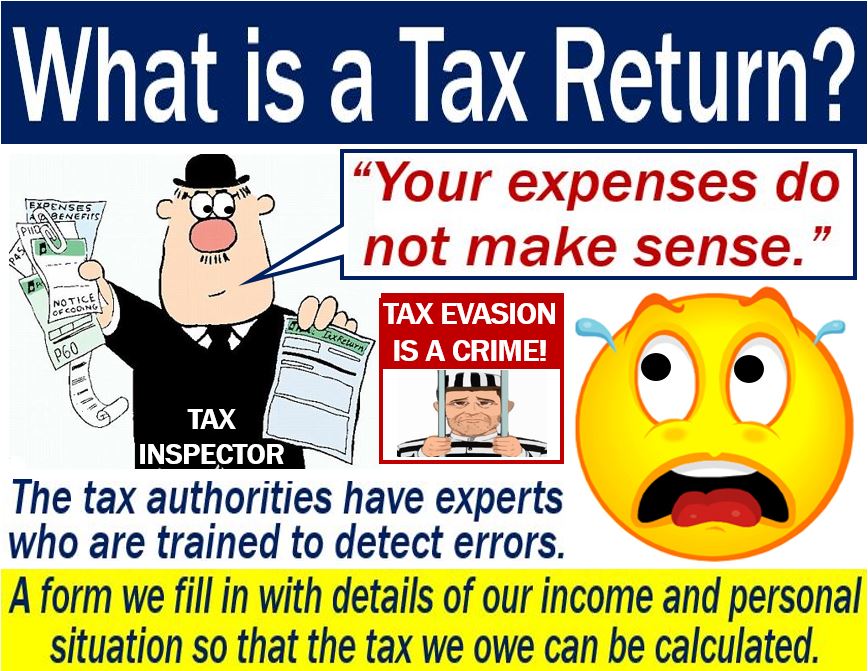

A tax return is a document that individuals and businesses complete each year to report income and file income taxes. They present this document to their country’s tax collecting agency. For example, in the U.S, it is the Internal Revenue Service (IRS), while and in the U.K., it is HMRC. HMRC stands for Her Majesty’s Revenue and Customs.

Individuals and businesses must fill out the tax return form if they get their income from dividends or interest. They must also fill it out if their income comes from profit, and in most countries, capital gains. Capital gain occurs when you sell a capital asset for more than you bought it for.

Employers automatically deduct taxes from employees’ wages and pensions. Often, financial institutions also deduct taxes automatically from people’s savings.

Purpose of the tax return

The form helps taxpayers calculate how much tax they must pay. In fact, it also helps them determine whether they should get a rebate. A rebate is a refund.

If a person or company had paid too much tax, they should receive a rebate.

Who must complete a tax return?

Regarding filing a federal income tax return, the US Government says:

“You may not have to file a federal income tax return if your income is below a certain amount. However, you must file a tax return to claim a refundable tax credit or a refund on income tax withheld.”

According to the UK’s tax authorities, the following individuals need to fill a form.

– When the government agency asks the person or company to do so.

– An individual who is an employer or pensioner with an annual income of £100,000+.

– A self-employed person, a business partner, or a limited company director.

– A person with a pre-taxed investment of £100,000 or more.

– A priest, rabbi, or imam. In fact, any minister of religion.

– Somebody who is a deceased person’s trustee or representative.

– People whose pre-tax investment incomes are at least £100,000 per year.

To be able to fill in your tax form properly, you must keep a record of your income. This means that you should file your bank statements. If some of your expenses are tax-deductible, you should also keep your receipts.

Tax authorities divide most tax returns into three parts: income, deductions, and credits.

The form is only a few pages long. However, this depends on the declared income or deductions requested.

Video – What is a Tax Return?

This video, from our sister YouTube Channel – Marketing Business Network – explains what a “Tax Return” is using easy-to-understand language and examples: