What is trade credit? Definition and meaning

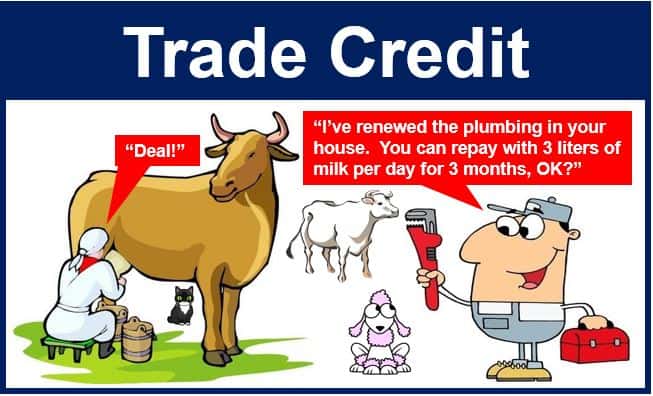

Trade credit, sometimes referred to as favorable terms, is the credit a seller offers to a business customer so that goods or services can be paid at a later date – usually 30, 60 or 90 days after delivery. Businesses commonly use trade credit as a source of short-term financing, i.e. it becomes an alternative to borrowing money from the bank.

Preferential payment terms are generally only offered to established customers or those with a good credit rating. Who to offer trade credit to, as well as what terms, are usually determined by a company’s credit control department.

In the jewelry business, credit terms may be extended for up to 180 days, and sometimes even longer.

Favorable terms effectively reduce the pressure on cash flow that immediate payment would make. This kind of financing is helpful in minimizing and managing the capital requirements of an enterprise.

Many large companies borrow more from suppliers through trade credit than from their banks. Trade credit for Wal-Mart is eight times the amount of capital invested by shareholders. Small and medium-sized businesses often complain that giant companies abuse trade credit facilities by dragging their feet with late payments.

In February 2015, the UK’s Groceries Code Adjudicator said it was investigating supermarket giant Tesco’s late payment of invoices to suppliers.

In a company’s balance sheet, trade credit appears in accounts payable from the buyer’s perspective and accounts receivable from the seller’s perspective. In other words, accounts payable is money a company owes its suppliers while accounts receivable is the opposite, i.e., money it is owed by its customers.

Effects of offering and requesting trade credit

When customers request favorable trade credit terms, the effect is the reverse on the seller’s cash flow. Any terms a company agrees with its buyers will reduce the benefit it has obtained through trade credit negotiations with its suppliers.

For example, if John Doe Inc. has agreed trade credit terms of 35 days with its suppliers and 30 days with its customers, the net benefit will be just 5 days. A business’ working capital is affected by the net amount.

According to Encyclopaedia Britannica:

“Trade credit (is the) deferment of payment for goods or services purchased by one company from another, granted by the seller for a short period, primarily to give the buyer a means of financing inventories.”