmouth.edu. Milton Friedman – thelibertarianrepublic.com)

Economists Stuart Weiner and Milton Friedman both warned policymakers to resist the temptation to get government to spend its way to lower unemployment rates, because the higher inflation does not go away, while the reduction in the unemployment rate is only temporary. (Images: Stuart Weiner – economics.dartmouth.edu. Milton Friedman – thelibertarianrepublic.com)

Point B, however, is unsustainable, and the economy will move to Point C.

Why can’t the economy just stay at Point B? Remember that at Point A employees were expecting inflation to be steady at 3%. Even though inflation rose to 5% at Point B, workers are still expecting a 3% inflation rate. Most workers’ wages are still tagged to the 3% inflation rate.

Soon, as contracts expire and new ones are negotiated, workers and their trades unions will demand 5% wage hikes. However, there will be no rise in aggregate demand – if wages rise by 5% and prices rise by 5%, aggregate demand is unchanged.

As wages rise, prices will increase further, because they are being fueled by both higher workers’ pay and greater government spending. Eventually, the economy will settle with a 6% unemployment rate and a 6% inflation rate. This is not more desirable than the initial position (Point A) of 6% unemployment and 3% inflation.

A poisoned chalice?

American economist Milton Friedman (1912-2006), who received the Nobel Prize for Economics in 1975, and other monetarist economists warned that this ‘inflation-for-jobs’ trade-off was a dangerous trap.

Professor Friedman said that any government that tolerated higher inflation in its attempt to bring down unemployment would soon see that the decline in joblessness was short-lived – it would fall a bit and then rapidly return to its previous level – but inflation would increase and remain high.

The monetarist economists argued that unemployment has a natural rate or equilibrium that is determined by the ‘structure’ of the labor market and not how much demand there is in an economy.

Regarding Prof. Friedman and other monetarists’ beliefs, the Economist’s glossary of terms writes:

“They argued, unemployment has an equilibrium or natural rate, determined not by the amount of demand in an economy but by the structure of the labor market. This is the lowest level of unemployment at which inflation will remain stable.”

“When unemployment is above the natural rate demand can potentially be increased to bring it to the natural rate, but attempting to lower it even further will only cause inflation to accelerate. Hence the natural rate is also known as the non-accelerating-inflation rate of unemployment, or NAIRU.”

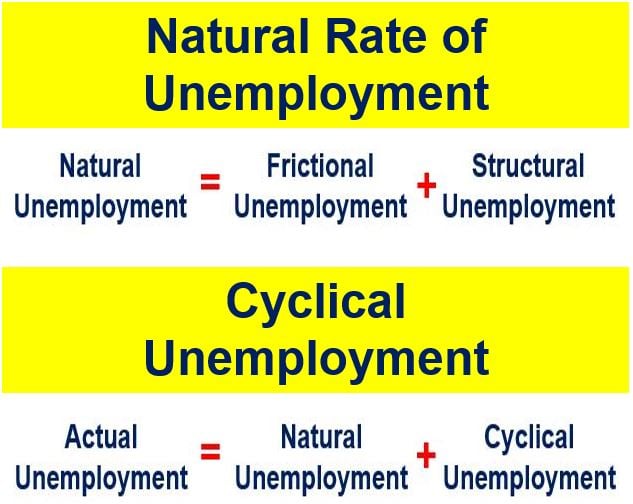

According to EconomicsHelp.org: “The natural rate of unemployment measures the unemployment when the labour market is in equilibrium. It is composed of supply side unemployment such as frictional and structural unemployment. Cyclical Unemployment is unemployment due to negative economic growth, or output being below full capacity.”

According to EconomicsHelp.org: “The natural rate of unemployment measures the unemployment when the labour market is in equilibrium. It is composed of supply side unemployment such as frictional and structural unemployment. Cyclical Unemployment is unemployment due to negative economic growth, or output being below full capacity.”

What determines the natural rate of unemployment?

Prof. Friedman said that the natural rate of unemployment is determined by the following institutional factors:

– Skills, Education & Training: the level of occupational mobility depends on the labor force’s levels of skills and the quality of education and retraining schemes.

– Degree of Labor Mobility: this refers to how easily workers can move to different jobs within a country’s economy. The two factors that drive the mobility of labor are: 1. Geographical mobility – how easily people can move between different parts of the country or internationally to seek employment. 2. Occupational mobility – how easily a worker can move from one type of job to another.

– Availability of Employment Information: a factor in determining how long people spend between jobs – in the process of moving from one job to another – known as ‘frictional unemployment’.

– How Flexible the Labor Marker is: for example, powerful trades unions can severely restrict the supply of labor to certain markets.

– Hysteresis: a concept which states that history influences the value of a current issue. Economists say that historical rates of unemployment probably influence the current and future unemployment rates. For example, when there is a recession, the natural rate of unemployment also rises, because when workers are out of work for longer than a certain period they become demotivated, start losing their skills, and find it harder to get new jobs.

Video – Natural rate of unemployment

This CherwellOnline video, aimed at British ‘A Level’ students (like US High School AP exam students), focuses on the definition of the natural rate of unemployment.