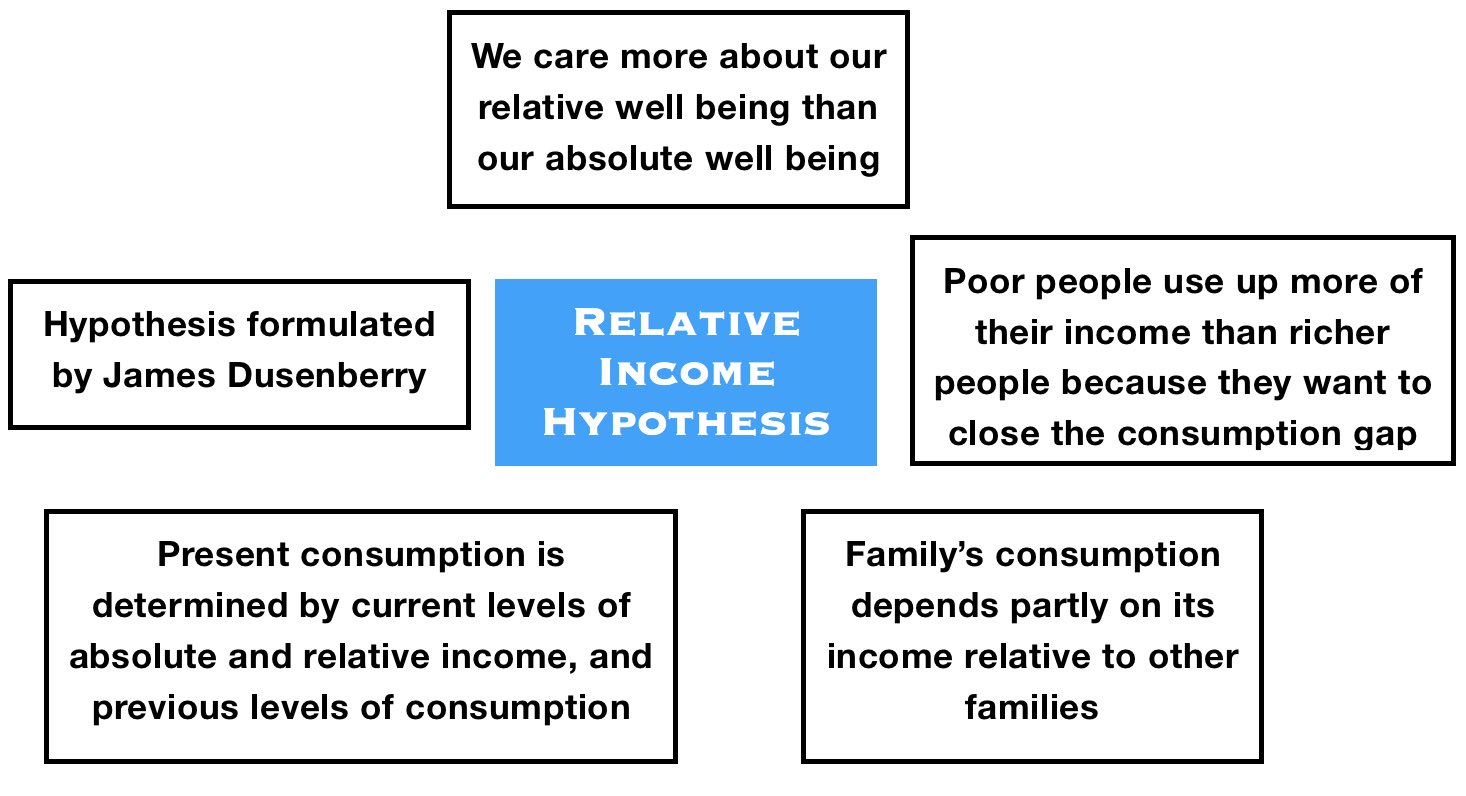

The Relative Income Hypothesis says that we care more about how much we earn and consume in relation to how other people around us do than our absolute well-being or our own earnings and consumption in isolation or comparison to a moment in the past.

According to relative income supposition, a typical person is happier if he or she got a $100 weekly wage rise if others only got $50 than receiving a $150 increase while everybody else received the same increase.

This concept also extends to the psychological impact of income perception, where individuals assess their economic position not just by their financial well-being, but by how they perceive their prosperity relative to their community or social circle

People on lower incomes may consume more of their earnings than their better-off counterparts because they would like to reduce the gap in their standards of living – consumption levels.

James Duesenberry

James Duesenberry (1918-2009), an American economist who made a considerable contribution to the Keynesian analysis of income and employment, first set out the relative income conjecture in 1949 when his book – Income, Saving and the Theory of Consumer Behavior – was published.

According to Duesenberry, the weekly consumption of a household depends in part on its income relative to other families.

According to the International encyclopedia of the Social Sciences: “Relative income hypothesis states that the satisfaction (or utility) an individual derives from a given consumption level depends on its relative magnitude in the society (e.g., relative to the average consumption) rather than its absolute level.”

According to the International encyclopedia of the Social Sciences: “Relative income hypothesis states that the satisfaction (or utility) an individual derives from a given consumption level depends on its relative magnitude in the society (e.g., relative to the average consumption) rather than its absolute level.”

There are several versions of this hypothesis. The one formulated by Duesenberry has received the most attention, and is the main focus of this article.

We don’t like to consume less than before

Supporters of the relative income hypothesis say that current consumption is not influenced just by current levels of relative and absolute income, but also by levels of consumption reached in previous period. As soon as a household reaches a level of consumption, it is difficult for it to consume less afterwards.

In other words, the relative income rationale has three components:

- Our attitude to consumption and saving is dictated more by our situation in relation to others than by abstract living standards.

- Poorer people spend more of their income than wealthier individuals because they want to close the consumption gap.

- We don’t like to consume less than we used to.

The relative income hypothesis suggests that conspicuous consumption, the purchase of goods or services for the direct purpose of displaying one’s wealth, is a direct consequence of individuals striving to signal their economic status relative to others.

Permanent and relative income hypothesis

Relative income hypothesis contrasts with Permanent Income Hypothesis, a consumer spending theory which states that we will spend money at a level that is consistent with our expected long-term average income.

Our level of expected long-term income is then thought of as our level of ‘permanent’ income that can be spent safely.

We all save only if our current income is greater than our anticipated level of permanent income – we do this to guard against future reductions in income, so the permanent income hypothesis states.

Rich households save more

Other hypotheses that followed Duesenberry’s relative income hypothesis, including the permanent income hypothesis, were also able to explain why rich households tended to save more than those further down the socioeconomic ladder – and in a less controversial way.

In an article published in the Quarterly Journal of Business and Economics – ‘The Relative Income Hypothesis: A Review of the Cross Section Evidence’ – George Kosicki wrote:

“Early models of household saving postulated that poor households acted in a way fundamentally diffrent from rich households. Duesenberry argues that effects in consumption weighed less heavily on rich households, and so savings rates should rise with position in the income distribution.”

“Although Duesenberry’s relative income hypothesis held up well under cross section empirical tests, it was supplanted by the life cycle and permanent income models that followed.”

“These models seemed capable of explaining the same empirical evidence in a less controversial manner.”

Absolute Income vs. Relative Income

Imagine two people, one earns $100,000 per year and the other $50,000 – this information is on their absolute incomes; one earns twice as much as the other.

However, if I now add some more information – the $100,000 per year person works 80 hours per week by 51 weeks of the year, while the $50,000 per year individual works just 4 hours per week by 30 weeks of the year, we are now looking at things differently.

In absolute terms the $100,000 per year person earns more, but in relative terms the $50,000 per year individual is way, way better off… In order to understand what the relative income hypothesis is, you first need to know what relative income means.

Video – What is Relative Income Hypothesis?

This educational video, from our sister channel on YouTube – Marketing Business Network, explains what ‘ Relative Income Hypothesis‘ means using simple and easy-to-understand language and examples.