A non-performing loan, also known as an NPL, is a loan where the borrower has stopped paying the installments on the principal (original amount) and interest – it is effectively in default or very close. The term canalso be spelled nonperforming loan without the hyphen.

Most loans become non-performing if payments are more than 90 days overdue – this will depend on the terms of the contract.

As soon as a loan is non-performing, the likelihood of it being repaid in full are considered to be significantly lower.

If payments resume on a non-performing loan, it becomes a re-performing loan, even if the borrower is still behind on payments.

Banks and other financial institutions may opt to sell their non-performing loans in order to clear their balance sheets of risky assets. They are sold to Asset Management Companies (AMCs), which try to recover as much of the money owed as possible.

AMCs use public or bank funds to remove non-performing loans from the banks’ books.

Federal Home Loan Mortgage Corporation (Freddie Mac) often sells non-performing loans. On its website, the US public government-sponsored enterprise writes:

“Subject to market conditions, Freddie Mac plans to periodically sell seriously delinquent non-performing loans (NPLs) it owns via competitive auctions. NPL sales are an important tool for the company to more effectively manage credit losses on its delinquent loan portfolio.”

Too many non-performing loans can seriously harm a bank’s prospects.

Too many non-performing loans can seriously harm a bank’s prospects.

Financial institutions usually set money aside to cover potential losses on loans (loan loss provisions). They write off their bad debt in their profit and loss account.

Authorities monitor non-performing loans closely

Non-performing loans can cause serious problems for lenders. They are no longer producing income and represent money that is probably lost, thus posing cash problems for banks.

In the United States, for example, if a bank has too many non-performing loans it will be scrutinized carefully by the FDIC (Federal Deposit Insurance Corporation), an independent agency created by Congress to maintain stability and public confidence in the country’s financial system.

According to the European Commission:

“Non-performing loans, or “NPLs”, are bank loans that are subject to late repayment or are unlikely to be repaid by the borrower.”

Example of a non-performing loan

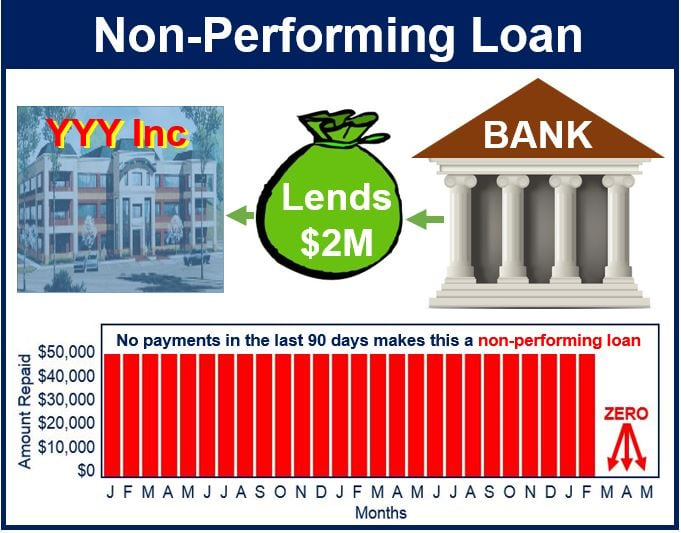

Imagine XXX Bank granted a $2 million loan to YYY Inc. The arrangement was for YYY to repay in monthly installments of $50,000. The borrower promptly paid every month for two years, and then ran into serious cash flow problems because its main client went bankrupt.

It has now been three months without any payments coming in from YYY. At this point XXX has a non-performing loan. If YYY continues not paying, the odds of the bank ever getting its money back decline considerably.

A non-performing loan is a type of bad debt.

Non-performing loans to total loans ratio

Banks usually report their ratio of non-performing loans to total loans (bank non-performing loans to total gross loans) as a measure of the quality of their loans outstanding. A smaller ratio points to lower losses for the bank, while a larger ratio could mean the bank is or will be in trouble.

Bank non-performing loans to total gross loans are defined by the World Bank as:

“The value of nonperforming loans divided by the total value of the loan portfolio (including nonperforming loans before the deduction of specific loan-loss provisions). The loan amount recorded as nonperforming should be the gross value of the loan as recorded on the balance sheet, not just the amount that is overdue.”

Other languages

Here is the term non-performing loan in various other languages:

- Spanish: Préstamo moroso, Crédito moroso.

- Hindi: गैर-निष्पादित ऋण (Gair-niṣpādit ṛṇa)

- French: Prêt non performant

- Arabic: قرض غير مُنتج (Qard ghair muntij)

- Bengali: অপ্রদর্শন ঋণ (Aprodarshan ṛṇa)

- Russian: Неработающий кредит (Nerabotayushchiy kredit)

- Portuguese: Empréstimo não produtivo

- Indonesian: Pinjaman bermasalah

- Urdu: غیر کارکردگی قرض (Ghair karkardagi qarz)

- German: Notleidender Kredit

- Japanese: 不良債権 (Furyō saiken)

- Swahili: Mkopo usiofanya kazi

- Marathi: अकार्यक्षम कर्ज (Akāryakṣam karja)

- Telugu: నిరుపయోగి ఋణం (Nirupayogi ṛṇaṁ)

- Turkish: Sorunlu kredi

- Korean: 부실 대출 (Busil daechul)

- Tamil: செயல்பாடு இல்லாத கடன் (Seyalpaadu illaatha kadan)

- Vietnamese: Khoản vay không hiệu quả

- Italian: Prestito non performing

- Gujarati: અકાર્યક્ષમ લોન (Akāryakṣam loan)

- Farsi: وام غیرعملی (Vam ghair-amali)

- Bhojpuri: बेकाम ऋण (Bekam ṛṇa)

- Hakka: (No standard translation available)

- Mandarin Chinese: 不良贷款 (Bùliáng dàikuǎn)

- Cantonese Chinese: 壞賬貸款 (Wái jeung tái fūn)

- Jin Chinese: (Likely similar to Mandarin, with dialectal variations)

- Southern Min: (Likely similar to Mandarin, with dialectal variations)

- Kannada: ನಿಷ್ಕ್ರಿಯ ಸಾಲ (Niṣkriya sāla)

Video – What is a Non-Performing Loan?

This video, from our sister channel in YouTube – Marketing Business Network, explains what a ‘Non-Performing Loan’ is using simple and easy-to-understand language and examples.