Ordinary share – definition and meaning

An Ordinary Share is a form of corporate equity ownership, i.e., a type of company share. We also call it a voting share. The United Kingdom and Commonwealth countries use the term ‘ordinary share,’ while the United States uses the term ‘common stock.’ It is the most common form of share that investors buy and sell in stock markets.

These shares embody the fundamental principle of equity investment, offering a balance between risk and potential growth.

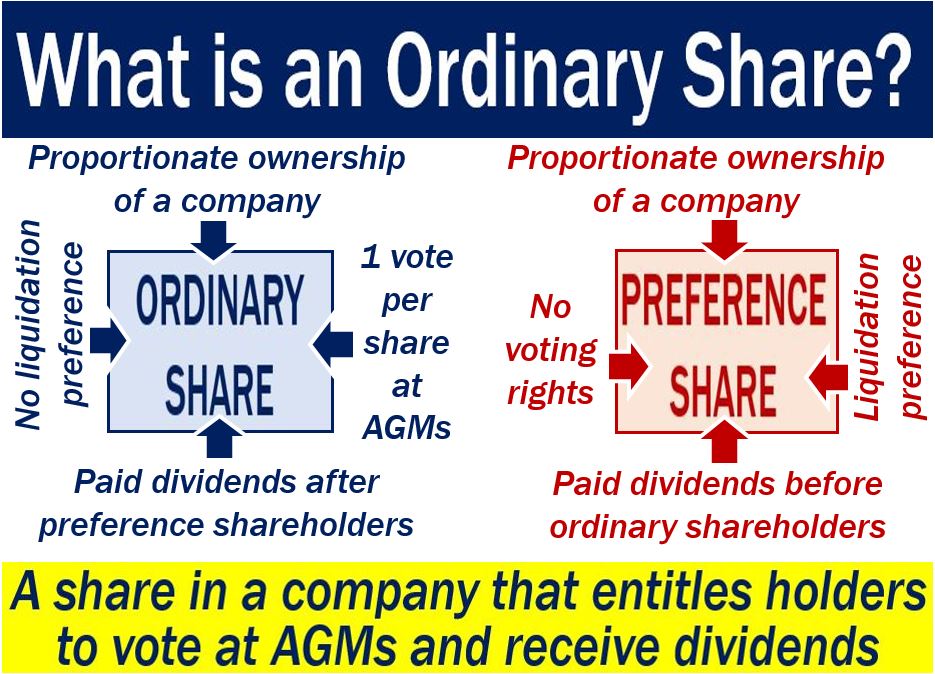

An ordinary share gives the owner the right to receive dividends and to vote at AGMs. AGM stands for Annual General Meeting. Ordinary shareholders receive dividends after preference shareholders have received theirs.

Evidence of proportionate ownership

Ordinary shares serve as evidence of proportionate ownership of a company. In other words, they are proof of ownership of part of a company.

For example, if XYZ PLC issued 10,000 shares and you own 500 ordinary shares, you own 5% of the company.

Every PLC must have ordinary shares as part of its stock. PLC stands for Public Limited Company.

In the UK and many other countries, the company must issue at least one ordinary share to a shareholder. Put simply; the law states that somebody must be the owner of the company.

In a Legal Vision article, Jill McKnight says the following regarding ordinary shares:

“An ordinary share gives the shareholder the right to vote on matters put before all of the shareholders of the company. The weight of a particular shareholder’s vote will usually depend on the ownership percentage that they have in the company.”

“Typically, one share equals one vote. An ordinary share also provides the shareholder with the right to receive a share of the company’s profits by way of dividends.”

Preference vs. ordinary share

What is the difference between a preference share and an ordinary share?

-

Preference share

We can also call them preferred stock or preferred share. As the name indicates, preference shares give their owners preferred treatment.

Owners usually receive fixed dividend payments and have priority over ordinary shareholders. In other words, preference shareholders receive their dividends first. What is left over goes to ordinary shareholders.

If a company becomes insolvent, preference shareholders are further up in the queue for repayment. Preference shareholders have a liquidation preference over ordinary shareholders.

Companies often pay a fixed percentage dividend to preference shareholders. This gives investors more certainty over their investment.

When considering investing in startups, investors prefer purchasing preference shares. They prefer this because startups have a higher risk of going bankrupt than established companies.

Also, a startup is unlikely to register profits during its first couple of years. Therefore, there will probably be no dividends for ordinary shareholders during the first two years.

-

Ordinary share

If you own an ordinary share, you can vote at AGMs. Shareholders get one vote per share. Preference shareholders do not vote.

Ordinary shareholders receive dividends as a percentage of profits. However, they only get their dividends after the company has paid its preference shareholders. If there is no money left over, ordinary shareholders get no dividends that year.

In fact, whether or not to pay dividends to ordinary shareholders is at the company’s discretion. Even if there are profits, it may decide to spend that money on new equipment or expanding overseas.

Ordinary shareholders often benefit from the company’s long-term growth potential, which can result in capital gains from their shares.

The dividends on ordinary shares fluctuate, unlike those of preference shares.

Shares – vocabulary and concepts

There are many different types of shares. Let’s take a look at some of them, their meanings, and how we can use them in a sentence:

-

Ordinary Shares

The most common type of shares, representing ownership in a company and usually coming with voting rights.

Example: “I invested in ordinary shares of the company for potential dividends and voting privileges.”

-

Preference Shares

Shares that provide a fixed dividend and have priority over ordinary shares in the event of liquidation.

Example: “The preference shares I hold guarantee me a fixed return each year.”

-

Cumulative Preference Shares

Preference shares that accumulate dividends if they are not paid in the year they are due.

Example: “Despite the company’s poor performance, my cumulative preference shares ensure I’m owed dividends from previous years.”

-

Non-Voting Shares

Shares that offer no voting rights in the company but may offer other benefits like higher dividends.

Example: “The non-voting shares I bought come with higher dividends, but I can’t vote in the annual meetings.”

-

Redeemable Shares

Shares that can be bought back by the company at a future date.

Example: “The company issued redeemable shares as a means of future capital adjustment.”

-

Bonus Shares

Shares given to existing shareholders as a bonus, usually free of charge, based on the number of shares already owned.

Example: “My portfolio increased significantly after receiving bonus shares from the company’s profits.”

-

Treasury Shares

Shares that were once fully paid and issued but were subsequently reacquired by the issuing company and held in the company’s treasury.

Example: “The treasury shares were held by the company to be reissued or retired at a later date.”

Video – What are Ordinary Shares?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what “Ordinary Shares” are using simple and easy-to-understand language and examples.