Operating Expenses, OpEx, or Operational Expenses are the ongoing costs you need to pay to keep your business running day-to-day, such as wages (payroll), advertising, utilities, and rent or lease payments.

The term Running Costs essentially means the same as operating expenses.

Operating expenses cover the essentials of operating your company, but they do not directly create the products or services for sale. In other words, they are the costs associated with the regular operations of a business, excluding the direct costs of creating goods or services.

Understanding operating expenses is crucial for anybody who is involved in running a business or analyzing its financial health.

American Express says the following about operating expenses (OpEx):

“OpEx is the sum of all the everyday expenses a business incurs to deliver services or products to its customers. For example, a coffee shop’s OpEx would include staff salaries, the energy it needs to run its espresso machines, the rent it pays to lease its premises, advertising and promotion, and staff salaries and benefits.”

Financial Management

Understanding your operating expenses is a critical part of financial management. These costs can affect your business in many ways. Let us take a look at three of them:

- Profitability

Operating expenses eat into your revenue. The lower your expenses, the higher your profits are likely to be. However, they should not be so low that they impede the effective functioning of the company.

- Pricing Strategy

When setting your prices, you must make sure that you cover your operating expenses, otherwise you will be running your business at a loss.

- Planning and Forecasting

Tracking your expenses is vital for accurate planning and forecasting, as it helps you predict future cash requirements for your company’s growth.

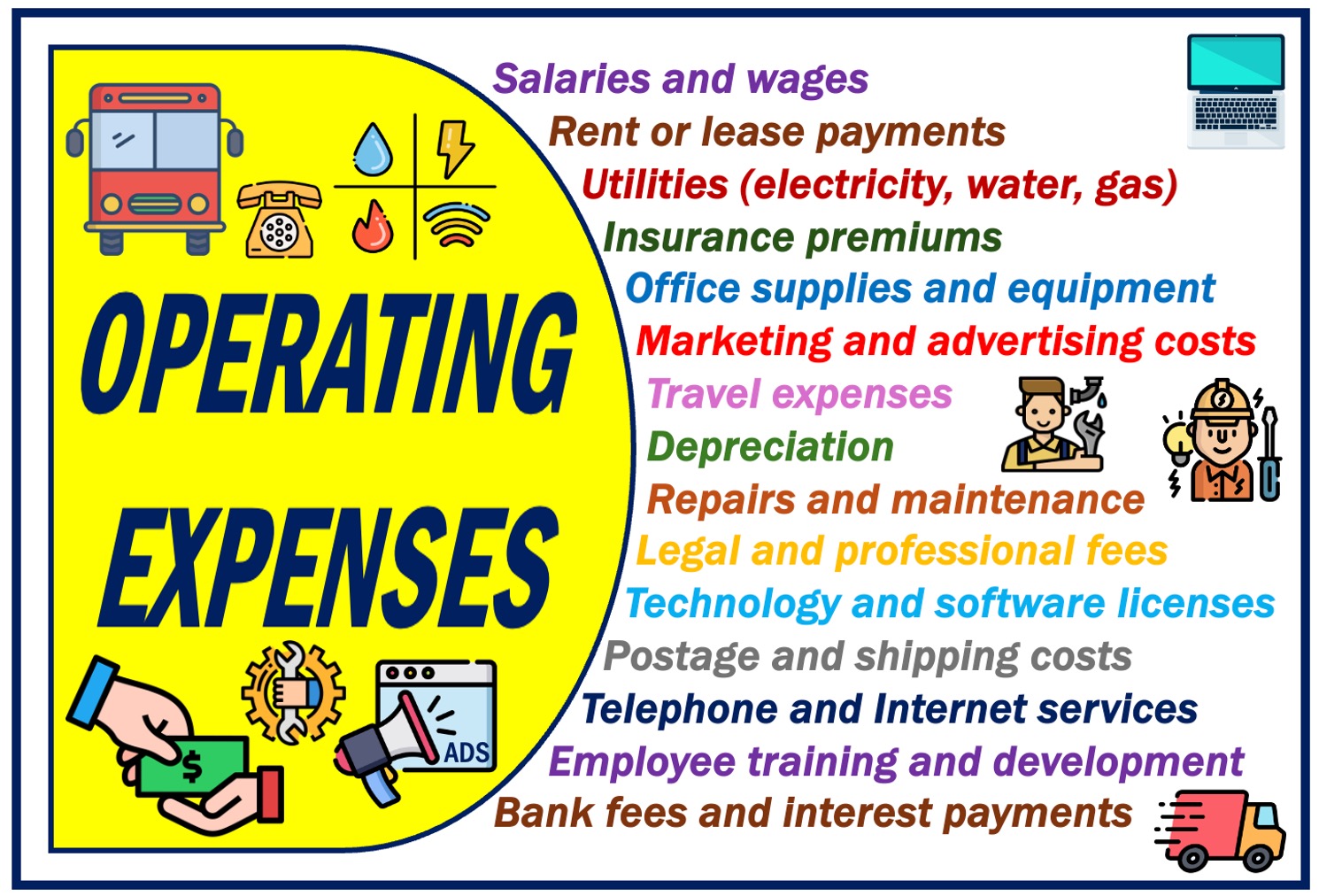

Examples of Common Operating Expenses

Let’s explore some of the various categories of operating expenses:

-

General and Administrative

This broad category includes office rent, utilities, insurance, legal and accounting fees, office supplies, non-production salaries, software subscriptions, company-wide training, and depreciation of office equipment and furniture.

-

Payroll

Salaries, benefits, bonuses, commissions, employee insurance, retirement contributions, and payroll taxes for employees.

-

Marketing and Advertising

Costs for promoting your business, such as website development, online ads, social media marketing, email campaigns, search engine optimization (SEO), trade shows, promotional materials, public relations, and print campaigns.

-

Research & Development (R&D)

Spending on developing new products, improving processes, innovating services, conducting market research, prototyping, product testing, patent filing fees, and collaboration with external research institutions.

-

Cost of Goods Sold (COGS)

The costs directly tied to creating your products. This includes raw materials, direct labor for manufacturing companies, production supplies, factory overhead such as utilities for the production facilities, freight and transportation costs, and costs associated with the warehousing of inventory.

Operating Expenses vs. Capital Expenses

Do not use these two terms interchangeably – their meanings are different:

- Operating Expenses (OpEx)

OpEx is for everyday needs. Examples include rent, electricity, or employee wages and bonuses.

- Capital Expenses (CapEx)

CapEx refers to long-term investments such as purchasing a building, machinery, or vehicles.

When managing your business’ finances, it is crucial to be able to distinguish between OpEx and CapEx, as they are treated differently for accounting and tax purposes.

Managing Operating Expenses

Managing operating expenses effectively can help your business thrive. Here are some tips to optimize these costs and enhance your company’s financial health:

-

Monitor and Track

Regularly review your expenses to spot trends. This can help you identify areas where you can cut costs.

-

Budgeting

Set budgets for different categories of operating expenses. This will help prevent overspending.

-

Negotiation

Be alert for opportunities to reduce costs by negotiating with suppliers or service providers.

-

Process Improvement

Look for ways to make work more efficient, which can potentially streamline processes and thus lower labor or materials expenses.

-

Leverage Technology

Invest in automation and technology that can handle routine tasks. This upfront investment not only saves your company money in the long run but also minimizes errors.

-

Energy Efficiency

Adopt energy-saving measures to cut costs; even small changes can meaningfully lower your utility bills and boost profitability.

Final Thoughts

Operating expenses are a natural part of doing business. If you can manage these expenses effectively, you are more likely to maintain profitability and achieve long-term success.