What is personal property coverage? Definition and examples

Personal Property Coverage protects policyholders in case of damage or loss of items in their home. We also call it Personal Property Insurance or Contents Insurance. In some countries, insurers may use the term Personal Items Insurance.

Personal property insurance and contents insurance are very similar and often have the same meaning. In simple English by Lemonade.com: ‘Contents insurance, or personal property insurance, is coverage for “your stuff” (bikes, laptops, TVs, etc.) – it’s also known as Coverage C on renters and homeowners insurance policies.’

Items of furniture, for example, as well as computers, jewelry, and other possessions are protected if you take out a policy.

Personal property coverage can give us peace of mind if replacing lost items would cost more than we could reasonably manage.

Most of us underestimate how much our personal property is worth. Unfortunately, many people only find out when they lose their property or it is damaged.

What items does Personal Property Insurance cover

In the United States, for example, most policies will cover furniture, appliances, cash, guns, fitness equipment, furs, clothing, tools, computers, and electronics. They will also cover linens, cookware, dishes, and silverware.

However, bear in mind that not all policies are the same. Check the items featured on policies’ basic coverage as you shop for quotes. With some insurers, you can pay for extended policies that cover additional items.

Personal property coverage protects against many hazards

Personal property insurance protects the policyholder from damage to or loss of possessions due to many potential hazards. Below are the most common ones:

- Riots.

- Freezing.

- Damage due to vehicles or aircraft.

- Theft.

- Lightning.

- Windstorm, such as a hurricane or tornado.

- Smoke.

- Hail.

What does personal property coverage not include?

Although personal property insurance covers most things, it does not protect you from the loss of or damage to:

- Cars and any other type of motorized vehicle.

- Anything that hovers or flies.

- Pets, in fact, any animal, including fish and birds.

- Some policies require you to list items that are worth more than a certain amount.

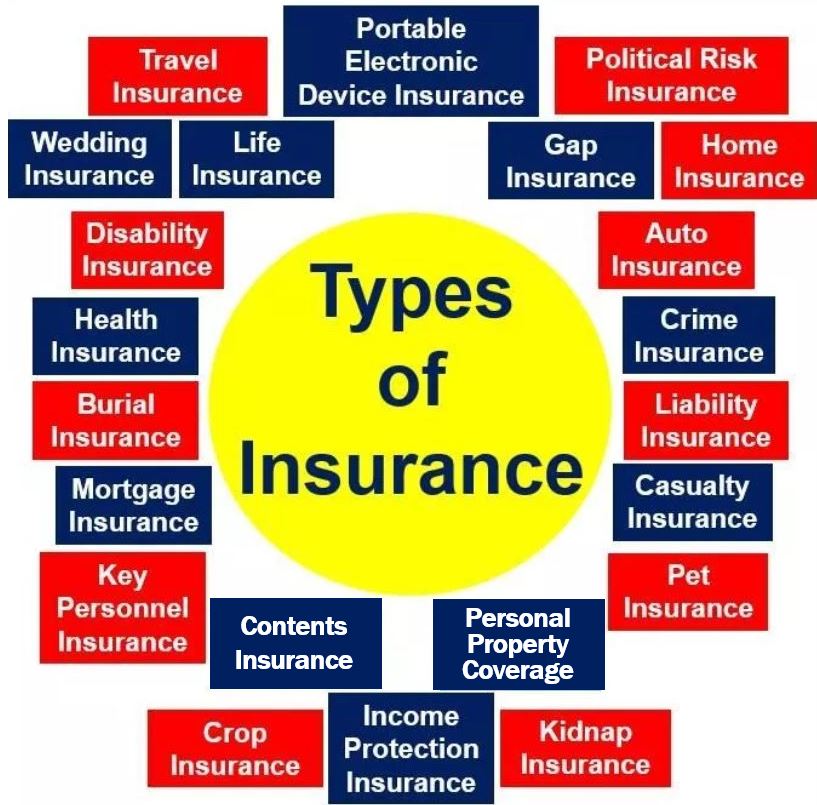

Many types of insurance policies

In the world of insurance, there are literally hundreds of different types of policies. In some cases, having a policy is compulsory. You cannot drive a car without at least 3rd party insurance. In most countries, contents insurance is not mandatory.