What is an underlying asset? Definition and meaning

An underlying asset is a term used to describe a security on which a derivative is based.

The underlying asset is a security (such as stocks, commodities, futures) or property or loan agreement that determines the price of the derivative.

Options are a type of derivative instrument. This means that their prices are obtained from another security’s price.

People use options and underlying assets as a means of speculating and hedging risk. Buying an option speculates a future stock price movement, reducing an investors risk while at the same time making potential earnings unlimited.

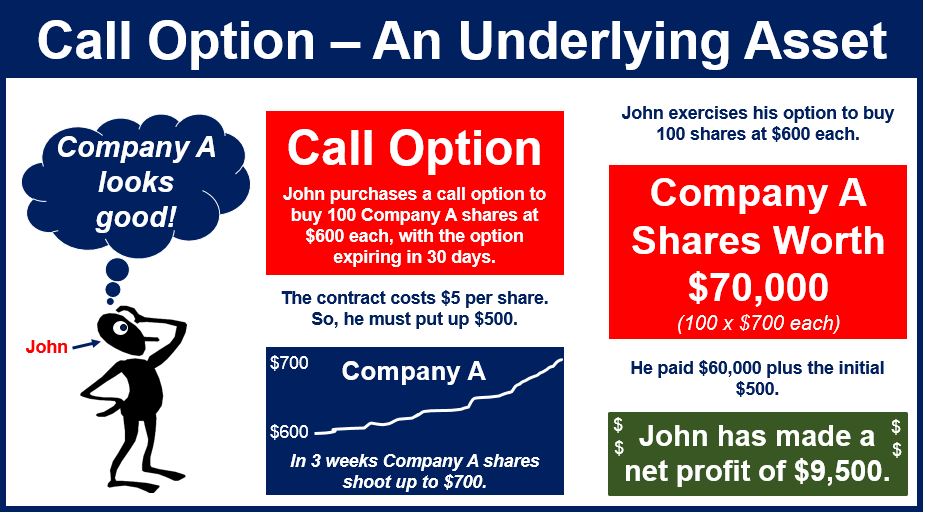

With a call option, if you get it right, you can make a lot of money.

With a call option, if you get it right, you can make a lot of money.

An option holder is able to buy or sell the underlying assets when buying an option contract.

Similarly when a futures trader exchanges contracts they promise to take or make delivery of the underlying asset at a future date.

The Nasdaq Business Glossary defines an Underlying Asset as:

“The security or property or loan agreement that an option gives the option holder the right to buy or to sell.”

According to the Financial Accounting Standards Board (FASB)’s Statement of Financial Accounting Standards No. 133 (FAS 133) – Accounting for Derivative Instruments and Hedging Activities, an underlying is:

A specified interest rate, security price, commodity price, foreign exchange rate, index of prices or rates, or other variable (including the occurrence or nonoccurrence of a specified event such as a scheduled payment under a contract). An underlying may be a price or rate of an asset or liability but is not the asset or liability itself.

Example:

Assume someone places a call option on shares of Microsoft (MSFT) with a strike price (the price at which a specific derivative contract can be exercised) of $50 and an expiration date of June 21. This hypothetical option would allow someone to buy 100 shares of Microsoft at a price of $50 on June 21 (which is valuable if the company is trading at more than $50 per share on June 21).

Video – Underlying assets, call options