Surety bond has two meanings: 1. It is bond issued by one party on behalf of a second party. The party guarantees that the other party will fulfil all obligations to a third party. 2. A fee charged when somebody loses a physical security issued to them and they have a duplicate issued.

In the United States it also refers to posting bail for an individual who is accused of a crime in exchange for a fee.

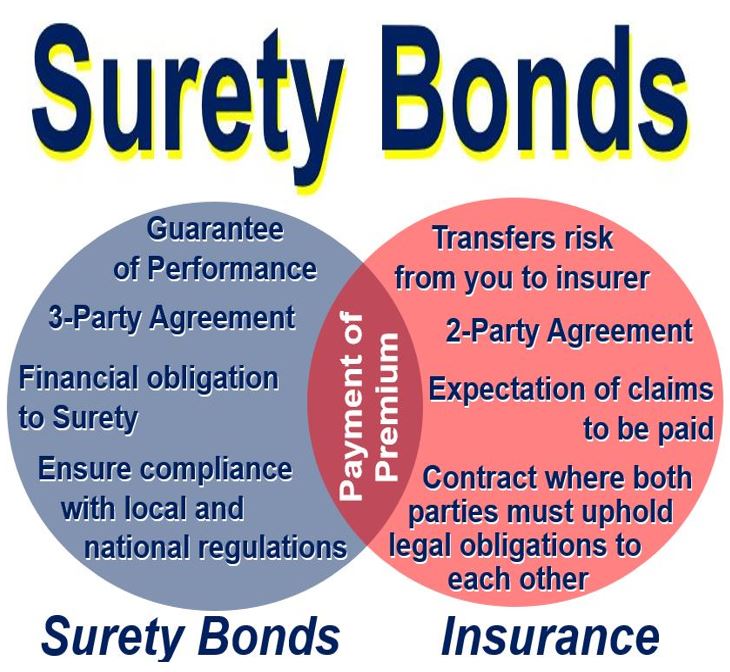

Surety bonds require you or your business to guarantee your honesty, performance or abiding by certain rules, laws or regulations. Surety bonds protect parties that could be affected by your business, such as subcontractors, clients, or the state. With just insurance, the insurance firm mitigates the risks you are facing in return for your regular payments. (Image: adapted from suretybonds.org)

Surety bonds require you or your business to guarantee your honesty, performance or abiding by certain rules, laws or regulations. Surety bonds protect parties that could be affected by your business, such as subcontractors, clients, or the state. With just insurance, the insurance firm mitigates the risks you are facing in return for your regular payments. (Image: adapted from suretybonds.org)

A contract with three parties

A surety bond is a contract that involves three parties:

– The Surety: this is the insurance company that backs the bond. It provides a line of credit in case the Principal fails to fulfill the task.

– The Obligee: the entity that requires the bond – typically government agencies working to regulate industries and reduce the likelihood of financial loss.

– The Principal: the individual or business that purchases the bond to guarantee future work performance.

There are literally thousands of different types of bonds, each with its own set of requirements.

The Obligee is entitled to make a claim to recover losses if the Principal fails to fulfill the task specified in the contract. If it is a valid claim, an insurance company will pay reparation, which cannot exceed the bond amount. The underwriters will then try to get back any claims paid from the Principal.

In Europe, surety bonds are issued either by surety firms or banks. When issued by banks they are known as Cautions in French and Bank Guaranties in English. Those that are issued by a surety firm are known as surety/bonds.

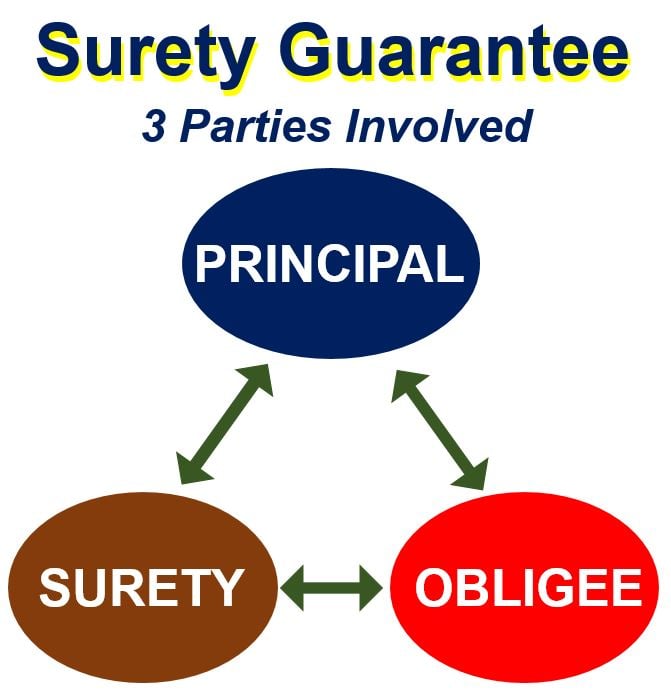

Three parties are involved in a surety guarantee: 1. The Principal – the person required to post bond. 2. The Obligee – a government entity or person requiring principal to be bonded. 3. The Surety – an insurance company that provides financial guarantee to the Obligee on behalf of the Principal. (Image: adapted from suretybonds.org)

Three parties are involved in a surety guarantee: 1. The Principal – the person required to post bond. 2. The Obligee – a government entity or person requiring principal to be bonded. 3. The Surety – an insurance company that provides financial guarantee to the Obligee on behalf of the Principal. (Image: adapted from suretybonds.org)

In the United States, state insurance commissioners are in charge of regulating corporate surety activities within their jurisdictions. They also license and regulate agents or brokers (producers) who sell bonds.

History of surety bonds

A Mesopotamian tablet written approximately 2750 BC is the earliest evidence we have of a contract of suretyship. Evidence of individual surety bonds exists among the ancient Hebrews, Carthage, Rome, Assyria, Persia, Babylon and in the Code of Hammurabi.

The Code of Hammurabi, a well-preserved Babylonian law code of ancient Mesopotamia, written about 1790 BC, is the earliest surviving mention we know of of suretyship in a written legal code.

The Guarantee Society of London, the first Corporate Surety, dates from 1840. In 1865, the Fidelity Insurance Company became the first Corporate Surety company in the United States; however, the venture soon failed.

Congress passed the Heard Act in 1894, which required surety bonds on all federally-funded projects. The Surety & Fidelity Association of America (SFAA), which was originally called The Surety Association of America, was formed to regulate the industry, and improve public understanding and confidence in the surety industry.

Definition of surety bond

According to JW Surety Bonds, a Surety Bond is:

“A legally binding contract that ensures obligations will be met between three parties. The three parties are: 1. The principal: whoever needs the bond. 2. The obligee: the one requiring the bond. 3. The surety: the insurance company guaranteeing the principal can fulfill the obligations.”

Lance Security Bond Associates Inc. makes the following comment regarding getting bonded:

“In order to get bonded, you don’t need to pay the full surety bond amount that’s required from you. You need to cover only a fraction of that, which is called the bond premium.”

“Once you’ve covered that premium, you are bonded, which is similar to having an additional line of credit with a bank. Your surety backs your business by guaranteeing its lawful operation and successful performance.”

Video – What is Surety Bond?

In this video, Allison Madrid, Account Manager at SuretyBonds.com, explains what surety bonds are.