What is Say’s law? Definition and meaning

Say’s law, also known as Say’s law of markets in Classical economics, states that supply itself creates its own demand. According to Say’s law, aggregate production necessarily creates an equal amount of aggregate demand. It is an economic rule that production is the source of demand, so says Say’s law.

When somebody produces a good or service, they get paid for that work, and are then able to use that money to demand other products and services. In other words, the money you earn from the production of new goods or the provision of an additional service is spent, which pushes up levels of demand.

According to law dissertation writing service – BuyDissertations.com, Say’s law was the argument put forward by Jean-Baptiste Say (1767-1832), a French economist and businessman who had classically liberal views and argued in favor of free trade and a **laissez-faire economy.

** A laissez-faire economy is one in which business activities between private individuals, commercial enterprises, and other entities are free from government interference, i.e. it is a free market economy.

According to the Merriam-Webster dictionary, Say’s law is: “A statement in economics: production creates not only the supply of goods but also the demand for them.”

According to the Merriam-Webster dictionary, Say’s law is: “A statement in economics: production creates not only the supply of goods but also the demand for them.”

Say was strongly influenced by Adam Smith (1723-1790), the Scottish economist, philosopher and author, known today as the father of modern economics. Some scholars today suggest that Say was not the first person to state what we currently call Say’s law.

Says law first explained in 1803

In 1803, in his book – A Treatise on Political Economy – Say explained:

“It is worthwhile to remark that a product is no sooner created than it, from that instant, affords a market for other products to the full extent of its own value. When the producer has put the finishing hand to his product, he is most anxious to sell it immediately, lest its value should diminish in his hands.”

“Nor is he less anxious to dispose of the money he may get for it; for the value of money is also perishable. But the only way of getting rid of money is in the purchase of some product or other. Thus the mere circumstance of creation of one product immediately opens a vent for other products.”

Say’s views, which suggested that the key to GDP (gross domestic product) growth was not by boosting demand, but by increasing production, were later expanded on by David Ricardo (1772-1823) and James Mill (1773-1836), two famous British classical economists.

Throughout the 19th century, Say’s law was generally accepted. In that century it was modified to incorporate the notion of a boom-and-bust cycle.

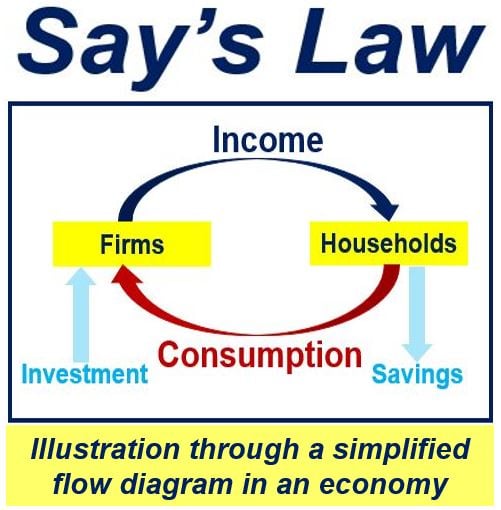

Followers of Say’s law believe that during the production process, necessary purchasing power is generated – which absorbs the extra supply. As shown in this diagram, households supply factor services to companies and earn income from them. Households spend some and save some of that income. Companies get their income from selling to households – they also get funds, which originate from households, for investments. (Image: adapted from economicsdiscussion.net)

Followers of Say’s law believe that during the production process, necessary purchasing power is generated – which absorbs the extra supply. As shown in this diagram, households supply factor services to companies and earn income from them. Households spend some and save some of that income. Companies get their income from selling to households – they also get funds, which originate from households, for investments. (Image: adapted from economicsdiscussion.net)

John Maynard Keynes (1883-1946), a British economist whose ideas fundamentally changed the theory and practice of macroeconomics, argued strongly against Say’s law.

According to Keynes, fiscal policy can boost demand if there is not enough of it to attain full employment. Fiscal policy means government spending and tax collection.

Jean-Baptiste Say’s formulation

According to Say, **economic agents offer products and services for sale so that they can spend the money that they expect to earn.

** An economic agent is a person, corporation, or any entity that has an effect on a country’s economy, for example by selling, buying or investing.

If a certain quantity of products and services is offered for sale, isn’t that clear evidence of an equal quantity of demand? Say thought it was.

Say’s claim is frequently summarized as ‘Supply creates its own demand’. However, that particular phrase never appeared in any of Say’s writings.

As production necessarily creates demand, it is impossible to end up with a ‘general glut’ of unsold goods and services, Say argued. If an excess of one product exists, there has to be a shortage of another.

According to Famous Economists: “Jean-Baptiste Say was a French businessman and economist best known for introducing Say’s Law. He was a strong proponent of free trade and competition who, throughout his life argued against the restraints on free business activity. Say worked at an insurance company and was also the editor of a popular periodical of the time.” (Image: adapted from famouseconomists.net)

According to Famous Economists: “Jean-Baptiste Say was a French businessman and economist best known for introducing Say’s Law. He was a strong proponent of free trade and competition who, throughout his life argued against the restraints on free business activity. Say worked at an insurance company and was also the editor of a popular periodical of the time.” (Image: adapted from famouseconomists.net)

According to Say:

“The superabundance of goods of one description arises from the deficiency of goods of another description … Sales cannot be said to be dull because money is scarce, but because other products are so. … To use a more hackneyed phrase, people have bought less, because they have made less profit.”

Therefore, Say’s law should be formulated as follows:

Supply of A creates Demand for B, subject to consumers being interested in purchasing A.

A’s producer is able to purchase B if there is demand for his or her products.

It is not possible for money earned from the sale of goods or services to remain unspent, thereby pushing the level of demand below that of supply, Say emphasized.

Money, as far as Say was concerned, is only a temporary medium of exchange.

Say wrote:

“Money performs but a momentary function in this double exchange; and when the transaction is finally closed, it will always be found, that one kind of commodity has been exchanged for another.”

John Maynard Keynes rejected Say’s law, as do all Keynesian economists. Classical and Neo-Classical economists, on the other hand, tend to slant towards Say’s arguments. (Image: Adapted from Wikipedia)

John Maynard Keynes rejected Say’s law, as do all Keynesian economists. Classical and Neo-Classical economists, on the other hand, tend to slant towards Say’s arguments. (Image: Adapted from Wikipedia)

Critics of Say’s law

The Reverend Thomas Robert Malthus (1766-1834), a British cleric and scholar, influential in the fields of demography and political economy, rejected Say’s law, because he observed in it evidence of general gluts.

In his 1820 book – Principles of Political Economy Considered With a View to Their Practical Application – Reverend Malthus wrote:

“We hear of glutted markets, falling prices, and cotton goods selling at Kamschatka lower than the costs of production.”

“It may be said, perhaps, that the cotton trade happens to be glutted; and it is a tenet of the new doctrine on profits and demand, that if one trade be overstocked with capital, it is a certain sign that some other trade is understocked.”

“But where, I would ask, is there any considerable trade that is confessedly under-stocked, and where high profits have been long pleading in vain for additional capital?”

The Great Depression of the 1930s posed a major challenge to Say’s law. Unemployment was extremely high in virtually all the advanced economies. In the United States, joblessness reached 25%.

One quarter of America’s labor force was out of work – this supply of labor for which, according to Say’s law, there should be an equal quantity of demand, did not occur – there was no equal quantity of demand.

In 1936, John Maynard Keynes claimed that Say’s law was wrong. According to Keynes, it was demand and not supply that determined the overall level of economic activity in a country.

Keynes insisted that demand depended on the propensity of people to consume and on the propensity of commercial enterprises to invest, both of which fluctuated up and down during the business cycle.

According to Keynes, there was no reason to expect aggregate demand to lead to full employment.

The vast majority of current mainstream economists reject Say’s law. They believe that supply does not create its own demand, but rather, especially during an economic downturn, demand creates its own supply.

If you look at what governments in North America, Europe and other parts of the world did to try to get their economies up-and-running again after the 2007/8 Global Recession, Keynesian economics is clearly the preferred option.

Video – Say’s Law

In this John Locke Foundation video, Dr. Paul Cwik, associate economics professor at Mount Olive College, explains what the arguments behind Keynesian economics and Say’s law are.