What is replacement rate? Definition and meaning

The term Replacement Rate has two main meanings:

-

Retirement income

The percentage of an employee’s pre-retirement monthly income that he or she receives each month after retiring. The rate is a common measure that is used to determine how effective a pension system is.

-

Fertility rate

The fertility rate a nation requires in order to maintain its current population. It may also include net migration – the number of people who die and emigrate each year balanced against the number of babies that are born plus how many people immigrate (come to live in the country from abroad).

While the concept of the replacement rate is straightforward, its implications are far-reaching, influencing national policies on immigration, healthcare, and social security.

Brief history

According to the Online Etymology Dictionary, the verb ‘replace’ emerged in the English language in England in the 1590s with the meaning ‘to restore to a previous place or position,’ from combining ‘re’ meaning ‘back, again’ + the world ‘place’ meaning ‘to take the place of.’

The noun ‘replacement’ can be traced back to 1790 with the meaning ‘act or fact of being replaced’; also in England. It is a combination of the verb ‘replace’ and the suffix ‘-ment’ meaning ‘something that replaces another’.

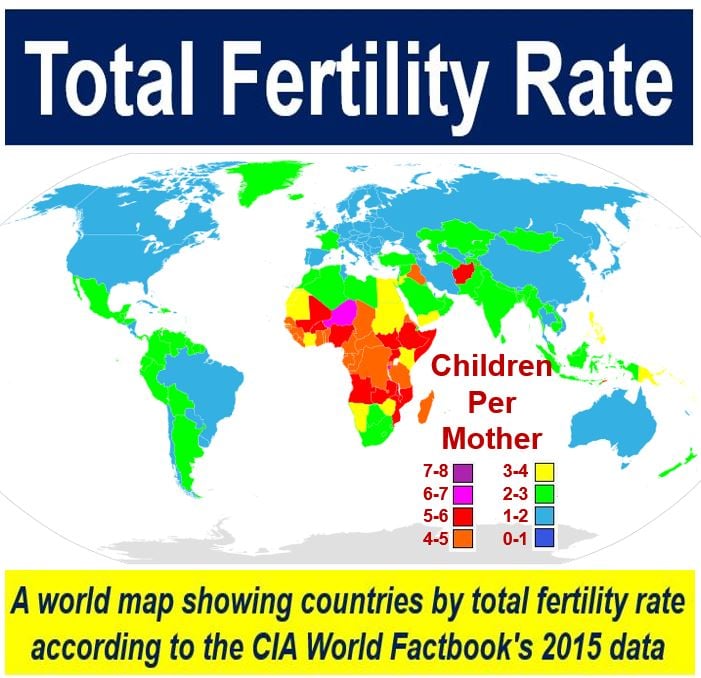

As you can see on this global map, there are vast areas of the world with a replacement rate below 2.1 – the rate required to prevent a population decline (in rich countries). Unless those countries have a significantly greater number of immigrants than emigrants, the tax burden on the working population in future will be enormous as people’s lifespans get longer. (Image: Adapted from Wikipedia)

As you can see on this global map, there are vast areas of the world with a replacement rate below 2.1 – the rate required to prevent a population decline (in rich countries). Unless those countries have a significantly greater number of immigrants than emigrants, the tax burden on the working population in future will be enormous as people’s lifespans get longer. (Image: Adapted from Wikipedia)

Replacement rate – population size

In the advanced economies (rich nations), the replacement rate is usually set at 2.1 children per woman. The additional 0.1 reflects the probability that a percentage of offspring will die before their parents.

In the developing and emerging nations, where infant mortality is higher, the replacement rate ranges from slightly to considerably higher than in the rich countries.

Since about twenty-five years ago, the fertility rate in some nations has slipped well below the replacement rate. Experts say that this has occurred for a number of possible reasons, and that if this trend continues, those countries in future will face serious problems funding their state pensions and caring of their elderly citizens.

The replacement rate and total fertility rate of a nation are not the same. For example, the total fertility rate of the United Kingdom in 2016 was 1.89 children born per woman, but its population increased. This was because the number of immigrants – people coming into the country from abroad to live in the UK – was considerably higher than the number of emigrants – British people who went to live abroad.

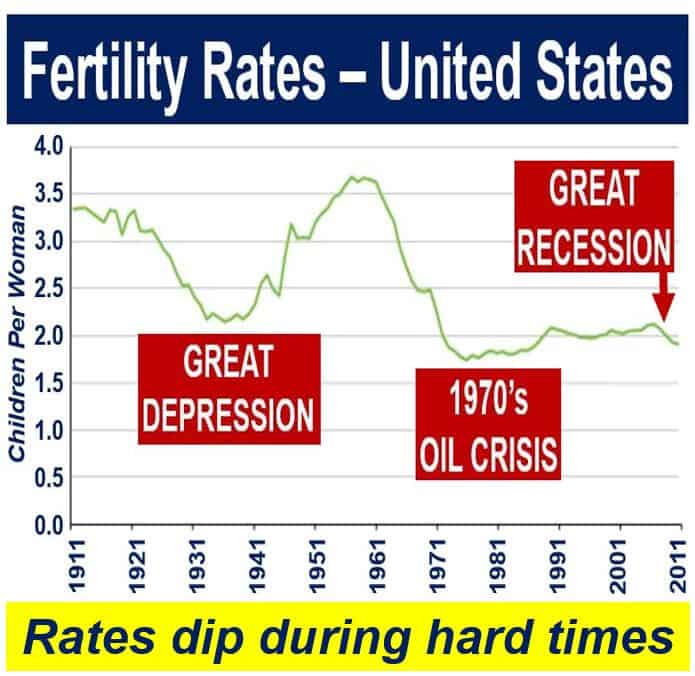

Over the past century, every time the economy suffered in the United States, fertility rates declined. Evidently, worsening job prospects and a negative economic outlook discourage people from having children. (Image: adapted from prb.org)

Over the past century, every time the economy suffered in the United States, fertility rates declined. Evidently, worsening job prospects and a negative economic outlook discourage people from having children. (Image: adapted from prb.org)

Some Southern European, Eastern European and East Asian countries had total fertility rates of 1.3 – these are known as the lowest-low fertility nations.

At the beginning of this century, over half of the population of Europe lived in nations with lowest-low fertility rates. Since then, some have improved and are nearer their required replacement rate.

Replacement rate – pensions

The replacement rate, also called the net replacement rate, refers to what proportion of a person’s salary – when they were working – their pension today represents.

If your monthly salary was $2000, and your pension is $1,200 per month, the replacement rate of your pension is 60% – sixty percent of $2,000 is $1,200.

It measures how effectively people’s pension systems provide an income during retirement to replace earnings while they were in employment.

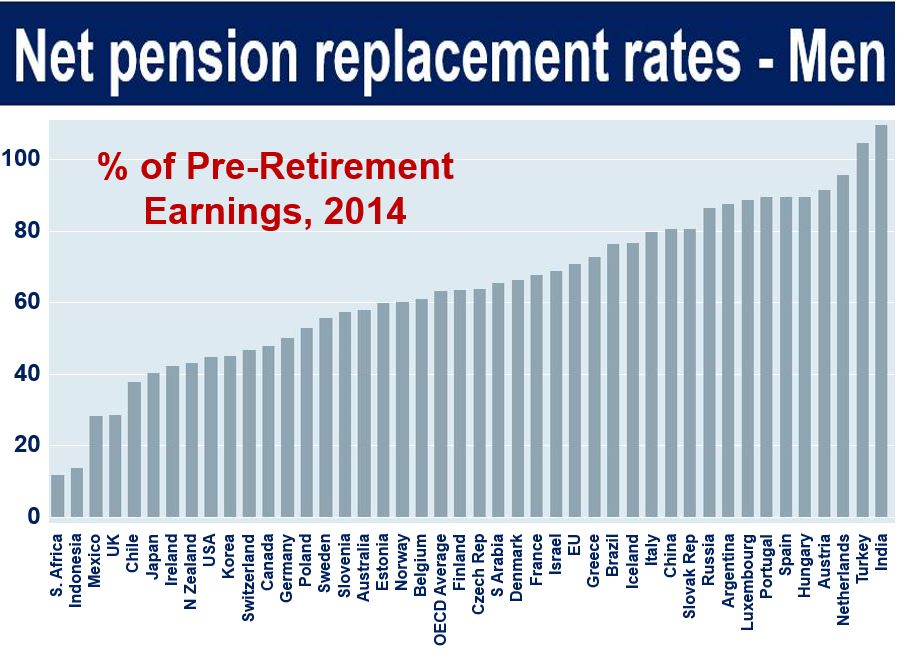

Source: data.oecd.org – this is a data file that downloads.

Source: data.oecd.org – this is a data file that downloads.

According to the OECD (Organization for Economic Development and Co-operation):

“The net replacement rate is defined as the individual net pension entitlement divided by net pre-retirement earnings, taking into account personal income taxes and social security contributions paid by workers and pensioners.”

“It measures how effectively a pension system provides a retirement income to replace earnings, the main source of income before retirement. This indicator is measured in percentage of pre-retirement earnings by gender.”

-

How much we need varies

Income replacement requirements vary from person to person. The amount we may need depends on the standard of living we wish to maintain plus an understanding of how much it will cost us to maintain that standard.

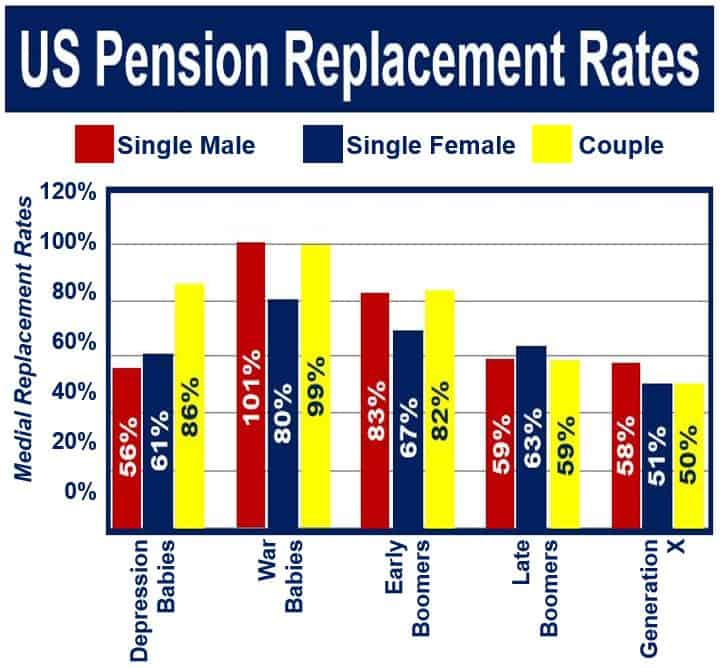

Depression Babies were born in the 1930s – War Babies in early 1940s – Early Boomers from 1946 to 1954 – Late Boomers from 1955 to 1954 – and Generation X from early 1960s to late 1970s. In the United States, the War Babies have the best pension replacement rates. (Image: Adapted from b-i.forbesimg.com)

Depression Babies were born in the 1930s – War Babies in early 1940s – Early Boomers from 1946 to 1954 – Late Boomers from 1955 to 1954 – and Generation X from early 1960s to late 1970s. In the United States, the War Babies have the best pension replacement rates. (Image: Adapted from b-i.forbesimg.com)

-

Example

For example, if John Smith and Mary Jones both earn $120,000 per year, but John requires $60,000 annually to maintain his desired standard of living while Mary requires $80,000, John’s ideal replacement rate will be 50% while that of Mary will be 66%.

The amount most people need after they retire to maintain their standard of living is usually significantly less than what they required while they were in employment.

By the age of sixty-five (typical retirement age), most homeowners have paid off their mortgages, the majority of them do not still have dependent children, and they are no longer paying into a contributory pension scheme. In other words, their monthly overheads are considerably lower.

-

The Great Recession

This trend, however, has slightly changed since the financial crisis of 2007/8 and the Great Recession that followed it. The number of people aged thirty who still live with their parents today in the advanced economies is considerably higher than it was during their parents’ or grandparents’ generations.

More elderly people than ever today are using their own savings, remortgaging their properties, or taking out personal loans to help their adult children get onto the property ladder.

Furthermore, the economic uncertainties of the 21st century, including the impact of technology on jobs and the rise of gig economy, are prompting policymakers to reconsider the adequacy of current pension systems.

Replacement rate – example sentences

Below, you can see eight sentences containing the term “replacement rate.” Four are about retirement incomes and the other four about countries’ fertility rates. They should help you see how we use the term in different contexts.

The context of retirement income:

- “Financial advisors often emphasize the importance of aiming for a retirement income replacement rate of around 70% to maintain one’s pre-retirement lifestyle.”

- “Adjusting the replacement rate for pensions is a critical step for ensuring that retirees can handle the rising cost of living without sacrificing their quality of life.”

- “The government’s reform of the public pension plan focuses on modifying the replacement rate to reflect longer life expectancies and changing demographics.”

- “A survey revealed that most retirees were not aware of their pension’s replacement rate and thus, were ill-prepared for financial stability in their later years.”

The context of fertility rates:

- “Demographers have expressed concerns over the country’s declining fertility rates, which have fallen well below the necessary replacement rate to sustain the current population without relying on immigration.”

- “In the latest census, the national replacement rate dipped to 1.8 children per woman, indicating potential future challenges for population stability.”

- “To counteract the effects of an aging population, the government is introducing incentives to raise the replacement rate and encourage larger families.”

- “The replacement rate has become a pivotal factor in planning for future workforce needs, as current trends suggest a shrinking pool of young workers to support an aging society.”

Video – What is the Replacement Rate?

This interesting video presentation, from our YouTube partner channel – Marketing Business Network, explains what the ‘Replacement Rate’ is using simple and easy-to-understand language and examples.