What are real terms? Definition and meaning

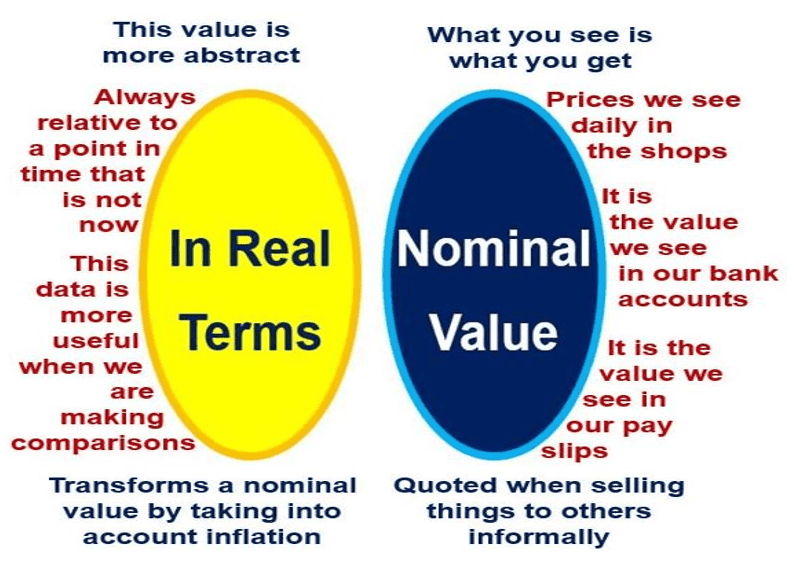

Real Terms refer to a value that has been adjusted to take into account the effects of inflation. The term contrasts with nominal value.

Grasping the concept of real terms is also essential when assessing historical economic data, allowing for accurate comparisons across different time periods without the distortion of inflation.

It is crucial that ‘ordinary’ investors fully understand the meaning of ‘real terms’ and ‘nominal value’. It is massively important because inflation can considerably undermine the value of money over time – something that has major implications for wage negotiations, retirement planning, budgeting, and long-term investment plans.

If you see a text that says adjusted for inflation, it means the value of something in ‘real terms’. ‘Constant prices’ and ‘current prices’ mean the same as in real terms and nominal value respectively.

An example

Imagine you were paid $20 per hour last year, and today your employer offers you a 10% increase – to $22 per hour. That is a ten percent increase in nominal value.

If inflation for the past 12 months stood at 10%, then that ten percent pay increase, in real terms, means that your income remains the same – you are no better off.

On the positive side, the ten percent pay rate per hour increase also means that your purchasing power has not fallen. However, it is important to consider things in ‘real terms’ when you make your spending plans for the year.

When quoting in nominal values, we are simply looking at the price of things in different points in time. When we quote them in real terms, we have adjusted for differences in the level of prices between those points in time.

When quoting in nominal values, we are simply looking at the price of things in different points in time. When we quote them in real terms, we have adjusted for differences in the level of prices between those points in time.

“In real terms means the change in a financial number after correcting for the effect of inflation. For example, if a company’s revenues have increased 4% over the previous year, but prices were (on average) 2% higher than in the previous year, then its revenues have only increased 2% in real terms.”

Savings – real terms vs. nominal value

When you are looking to invest your money into a savings account, you need to subtract the annual inflation rate from the annual interest rate that the financial institution is offering you.

If John Doe Savings Inc. offers you a 4% interest rate on a $10,000 deposit, as long as you do not withdraw that money for 12 months, they will tell you that you will be the proud owner of $10,400 at the end of the first year.

This image of the US Federal Minimum Wage since the 1930 tells us two quite different stories. Although nominally, people’s wages have increased over the past eighty years, in real terms we are still way below the peak reached in the 1960s. (Source of Data: economicfron.wordpress.com)

This image of the US Federal Minimum Wage since the 1930 tells us two quite different stories. Although nominally, people’s wages have increased over the past eighty years, in real terms we are still way below the peak reached in the 1960s. (Source of Data: economicfron.wordpress.com)

However, all they have told you is the nominal value of your increased savings. It does not necessarily mean that after a year you are 4% richer.

In order to find out what it is worth in real terms, you must subtract the annual inflation rate from the 4% interest rate.

If inflation over the past 12 months was 3.5%, all you have gained – in real terms – is 0.5%, i.e. you are only half-of-one-percent richer.

What is money illusion?

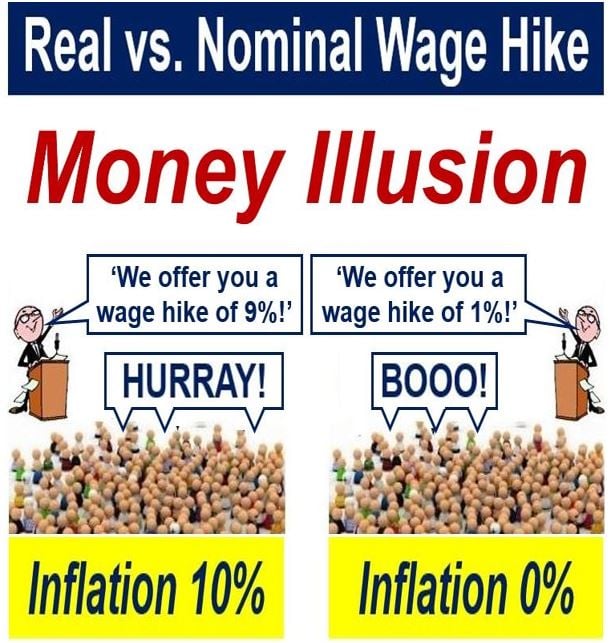

Money illusion refers to our tendency to consider only the nominal value of something, rather than its ‘real value’ – what it is worth in ‘real terms’.

People suffering from money illusion see one dollar today as still one dollar tomorrow, next year, and in ten years’ time. Physically, in each point in time it is still one dollar. But if I can buy one Snicker’s bar today for one dollar, and only half-a-bar for one dollar in ten years’ time, that unit of currency has lost half its purchasing power.

Irving Fisher (1867-1947), an American economist, statistician, progressive social campaigner, and inventor, coined the term ‘money illusion’ in Stabilizing the Dollar. In 1928, he wrote a book that focused on the subject – The Money Illusion.

British economist, Maynard Keynes (1883-1946) popularized the term in the 1930s.

We all fall into the money illusion trap sometimes. Employers have often managed to fool their employees into thinking that they have negotiated a good wage settlement in times of high inflation, when in fact, in real terms their income has declined.

-

Money illusion affects many workers

Millions of employees today across the world are affected by money illusion. Most workers are happier to receive a 10% pay rise when inflation is at 10% than a 1% pay rise with inflation at 0%.

The thought of having 10% more dollars, pounds, euros, yens makes them feel happier. In real terms, however, they are better off with the 1% wage hike with inflation at 0%, than the 10% rise with inflation at 10%.

In 1913, Fisher said:

“We have standardized every other unit in commerce except the most important and universal unit of all, the unit of purchasing power. What business man would consent for a moment to make a contract in terms of yards of cloth or tons of cola, and leave the size of the yard or the ton to chance?”

Nominal GDP vs real GDP

When a noun, such as wage, price, value, GDP is preceded by the word nominal, it means that the figure has not been adjusted for inflation. When those nouns are preceded by the word real, it means adjustments for inflation have been made.

Imagine a fictitious nation – Neverland – had a GDP of $200 billion on January 1st, 2017, and $220 billion on January 1st, 2018.

Does this mean that Neverland’s GDP grew by 10% in one year? The answer is:

- Yes for nominal GDP.

- No for real GDP.

If inflation during that 12-month period was 2%, then real GDP grew by 10% minus 2% = 8%.

The only time nominal and real values are the same are when prices have not gone up or down – when annual inflation is zero.

Furthermore, understanding the difference between real and nominal values is pivotal for comprehending economic growth indicators, as they can often portray a misleading picture of an economy’s true health if not evaluated in the context of inflation.

Compound phrases incorporating “real terms”

Let’s have a look at some compound phrases containing “real terms” in context:

-

Real Terms Adjustment

A modification made to financial figures to account for inflation.

For example: “The economist applied a real terms adjustment to the historical prices to accurately compare them to current prices.”

-

Real Terms Comparison

The process of evaluating financial data from different time periods using inflation-adjusted values.

For example: “In a real terms comparison, the purchasing power of the average salary has not increased over the last decade.”

-

Real Terms Growth

An increase in economic indicators that account for the inflation rate.

For example: “Despite the nominal GDP increase, the real terms growth was minimal due to high inflation.”

-

Real Terms Value

The value of an item or currency once the effects of inflation have been considered.

For example: “Although the nominal price of the house went up, its real terms value actually decreased when accounting for inflation.”

-

Real Terms Income

The measure of income that reflects the actual purchasing power after adjusting for inflation.

For example: “Despite receiving a raise, her real terms income remained the same because of the surge in inflation rates.”

3 Videos

These three interesting videos featured on our partner YouTube channel, Marketing Business Network, explain the meanings of ‘Real Terms,’ ‘Nominal Value,’ and ‘Money Illusion,’ utilizing straightforward language and easy-to-understand examples.

-

What are Real Terms?

-

What is Nominal Value?

-

What is Money Illusion?