What is the secondary mortgage market? Definition and Meaning

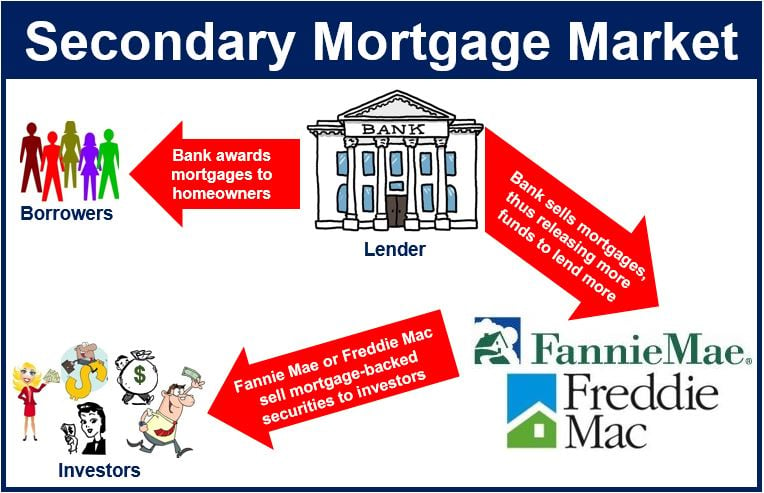

The secondary mortgage market is the purchasing and selling of existing home loans, which are typically bundled together and traded as mortgage-backed securities. In other words, it is the trading of securities or bonds collateralized by the value of mortgage loans.

Mortgage-backed securities, also known as MBS or mortgage pass throughs, are bonds which are secured by a mortgage or pools of home loans. In their most basic form, the borrower’s monthly installment payments are passed on to the bondholder.

The mortgage lender, commercial banks, or specialized companies will pool together several loans from the primary mortgage market and sell them on as MBS to investors such as hedge funds, insurance companies and pension funds.

Thanks to the secondary mortgage market, smaller banks can lend more.

Thanks to the secondary mortgage market, smaller banks can lend more.

BMS are frequently combined into CDOs (collateralized debt obligations), which sometimes include other kinds of debt obligations such as corporate loans.

Secondary mortgage market helps banks release more funds

The secondary mortgage market emerged with the aim of providing a new source of funds for home loans when the traditional source in one market (e.g. thrifts in the US) was unable to.

Before the secondary mortgage market, only the very large banks had deep-enough pockets to cover lots of home loans, which typically had a lifetime of between 15 and 30 years. This made it difficult for potential homebuyers to find mortgage lenders. There was also much less competition, which meant that lenders could charge high interest rates.

The 1968 Charter Act in the United States saw the creation of Fannie Mae and Freddie Mac two years later. These two GSEs (government-sponsored enterprises) bought mortgages from lenders and sold them on to other investors. They secured their value, i.e. guaranteed payment on the loans, even if the borrower defaulted.

While the aim of making more capital available for home loans was achieved, it also undermined the relationship between mortgagor (borrower) and lender. With securities guaranteeing mortgage payments, the incentive to make sure the lender could pay the loan was undermined.

Financial crisis changed the market

Before the subprime mortgage crisis, Fannie Mae and Freddie Mac owned or guaranteed about 40% of all mortgages awarded in the US. As several banks, including Bear Stearns and Lehman Brothers sank due to problems with mortgage-backed securities and other derivatives during the 2008 global financial crisis, private banks abandoned the mortgage market.

After the financial crisis, Freddie and Fannie became responsible for virtually all US mortgages. Banks only began returning to the secondary mortgage market in 2013.

In 2014, the two GSEs were still holding onto 27% of all US mortgages.

According to nasdaq.com, the secondary mortgage market is: “Buying and selling existing mortgage loans, which are often pooled and traded as mortgage-backed securities.”