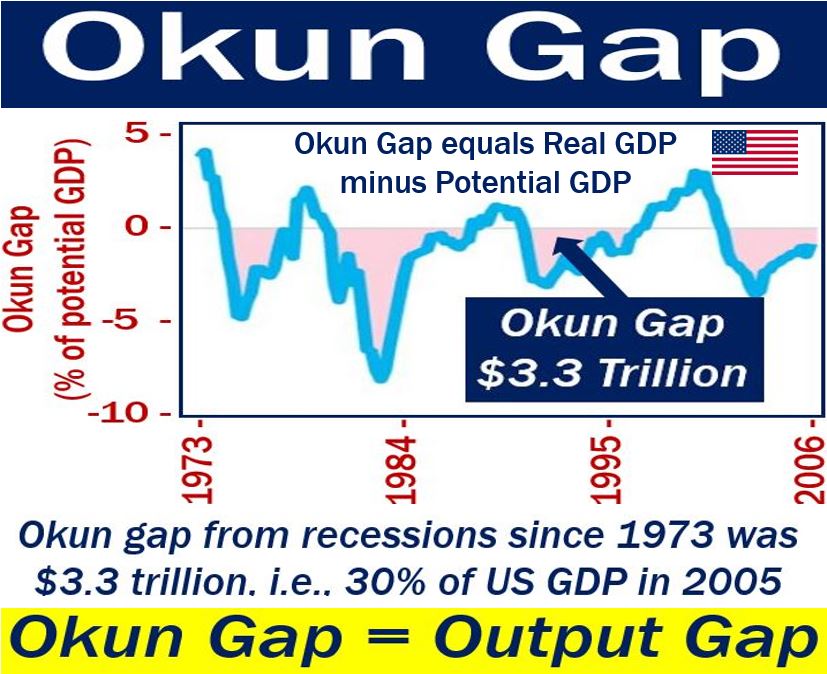

The Okun gap or output gap is the difference between an economy’s potential and actual GDP. We refer to the Okun gap as an inflationary gap when actual output is larger than the potential output. Conversely, we refer to it as a recessionary gap when the actual output is inferior to the potential output.

The money supply, unemployment, and some other factors contribute to the difference between an economy’s potential and actual GDP. GDP stands for Gross Domestic Product.

Okun gap – a macroeconomic term

The term ‘Okun gap’ is a macroeconomic term. Macroeconomics focuses on general or large-scale economic factors, such as GDP, interest rates, prices, and unemployment.

We can express an Okun gap in either absolute or percentage terms. In other words, the total amount in dollars or a percentage of GDP.

It is a measure of how much output the economy produced in a given time relative to its full-employment level.

American economist Arthur Okun (1928-1980) discovered Okun’s law. He was a professor at Yale University and a senior economist at the CEA (1968/69) during President Lyndon Johnson’s term in office. CEA stands for Council of Economic Advisers.

Okun’s law is an empirical relationship in economics. It states that a certain change in GDP results in a different but correlated change in the unemployment rate. The Okun gap is one of the relationships Prof. Okun described in Okun’s law.

Prof. Okun once said that the notion that all unemployment is the result of high wages is a myth. It is like believing that a hole in a flat tire is on the bottom because the bottom is flat.

Okun gap equation

Okun reasoned that when the unemployment rate is high so are idle resources. Therefore, one could expect the actual rate of output to be below its potential. However, an extremely low rate of unemployment would correlate with a reverse scenario.

Thus, the Okun gap took the following form:

Unemployment Rate = C + D (Gap between potential and actual output)

Variable ‘C‘ is the unemployment rate in relation to full employment.

Implications of the Okun Gap on Policy Decisions

Understanding the Okun gap is vital for policymakers and economists as it serves as an indicator of the overall health and efficiency of an economy.

A large gap suggests that there is a potential misalignment between resources and production capabilities. This information can be instrumental for central banks and governments in making informed decisions about monetary and fiscal policies.

For instance, when the actual output is significantly less than the potential output (recessionary gap), policymakers might consider adopting expansionary fiscal policies, like increasing public spending or reducing taxes, to stimulate economic growth.

On the other hand, when the actual output surpasses potential output (inflationary gap), contractionary policies should be adopted to control inflation and stabilize the economy.

Ultimately, the Okun gap provides a foundation for actionable insights that can lead to more effective economic strategies and interventions.