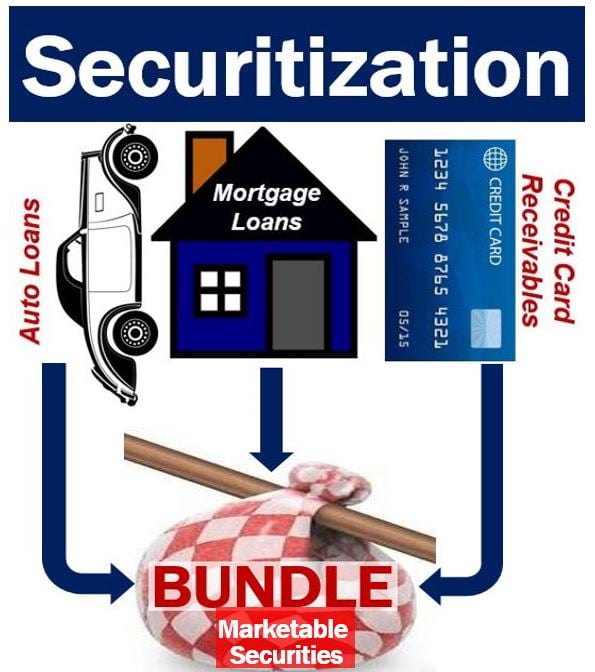

Securitization is a process of bundling or pooling a range of debt instruments with the aim of selling them for cash – turning a future cash flow into securities. The combined value of the debt-instrument bundle is used to convert the various types of bundled debts into a bond issue, which may in turn be bought by investors. It is a way for lenders to move debts and risk off their balance books and get cash.

Securitization is the issuance or creation of bonds and other tradable securities that are backed by income generated by loans, assets, public works projects, and other sources of revenue.

In other words, securitization is a process of taking illiquid assets, and turning them into a security through financial engineering.

Mortgage-backed securities (MBS) – bonds that are backed either by a mortgage or a mortgage pool (collection of mortgages), in which borrowers are essentially paying the bondholders through their monthly installments – are examples of securitization.

The Economists’ glossary of terms says: “Securitiation has many benefits, at least in theory. Issuers gain instant access to money for which they would otherwise have to wait months or years, and they can shed some of the risk that their expected revenue will not materialize.”

The Economists’ glossary of terms says: “Securitiation has many benefits, at least in theory. Issuers gain instant access to money for which they would otherwise have to wait months or years, and they can shed some of the risk that their expected revenue will not materialize.”

Apart from mortgage-backed securities, securitization also includes the financial practice of pooling auto loans, credit card debt obligations, and other types of loans, and selling their related cash flows to investors as securities.

These securities are sold to third parties as CDOs (collateralized debt obligations), pass-through securities, or bonds.

Securities backed by assets are known as ABS (asset-backed securities), while those backed by mortgage receivables are called MBS (mortgage-backed securities).

Regarding securitization, the IMF writes: “The [basic] process involves two steps (see chart). 1. A company with loans or other income-producing assets (originator) selects assets it wants removed from its balance sheet and pools them into the reference portfolio. The issuer, an entity typically set up by a financial institution, buys the pooled assets. 2. The issuer finances the acquisition of the pooled assets by issuing tradable, interest-bearing securities that are sold to capital market investors, who receive fixed/floating rate payments from a trustee account funded by the cash flows generated by the reference portfolio.”

Regarding securitization, the IMF writes: “The [basic] process involves two steps (see chart). 1. A company with loans or other income-producing assets (originator) selects assets it wants removed from its balance sheet and pools them into the reference portfolio. The issuer, an entity typically set up by a financial institution, buys the pooled assets. 2. The issuer finances the acquisition of the pooled assets by issuing tradable, interest-bearing securities that are sold to capital market investors, who receive fixed/floating rate payments from a trustee account funded by the cash flows generated by the reference portfolio.”

Debt mix in securitization

The bundle of debt instruments that make up a securitization item does not have to include identical or similar types of debts. A single securitization deal may include mortgages, vehicle loans, credit card debts, other types of debts, and a number of other debt instruments.

Virtually any type of debt instrument that continues generating income from the payments received on the debt’s principle plus any additional interest may be included in the bundle.

This type of mortgage pool strategy is extremely common. Investor consortiums, banks and other financial institutions frequently engage in the securitization process.

As far as the debtor is concerned, all that is required is to change the address where repayments are remitted.

Securitization projects do not generally lead to a rise in interest rates.

Securitization – a brief history

Securitization has been around since at least the eighteenth century. In the United States, farm railroad mortgage bonds, issued in the middle of the 19c century – are examples of early mortgage-backed securities.

The first example of a modern residential mortgage-backed security was probably in the United States in 1970 – the Government National Mortgage Association (GNMA – Ginnie Mae) sold securities backed by a portfolio of mortgages.

By 1985 in the US, securitization techniques that had been created in the mortgage market where applied to auto loans.

Eli Broad, an American entrepreneur and philanthropist, is the only individual to build two Fortune 500 businesses in different industries – SunAmerica (insurance) and KB Home (homebuilding). In March 2017, Mr. Broad, the son of Lithuanian immigrants, was estimated by Forbes to have a net worth of $7.7 billion. (Image: adapted from broadinstitute.org)

Eli Broad, an American entrepreneur and philanthropist, is the only individual to build two Fortune 500 businesses in different industries – SunAmerica (insurance) and KB Home (homebuilding). In March 2017, Mr. Broad, the son of Lithuanian immigrants, was estimated by Forbes to have a net worth of $7.7 billion. (Image: adapted from broadinstitute.org)

Auto loans – whose volumes in the US are second to mortgages in the loans market – were a good match for structured finance. With shorter maturities than those of mortgages, they allowed for more predictable timing of cash flows. Auto loans also had a long history of good performance, which gave investors confidence.

A $60 million auto loan deal – that was originated by Marine Midland Bank – was securitized by the Certificate for Automobile Receivables Trust (CARS) in 1985.

The first major credit card sale hit the market in 1986 with a private $50 million placement of outstanding bank credit card loans. The transaction showed to investors that with high-enough yields, loan pools could support asset sales with greater expected losses and administrative costs than those that existed in the mortgage market.

In the 1990s, securitization techniques were applied to several sectors of the insurance and reinsurance markets, including catastrophe and life. By 2006, following the disruptions in the underlying markets by Hurricane Katrina, this activity grew to almost $15 billion of issuance.

The 1977 Community Reinvestment Act (CRA) was designed to encourage savings associations and commercial banks to help the needs of low- and moderate-income borrowers. The first securitization of CRA loans began in 1997.

After the credit crunch during the 2007/8 financial crisis, which was precipitated by the subprime mortgage crisis, the market for bonds backed by securitized loans in the US was extremely weak in 2008, except for federally-guaranteed bonds.