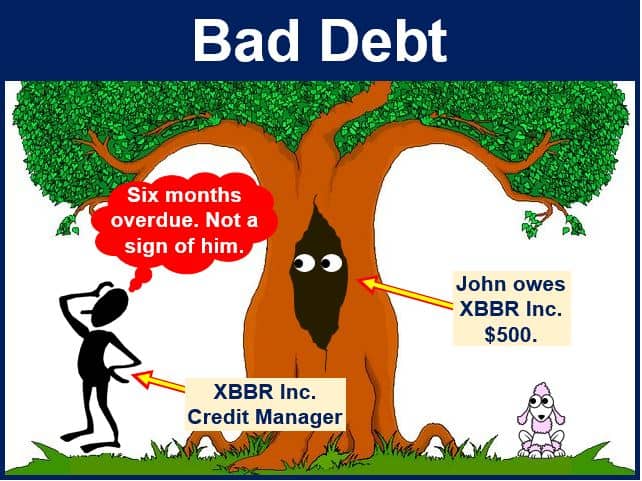

Bad debt – definition and meaning

A Bad Debt, Bad Loan, or Delinquent Loan is money that a debtor borrowed and won’t pay back. The definition can vary from country to country, company to company, and different accounting conventions. In personal finance, the term refers to high-interest debt on goods that consumers bought from retailers.

In the United States, a loan with over ninety days’ arrears becomes a ‘problem loan’. Companies should write off the full amount of a delinquent loan to the profit and loss account. Additionally, businesses should make provisions for bad loans as soon as they foresee them.

Bad debts not only affect the financial health of the lending institution but can also have broader economic implications, as high levels of delinquent loans can lead to tighter lending standards and reduced credit availability in the economy.

Bad debts and bankruptcies

A bad debt is typically the result of the borrower going into bankruptcy. The creditor may class a loan as a bad loan if it decides that the cost of chasing payment is too high. In other words, if recovering the money costs more than the value of the debt. In such cases, the lender will probably write off the bad debt as an expense.

** The creditor is the person or firm that lent the money. Debtors owe money to creditors.

Most businesses sell their products on credit, even though some sales might be to customers with poor credit ratings. Firms that make credit sales should estimate what proportion of invoices sent out will never be paid – this can usually be found in their allowance for doubtful accounts.

The credit control department in a company determines who to offer trade credit to, as well as chasing bad debts.

Effective credit management strategies, including thorough credit checks and regular monitoring of accounts, can significantly mitigate the risk of accumulating bad debts.

Bad credit

Do not confuse the term with ‘bad credit.’ Bad credit refers to a person’s or company’s credit score. If you have bad credit, it means that you have a bad credit score, i.e., your credit score is low.

People with a low credit score have had problems paying their debts. Either they did not pay back their debts at all or they were late. Their credit history does not look good. The lower your credit score, the harder it is to get a loan.

Bad debt versus doubtful debt

A bad debt is money somebody owes that the creditor clearly identifies as not being collectible. The company’s accountant will remove that money due from accounts receivable. Accounts receivable is money a company expects to come in from customers who purchased goods or services on credit.

A doubtful debt is an account receivable that could turn into a bad debt at some point in the future. For the moment, however, there is no certainty – the debtor might or might not pay.

There is no clear margin separating the two definitions. What one company may define as a bad debt another may call a doubtful debt.

The US Internal Revenue Service (IRS) says the following regardig the term:

“You have a bad debt if you cannot collect money owed to you. A bad debt is either a business or a nonbusiness bad debt. A business bad debt is a loss from the worthlessness of a debt that was either created or acquired in your trade or business, or closely related to your trade or business when it became partly or totally worthless.”

Bad debt in personal finance

In personal finance, bad debt generally means high-interest consumer debt – debt that is not beneficial in the long-term.

A mortgage is not a loan because the borrower has the potential to profit from a rise in the price of his or her home.

Credit card debt, and many credit arrangements done with purchases from retailers are bad debts, because they are taken on for consumption and interest rates are very high.

Consumer goods, unlike property, nearly always go down in value over time – so the borrower owes more on debts from their purchases than their worth.

Video – What is a Bad Debt?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Bad Debt’ is using simple and easy-to-understand language and examples.