What is a public company? Definition and meaning

A Public Company is a business whose shares can be freely traded on a stock exchange or over-the-counter. Also known as a Publicly Traded Company, Publicly Held Company, or Public Corporation. The stocks of this type of company belong to members of the general public, as well as pension funds, and other large investing organizations.

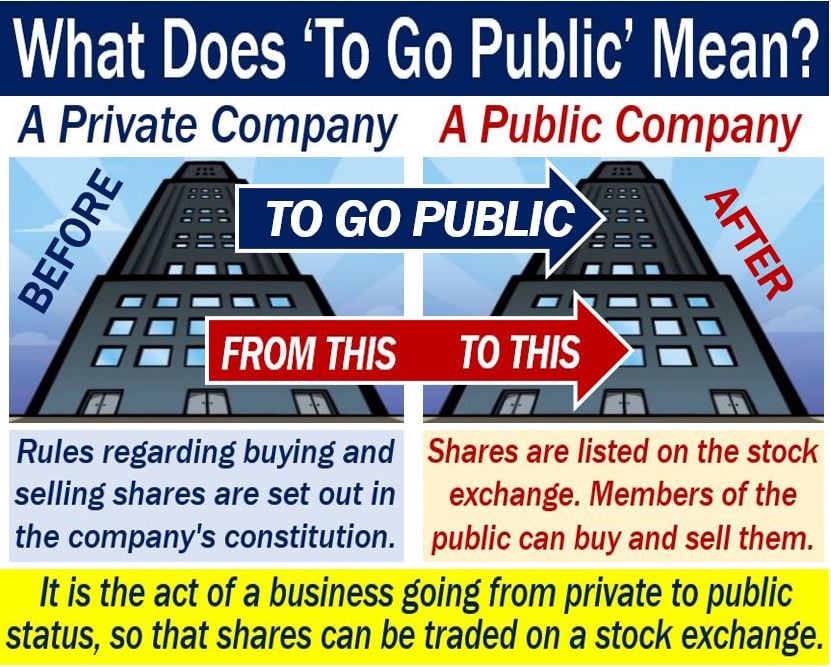

A public company contrasts with a private company, which is not listed on a stock exchange and whose shares are only traded/exchanged via a private arrangement with the stockholders.

In most cases, the stocks of a public company belong to many investors, while those of a private company are in the hands of comparatively few shareholders.

The value of a public company is determined through daily trading.

Public companies more open than private companies

While enjoying the benefits of being able to raise considerable amounts of money in public capital markets, public companies are subject to much higher levels of reporting, regulations and public scrutiny than private companies.

They must publish annual reports, such as the Form 10-K that has to be filed with the SEC in the US. They have to make public details about their finances and business activities.

Some large companies prefer to stay as private firms because because they do not want to disclose proprietary information which could help rivals.

In public companies, the directors need to get shareholders’ approval for any significant change in strategy or operations.

The US Securities and Exchange Commission (SEC) says that any company in the United States with over 500 shareholders and more than $10 million in assets must register with the SEC and adhere to its reporting standards and regulations.

How to become a public company

For a company to become public it launches an IPO (initial public offering) – on the day of the IPO it converts from a private into a public company.

Businesses generally use IPOs as a means of raising money. Sometimes the directors may decide to go public so that the workers, owners and early investors can cash in their shares.

The money that members of the public spend buying shares during an IPO does not have to be paid back. Those investors effectively become the owners of the business.

Going public also offers a company heightened prestige and visibility in the market, which can be advantageous in attracting top talent and new business opportunities.

Some public companies go private

Publicly traded companies can revert to being private firms again if enough shares are purchased from the shareholders.

Dell Inc., a multinational computer technology company based in Round Rock, Texas, turned back from being a public company into a private one in 2013. Michael Dell, the company’s CEO, Microsoft and Silver Lake Partners took the company private for $24.4 billion. Its shares were delisted from the NASDAQ and Hong Kong Stock Exchange.

Why did Dell go private? Ashlee Vance wrote in BloombergBusiness that it was probably so that Michael Dell could keep his company and his job.

“Dell, Silver Lake, and Microsoft get a company that pumps out enough cash to keep all parties happy, while Michael Dell shields himself from being berated by analysts, investors, and the media. Best of all, he gets to keep his company.”

In most countries, public companies are required by law to use generally accepted accounting principles. That is why it is generally easier to compare such companies (financial ratios) than private companies, which may have many different types of accounting methods.

Public companies can leverage their stock as a form of currency for mergers and acquisitions, facilitating growth and diversification.

Compound nouns related to companies

There are many compound nouns (terms consisting of two or more words) containing the word “company.” The term “public company” is a compound noun. Let’s have a look at some of them, their meanings, and how we use them in a sentence:

-

Public Company

A corporation (company, business) whose shares are publicly traded on a stock exchange, allowing anyone in the general public to buy, sell, or hold shares.

Example: “The public company was required to disclose its financial statements quarterly to comply with regulatory standards.”

A corporation that owns enough voting stock in another firm to control its management and operations.

Example: “The holding company owns several smaller businesses across different industries.”

-

Parent Company

A company that owns a controlling percentage of another company, making the latter its subsidiary.

Example: “The parent company oversees the strategic direction of its subsidiaries.”

Two or more companies that are owned by the same parent company but operate independently.

Example: “Both the manufacturing and the retail units operate as sister companies under the conglomerate.”

A company that is completely or partly owned and wholly controlled by another company.

Example: “The subsidiary company was acquired last year to expand the corporation’s portfolio.”

-

Joint Venture Company

A business enterprise created by two or more parties, typically characterized by shared ownership, returns, risks, and governance.

Example: “The joint venture company was established to develop new technologies collaboratively.”

A business that exists only on paper and has no office and no employees, but may have a bank account or hold passive investments or be the registered owner of assets.

Example: “The shell company was used primarily for financial transactions without operational activities.”

A business model where a party (franchisee) is granted the rights to use a company’s (franchisor’s) brand and operations to sell products or services.

Example: “The franchise company has grown rapidly, with outlets in every major city.”

Two Educational Videos

These two interesting video presentations, from our sister YouTube channel – Marketing Business Network, explain what the terms ‘Public Company’ and ‘Company’ mean using simple, straightforward, and easy-to-understand language and examples.

-

What is a Public Company?

-

What is a Company?