Scenario analysis is a way of predicting future values based on certain potential events. Experts use scenario analysis to predict what might happen to an investment portfolio, for example, if specific events occur or don’t occur. Economists and statisticians use scenario analysis to analyze and predict possible future events by considering alternative worlds – alternative possible outcomes.

Analysts, economists, company managers and directors, statisticians, and other professionals use scenario analysis – also known as total return analysis or horizon analysis – to test their plans against a number of possible scenarios to see what could happen if things do not go according to plan.

It is an important technique used by risk management professionals to help companies make sure they do not carry too much risk.

The risk manager presents the company with the results of his or her scenario analysis – he or she is not usually expected to put forward a scenario the company should take.

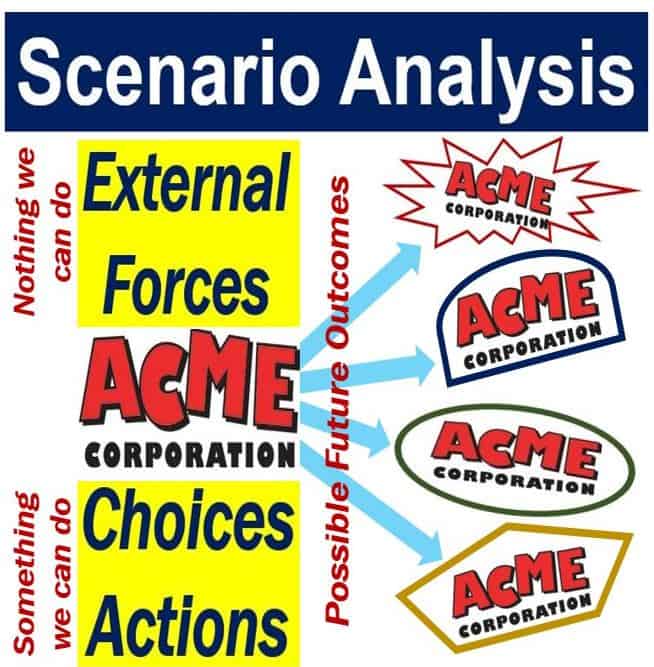

What happens to the ‘Acme Corporation’ in future depends partly on forces that we have no control over, and the actions and choices we take today. There are so many external events and choices & actions that there is an infinite number of permutations of possible futures. Scenario analysis takes some snapshots of these alternative futures and studies a few of them.

What happens to the ‘Acme Corporation’ in future depends partly on forces that we have no control over, and the actions and choices we take today. There are so many external events and choices & actions that there is an infinite number of permutations of possible futures. Scenario analysis takes some snapshots of these alternative futures and studies a few of them.

Scenario analysis vs. a prognosis

Not only does the analyzer observe predicted outcomes, but also the development paths that lead to those outcomes.

Unlike a prognosis, a scenario analysis has nothing to do with **extrapolating what happened in the past or the extension of past events.

** Extrapolating means estimating or concluding something using the assumption that current trends will continue or that an existing method will remain applicable.

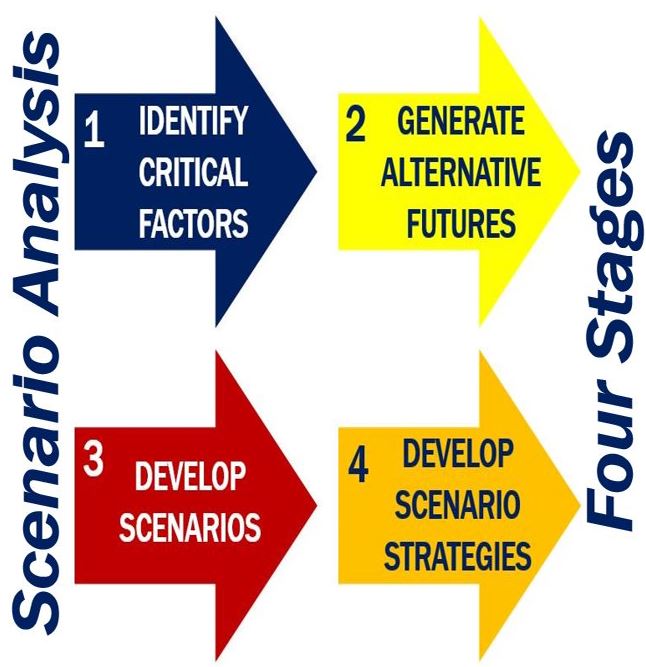

August Jackson, a Strategy & Competitive Intelligence Manager, identifies four steps – the ones shown in the image above – to scenario analysis. The World Bank suggests eight steps: 1. Define a focal issue/decision. 2. Identify driving forces. 3. Write scenario plots. 4. Flesh out scenarios. 5. Look at implications. 6. Choose ‘leading indicators’. 7. Disseminate scenarios. 8. Integrate scenario outcomes in daily procedures. (Image: adapted from: image.slidesharecdn.com/scenarioanalysisslides)

August Jackson, a Strategy & Competitive Intelligence Manager, identifies four steps – the ones shown in the image above – to scenario analysis. The World Bank suggests eight steps: 1. Define a focal issue/decision. 2. Identify driving forces. 3. Write scenario plots. 4. Flesh out scenarios. 5. Look at implications. 6. Choose ‘leading indicators’. 7. Disseminate scenarios. 8. Integrate scenario outcomes in daily procedures. (Image: adapted from: image.slidesharecdn.com/scenarioanalysisslides)

Scenario analysis does not expect past observations to continue being valid in the future – it does not rely on historical data at all. Instead, it attempts to consider possible turning points and developments, which might have a past connection.

In other words, the method fleshes out several scenarios to show potential or possible outcomes. Each scenario is different – while some are pessimistic, others might be either optimistic or a combination of the two – they all include more and less probable developments.

While all the scenarios should be different, they have one thing in common – they must be plausible.

Most experts say that the most appropriate number of different scenarios when discussing future strategies is three. Four or more scenarios risk making the analysis too complicated.

Scenario analysis of a portfolio

When dealing with a **portfolio, scenario analysis is a method for estimating the expected value of a **portfolio after a specified period, assuming that certain key factors or changes in the investment portfolio’s securities occur, such as a rise or decline in interest rates.

** A portfolio is a group of investment products that are held and managed by a person, financial institution, hedge fund, company, or any entity. My portfolio is my spread of investments.

Investment professionals often use scenario analysis to predict what might happen to a portfolio if an undesirable or unfavorable event or series of circumstances occur. It is sometimes used to illustrate what could happen in a theoretical worst-case scenario.

Different reinvestment rates for a number of expected returns that are reinvested are computed for the investment period – what we call the investment horizon.

Scenario analyses provide processes to estimate changes in a portfolios’ values – based on statistical and mathematical principles. The analyzer creates a number of different situations – scenarios – and makes predictions using ‘what is’ principles.

Scenario analysis helps decision-making

Business managers, investment experts, economists and statisticians say that the aim of scenario-building is to help those in charge make more successful decisions, because they were able to consider a number of alternative worlds, their outcomes and implications.

Forecasters can use scenario analysis to illuminate wild cards. Wild cards are unexpected and surprising events with an extremely low perceived probability of occurrence, but with a very high impact. The 2001 terrorist attack on the World Trade Center in New York City on 9/11 is an example of a wild card.

For example, when investigating the chances of planet Earth being hit by a large asteroid or comet, we know that over the short-term – one to ten years – the probability is extremely low.

We also know that the potential damage a large meteor could inflict is considerably greater than the low probability over a one-year period would suggest.

Scenario analysis leads us to the conclusion that the repercussions of a direct hit would be so catastrophic, that we should ignore it, i.e. there is nothing we could do to reduce the damaging effects. As far as being hit by an asteroid is concerned, a company’s management will decide to disregard the threat – to adopt the ostrich-head-in-the-ground approach.

It is a method that helps people or organizations think ahead about the future. It’s used to spot possible problems early and get better prepared to deal with them.

By imagining different “what if” situations, both good and bad, it becomes easier to see how different choices could play out and what steps might lead to those outcomes. This helps organizations adjust their plans and reduce risks before issues actually happen.

Scenario analysis vs. sensitivity analysis

While scenario analysis looks at a number of contexts in which a plan might be executed, sensitivity analysis examines what the effect a change in the value just one parameter might have on outcome.

Let’s say a company is planning to launch a new type of airplane. A scenario they might consider is a change in the demand for international travel. At the same time, they might use sensitivity analysis to see how the project would be affected if certain parts needed for the plane take longer than expected to develop.

Sensitivity analysis helps figure out how much you can change one part of a plan without it causing a big change in the final result. It’s useful for understanding which parts of a plan really matter and which ones are less critical.

This CommunityViz video tutorial explains what scenario analysis is using simple language and easy-to-understand examples and situations.