Shares outstanding, also known as outstanding shares, outstanding stock or issued shares, are all the shares that a company has authorized and issued, and that are held by stockholders, company officials, and investors.

This includes all common stock held by the public as well as restricted shares that belong to the company’s internal management.

Shares outstanding should not be confused with authorized capital, which refers to the maximum amount of shares a company is allowed to sell.

The shareholders are part-owners of the business and have certain rights, such as deciding who sits on the board of directors.

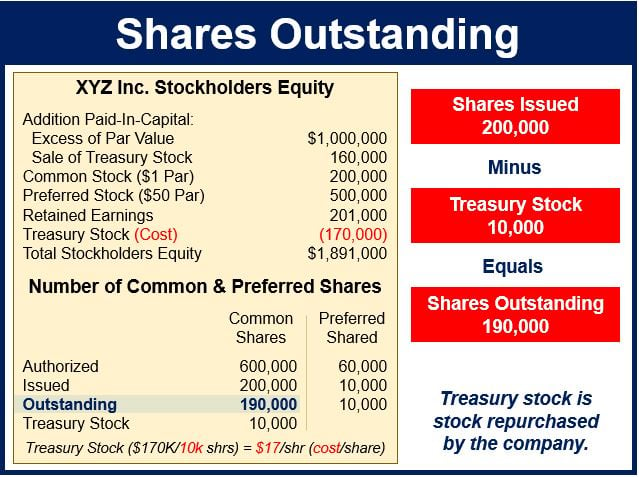

The term does not include stock repurchased by the company, known as treasury shares. When the number of treasury shares increases, the total for outstanding shares declines, and vice-versa.

You can find the total shares outstanding in a company’s balance sheet.

You can find the total shares outstanding in a company’s balance sheet.

There are two ways of calculating shares outstanding – basic or fully diluted.

The basic count is the current total number of shares; voting in the general shareholders’ meeting and dividend distribution are calculated using this number.

The fully diluted shares outstanding count includes diluting securities, such as convertibles, capital notes and warrants. Companies with diluting securities could increase the number of shares outstanding in the future, i.e. they could issue more shares one day.

Shares outstanding appear on a company’s balance sheet under the heading ‘Capital Stock Issued & Outstanding’ in the US, and ‘Issued Share Capital’ in the UK.

Why are shares outstanding important?

Shares outstanding is included in a company’s earnings’ per share formula (EPS calculated as outstanding shares divided by total earnings) and its market capitalization formula (outstanding shares times current share price).

These are two key measures investors use to gauge a company’s performance and value.

Example of shares outstanding

Imagine a company called XYZ Inc. issues a total of 20,000 shares. Twelve thousand of them are issued as floating shares to members of the public, 4,000 are issued as restricted shares to people within the firm, and 4,000 are kept in the company’s treasury.

In this case, XYZ has 16,000 outstanding shares (the treasury shares are not counted).

The term ‘outstanding shares’ does not equal the float, which does not include shares owned by insiders and officers or restricted shares. The float refers to shares available for trading by the public.

The total can fluctuate

The number of shares outstanding can fluctuate as the business issues more shares, repurchases some of them, and retires shares.

Experts say investors should become wary if a company’s outstanding share count increases faster than about 3% to 5% per year, as current shareholders would have their stock diluted by the new shares and would be owning a smaller part of the company.

Video – Stockholders’ Equity

This video explains several types of stocks and how they are presented in a balance sheet, including shares outstanding.