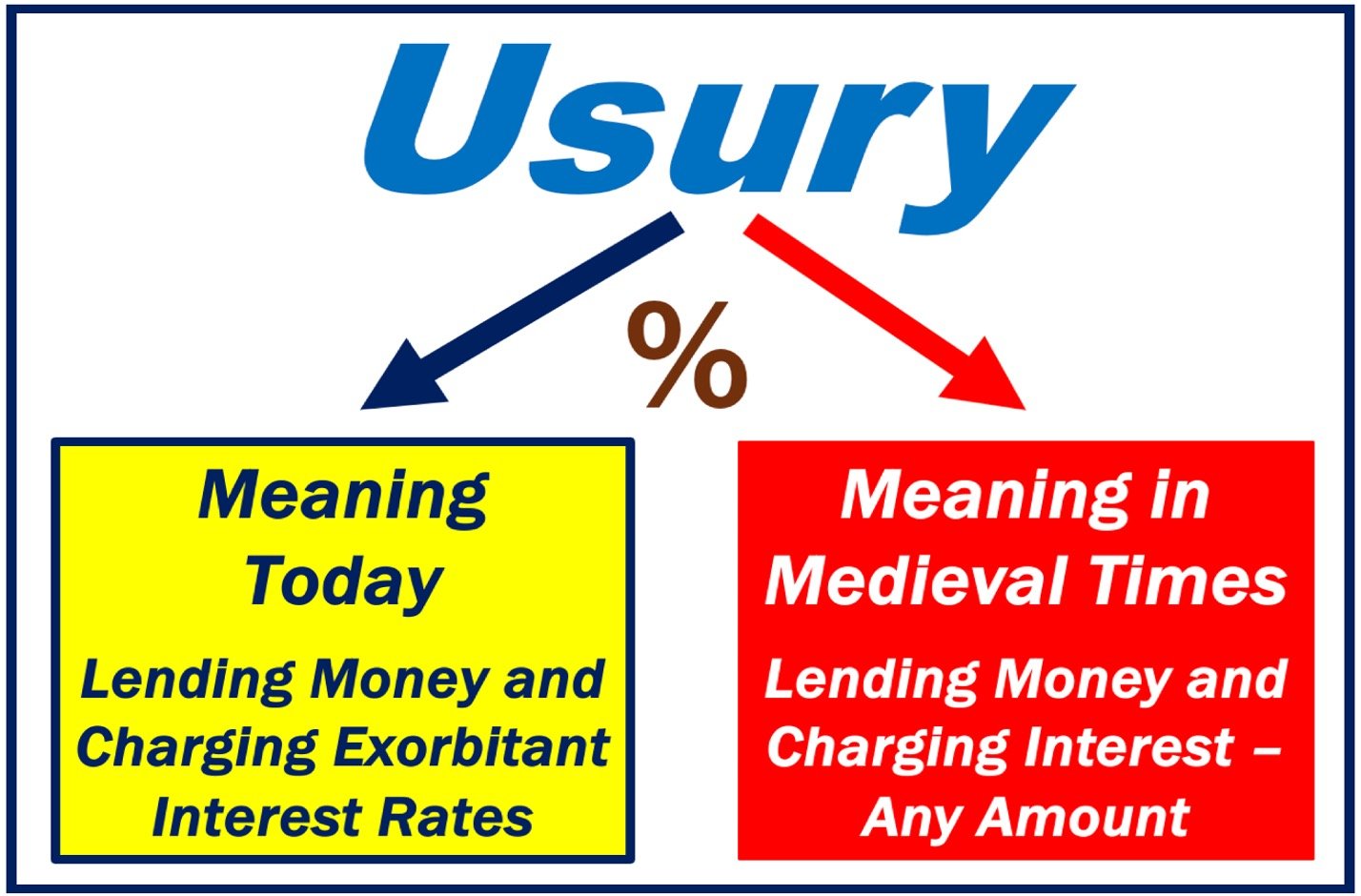

Usury refers to the practice or act of lending money at exorbitant rates of interest – sometimes the interest rate is illegally high. The adjective is ‘usurious’ as in: “That company lends money at usurious rates.” The adverb (rarely used) is ‘usuriously’, as in: “The money was lent usuriously”.

Interest rate refers to the percentage of the total loan that is added onto how much is owed each year.

A person who charges exorbitant interest rates is called a ‘usurer’. In more common everyday English, he or she is known as a loan shark.

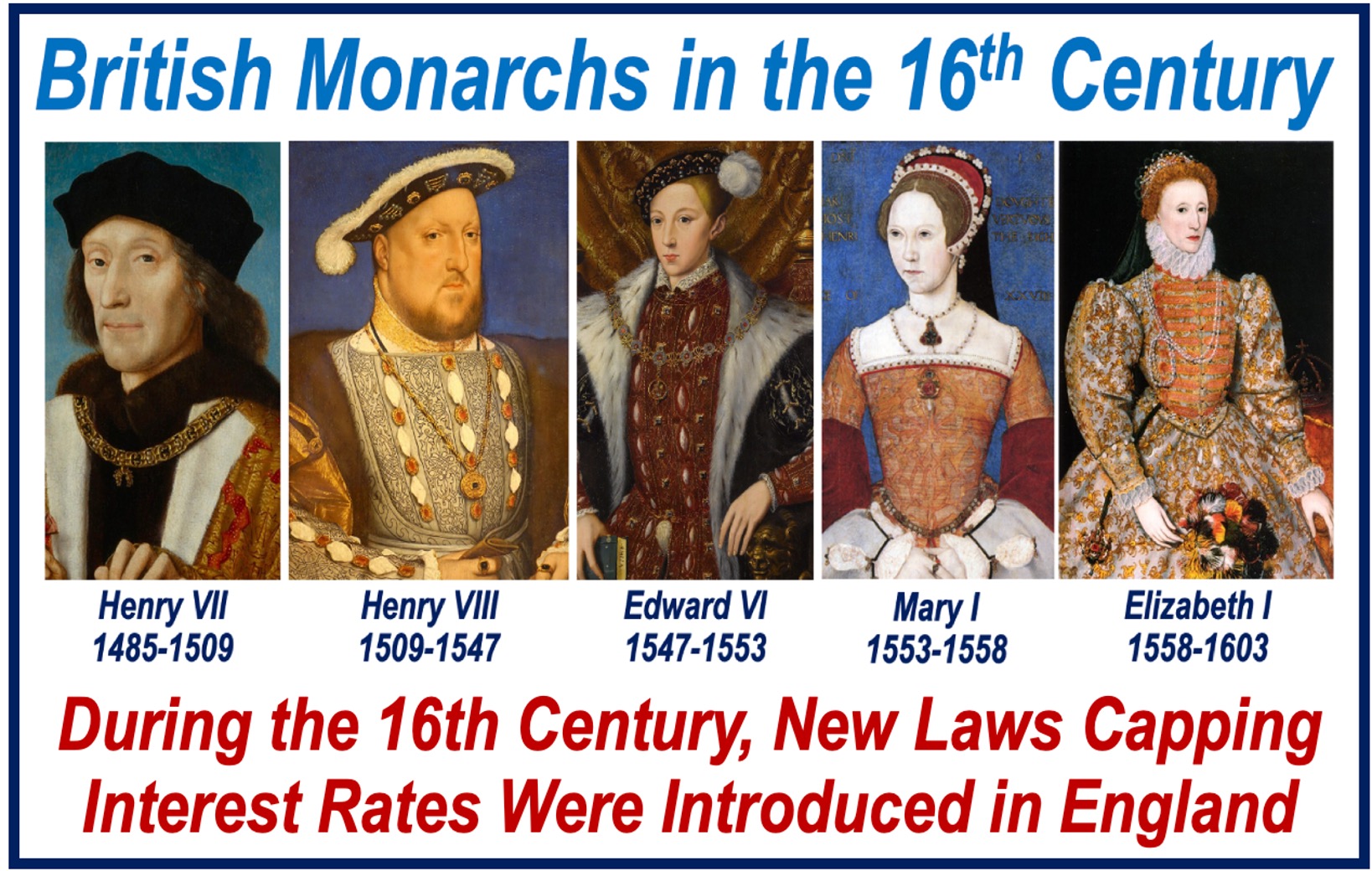

In medieval Europe, usury was common until the end of the reign of Henry VIII (1547), King of England and Ireland. However, until the end of his reign the term referred to lending money and charging any kind of interest – regardless of whether it was exorbitant or reasonable.

In some religions, the lending of money or lending plus charging interest is a sin – in such cases, usury refers to either situation.

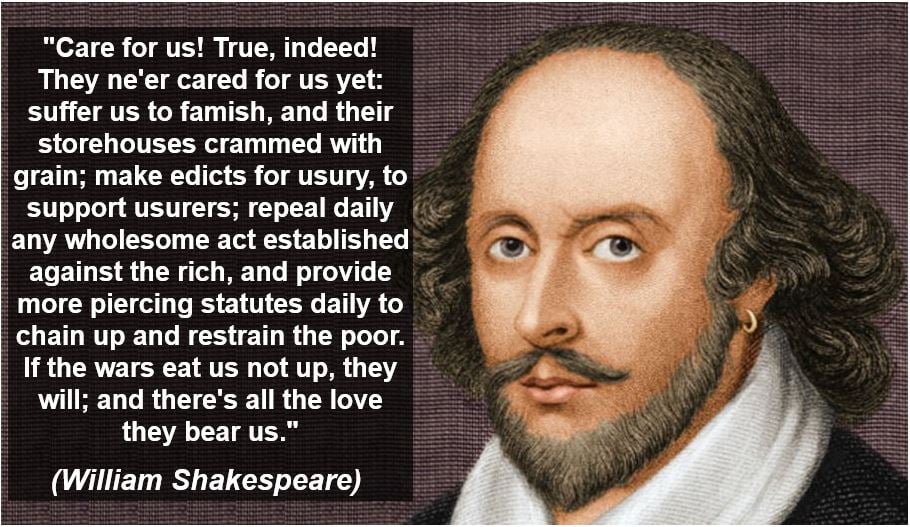

Throughout history, unscrupulous and greedy people have taken advantage of vulnerable individuals. Without good legislation and enforcement, usury spreads rapidly in a society. Charging interest on loans dates back several thousands of years. However, in 16th century England limits were placed on how much one could legally charge on a loan. This was later lifted.

According to the Financial Times glossary of terms, usury is:

“When someone lends people money and makes them pay an unfairly high rate of interest.”

Define Usury – a legal or moral issue

Usury may be a moral or legal term:

- Moral: it is used to condemn individuals who take advantage of other people’s misfortunes.

- Legal: where interest rates are regulated by law, it is used when a lender is charging more than the legal limit.

The United Kingdom, which in modern history had no laws to protect its citizens from usury, had to introduce new legislation in 2015 because payday loan companies were charging astronomical rates of interest – they were literally pushing tens of thousands of people into destitution. Wonga, a London-based lender, was charging an annual percentage rate (APR) of 5,853%. The Financial Conduct Authority made Wonga pay redress for unfair debt collection practices.

Etymology of ‘usury’

Etymology means the study of the origin of words. Somebody who specializes in word origins is an etymologist.

According to the Online Etymology Dictionary, the use of the word ‘usury’ in the English language dates back to 13th century England. Originally, it meant the ‘practice of lending money at interest’.

It was not until later that ‘excessive rate of interest’ was added to the meaning. This came from Medieval Latin Usurua, an alteration of Latin ‘Usura’ which meant ‘payment for the use of money, interest,’ especially ‘exorbitant interest’.

Usury laws – USA, Canada & UK

The United States: limits on terms and conditions regarding loans are imposed by individual states. Usury laws are state laws that stipulate the maximum legal interest rate for loans. Each individual state has its own statute.

If a lender is charging more than the state limit, he or she will not be able to use the courts to recover a debt. In fact, in New York and some other states, such loans are voided ab initio (from the beginning).

Canada: according to Canada’s Criminal Code, interest rates are limited to a maximum of 60% per year. The law is not clearly defined and the country’s courts have frequently intervened to remove ambiguity.

United Kingdom: in modern history, there were no usury laws in Britain until 2015. In 2012, the UK was described as a ‘Gangsta’s Paradise’. In January 2015, the Financial Conduct Authority introduced new legislation limiting payday loan companies’ interests to 0.8% per day.

Usury in a religious context

– Christianity: there are several references in the New Testament to usury:

“Well then, you should have put my money on deposit with the bankers, so that when I returned I would have received it back with interest..” (Matthew 25:27)

“Out of thine own mouth will I judge thee, thou wicked servant. Thou knewest that I was an austere man, taking up that I laid not down, and reaping that I did not sow. Wherefore then gavest not thou my money into the bank, that at my coming I might have required mine own with usury?” (Luke 19:22-23)

– Judaism: according to the Torah (Jewish scriptures) and other books of the Tanakh (Hebrew Bible), Jews are not allowed to use usury when lending to fellow Jews, but are allowed to charge interest on money lent to non-Jews.

“If you lend money to one of my people among you who is needy, do not treat it like a business deal; charge no interest.” (Exodus 22:24)

“Take thou no interest of him or increase; but fear thy God; that thy brother may live with thee.” (Leviticus 25:36).

– Islam: the following is a quotation from The Qur’an (translated into English):

“Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, ‘Trade is [just] like interest.’ But Allah has permitted trade and has forbidden interest.”

“So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein.” (Al-Baqarah 2:275)

How do Islamic banks operate?

If Islam prohibits charging interest on loans, how do Islamic banks make money? There are several approaches which circumvent charging interest. The following explanations are based on Waleed Kadous, a student of Islam who wrote in Quora.com:

– Profit & Loss Sharing (Mushaarakah): this is a bit like a direct investment in a mutual fund. You give your capital to the bank, which then seeks out projects for growth, and invests money in them. You and the bank share in the profits and losses. This type of investment has no fixed rate of return and carries some element of risk.

– Rental with eventual ownership (Ijaarah Muntahiya bittamleek): the bank rents an asset such as a house to a client. Over a period of time, the client pays more than just the rent amount for the asset to the bank. The excess is used to increase the share ownership of the house or whatever asset is being used. By the end of the term, the client is the owner of 100% of the asset.

– Ijaarah: the bank buys an asset and rents it to a customer. As occurs in a lease agreement, the arrangement might end in a purchase of the asset.

Usury in other languages: usura (Spanish, Portuguese, Italian), usure (French), Wucher (German), ростовщичество (Russian), お金 (Japanese), 高利贷 (Chinese), الربا (Arabic), सूदखोरी (Hindi), সুদ (Bengali), riba (Indonesian, Swahili), lichwa (Polish), åger (Norwegian, Danish), and ocker (Swedish).

Video – What is Usury?

This video, from our sister YouTube Channel – Marketing Business Network – explains what “Usury” is using easy-to-understand language and examples: