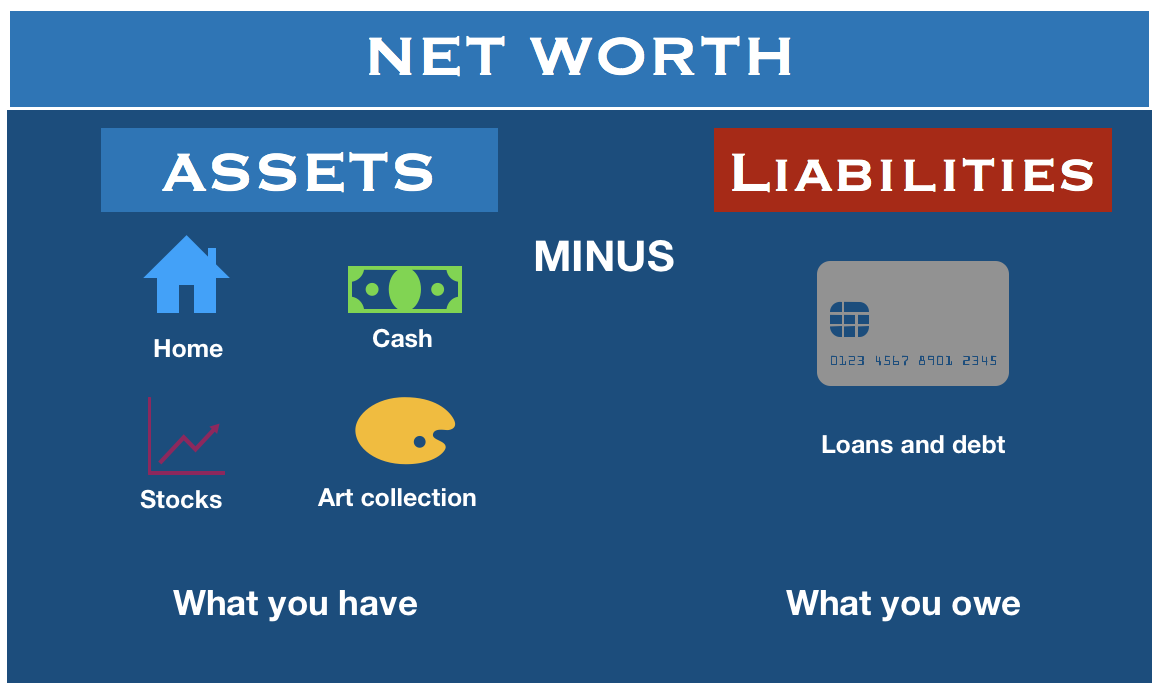

Net worth is calculated by subtracting the net liabilities of an entity (individual or company) from their net assets.

Net worth is a term used to describe the value of an entity.

Simply put, it is the difference between what is owned and what is owed.

An increase in net worth is an indicator of good financial health. In contrast, a continuous decrease in net worth (which could be caused by annual losses) is a sign of bad financial health.

In business, the terms “book value” or “shareholders’ equity” are the same as net worth. It is a component in several financial ratio calculations, including the price-to-book ratio.

It is commonly used to measure the creditworthiness of a company as it provides an accurate picture of its investment history.

The first thing a bank wants to find out, apart from your credit history and employment status when you apply for a loan, is your net worth.

The first thing a bank wants to find out, apart from your credit history and employment status when you apply for a loan, is your net worth.

Example of calculating net worth

Assume a man has the following assets: a house worth $300,000, an investment portfolio valued at $50,000 and cars and other assets valued at $15,000.

His liabilities include: an outstanding mortgage balance of $50,000 and a car loan of $4,000.

This particular individual’s net worth would be $311,000.

[Net assets ($365,000) – Net liabilities ($54,000)] = $311,000

In March 2015, Bill Gates, the co-founder of Microsoft Corporation, had the world’s greatest net worth ($79.2 billion), followed by Mexican telecoms mogul Carlos Slim, and American investor Warren Buffet.