Optimal price – definition and meaning

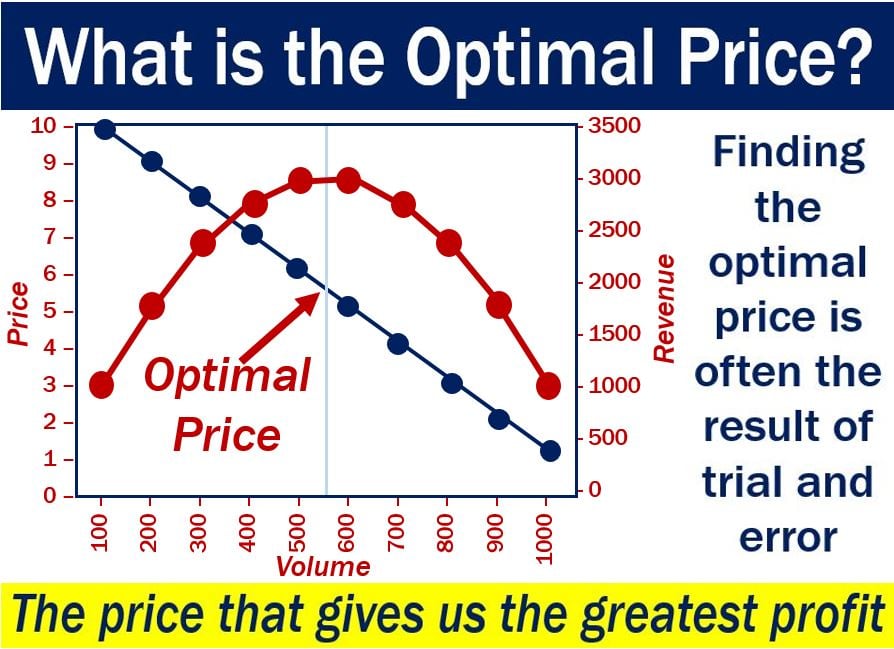

The Optimal Price is the price at which a seller can make the most profit. In other words, the price point at which the seller’s total profit is maximized. We can refer to the optimal price as the Profit-Maximizing Price. The optimal price refers to both products and services. There are various ways to determine this price.

If a product’s price is too low, the manufacturer is moving lots of it. However, the company is not earning the maximum possible profit from that product.

However, when a product’s price is too high, the manufacturer moves too few units. Even though it earns a high margin per unit, its profit is not the highest possible.

Most companies find their optimal price through trial and error. When they find the price point that gives them the ideal sales volume, they have reached the optimal price.

The word ‘price‘ refers to how much the seller will accept for the sale of something.

According to accountingtools.com, this is the definition of “optimal price”:

“The optimal price is that price point at which the total profit of the seller is maximized. When the price is too low, the seller is moving a large number of units but is not earning the highest possible aggregate profit.”

How to set your optimal price

Getting the price right for a good or service is crucial. It is one of the most important decisions business people make for their company.

However, getting the optimal price is not easy. Below are some tips for setting your optimum price:

-

The product’s perceived value

You need to find out what your customers and potential customers perceive to be the value of your product.

Then, you will know what your maximum price is.

Perceived value matters much more than ‘actual’ value. Ideally, your product should have a greater perceived value than actual value.

-

What are your competitors charging?

What your competitors charge is important. You need to find a way of differentiating your product from your rivals’ if you want to charge a premium.

Sellers of commodities have little flexibility with price. For example, one gas station (UK: petrol station) cannot raise its price higher than another station’s price across the road.

-

Cost structure

In an Entrepreneur article, Doug and Polly White say that we should first focus on variable costs. Variable costs are those that increase as revenue grows.

For example, labor and material costs are variable. Variable costs determine what your lowest-possible price is.

We cannot set a price below variable prices because we will lose money if we do.

Price minus variable costs equals the amount of money you can make on each unit you sell. We call this the ‘variable contribution.’

We should then focus on fixed costs. These are costs that never change, regardless of how much we sell. For example, the rent of the premises is a fixed cost.

By dividing the fixed costs by the variable contribution, we get how many units we must sell to break even.

If you believe you can reasonably sell that many units, that’s great. However, if you can’t, it means that your price is too low. Therefore, you will need to raise the price.

-

Profit target

Now we add our profit target to fixed costs. We then divide the total by the variable contribution. We will then have how many units we must sell to reach our profit objective.

Regarding getting the price, right, Doug and Polly White write:

“If it is reasonable to believe that you can achieve this number of units at the price you are planning to charge, great. If not, you may need to adjust your price either up or down.”

According to economic theory, as prices rise volume will decline. You might need to make price adjustments over time to determine how they affect profits.

For example, does a slight reduction in price result in enough of a volume increase to raise profits? Conversely, does a price rise result in higher profits, even if volumes decline a bit?

You will need to continue adjusting your price until you reach the optimal price. Strategic price adjustments, while seeking the optimal price, must also account for market dynamics and consumer behavior trends to ensure long-term profitability.

-

Monitor your competitors’ responses

It is very unlikely that your business is a monopoly. There are others in the market trying to sell similar products to your target customers. In other words, competitors react to their rivals’ behaviors and actions.

Whenever you make a decision, try to factor in what your rivals will do. And above all, monitor their responses carefully.

Successful implementation of an optimal pricing strategy not only boosts profits but also enhances the product’s positioning in the market, aligning with consumer expectations and demand.

“Optimal price” – vocabulary & example sentences

There are many terms in business English related to “optimal price,” especially compound nouns. A compound noun, such as “optimal price strategy,” is a term that consists of at least two words. Here are seven such compound nouns, their meanings, and examples of how we can use them in a sentence:

-

Optimal Price Point

The specific price at which the combination of profit and volume is maximized for a product or service.

Example: “After extensive market research, the company set the optimal price point for its new product to attract the maximum number of customers while ensuring a healthy margin.”

-

Optimal Price Strategy

A planned method of pricing products or services to achieve maximum profit.

Example: “The company’s optimal price strategy involved a detailed analysis of market trends, consumer purchasing patterns, and competitive pricing.”

-

Optimal Price Model

A mathematical or theoretical model used to calculate the best pricing for goods or services.

Example: “Using an optimal price model, the firm was able to determine the most profitable pricing structure for its entire range of products.”

-

Optimal Price Range

A set range of prices considered ideal for selling a product and achieving the best profit margin.

Example: “The marketing team suggested an optimal price range that would make the product competitive yet profitable.”

-

Optimal Price Analysis

The process of examining various prices to identify the one that will yield the highest profit.

Example: “The financial analysts conducted an optimal price analysis to ascertain the impact of different pricing scenarios on the company’s bottom line.”

-

Optimal Price Determination

The act of deciding the best price for a product based on various economic factors.

Example: “Optimal price determination is crucial for the product launch, as it can significantly affect the initial market penetration.”

-

Optimal Price Adjustment

The act of changing prices to reach the most profitable level after considering market feedback.

Example: “The company made an optimal price adjustment after the initial product release to better align with consumer expectations and willingness to pay.”

Video – What is Optimal Price?

This video, from our sister channel on YouTube – Marketing Business Network, explains what the ‘Optimal Price’ is using simple and easy-to-understand language and examples.