Savings account – definition and meaning

A savings account, also known as a deposit account, is held by retail financial institutions. These accounts provide principal security and a moderate interest rate.

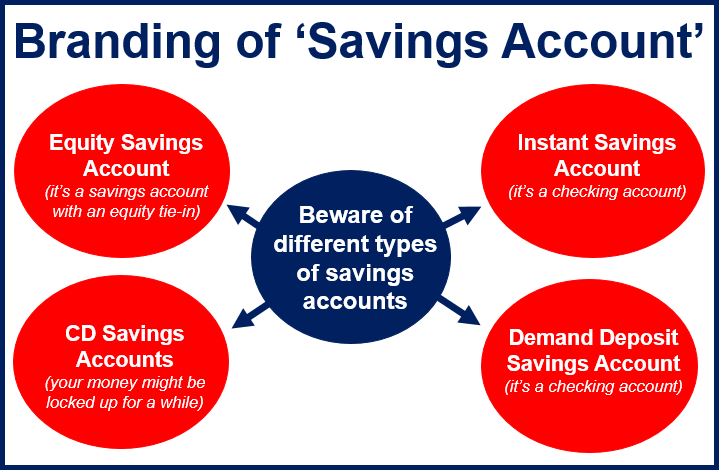

Savings accounts are probably the simplest type of account available to consumers.

They allow people to store excess cash – the proportion of their disposable income that they have not spent – in a secure location while earning interest on the balance.

Compared to a checking account (UK: current account) there is less flexibility when it comes to writing checks or carrying out transfers, as there are usually extra fees charged or limits on the amount (or frequency) that can be taken out with savings accounts.

These limits are imposed to discourage withdrawals on savings. However, savings accounts are still one of the most liquid investment options – if you really need access to the cash, it’s there.

Today, there is not a big difference between a savings account and a checking account. Go for the yield!

Today, there is not a big difference between a savings account and a checking account. Go for the yield!

It is a viable option for those who want to store money away that they don’t plan on using for daily expenses. These types of accounts give you better interest rates compared to checking accounts, but less than **treasury bills.

** Treasury bills are promissory notes issued by the government with a maturity of between just a few days and 52 weeks.

Access to savings accounts can be done through a local bank branch, over the internet, and through automated teller machines (ATMs).

Savings accounts in the US

In the US, according to Regulation D, 12 (CFR) §204.2(d)(2), the depositor is allowed to make up to six pre-authorized transfers or withdrawals in every 4 week statement cycle.

Savings accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Share Insurance Fund.

Nasdaq.com describes a savings account as:

“A deposit account held with a financial institution that pays interest but does not allow for direct withdrawal through checks. Pays interest at a rate higher than that of checking account but lower than that of treasury bills.”

Savings accounts in the European Union

In most European nations, interest paid on savings accounts is taxed at source. The high tax rates in some eurozone members had led to an explosion of a huge offshore savings industry.

EU authorities have made arrangements with many tax havens for either interest earned to be shared with European tax authorities or witholding tax to be deducted on interest paid on offshore accounts.