Value Investing refers to buying securities that are considered undervalued in the market. Investors using this strategy buy securities for less than their intrinsic value. The term ‘securities,’ in business and finance, refers to financial instruments, such as company shares or government bonds. In the world of value investing, ‘securities’ typically refers just to company shares.

Have you ever found a hidden gem in a flea market or scored an incredible bargain online? Value investing is similar, but instead of hunting for rare jewelry, antiques, or discounted electronics, we are search through the stock market for company shares that are undervalued.

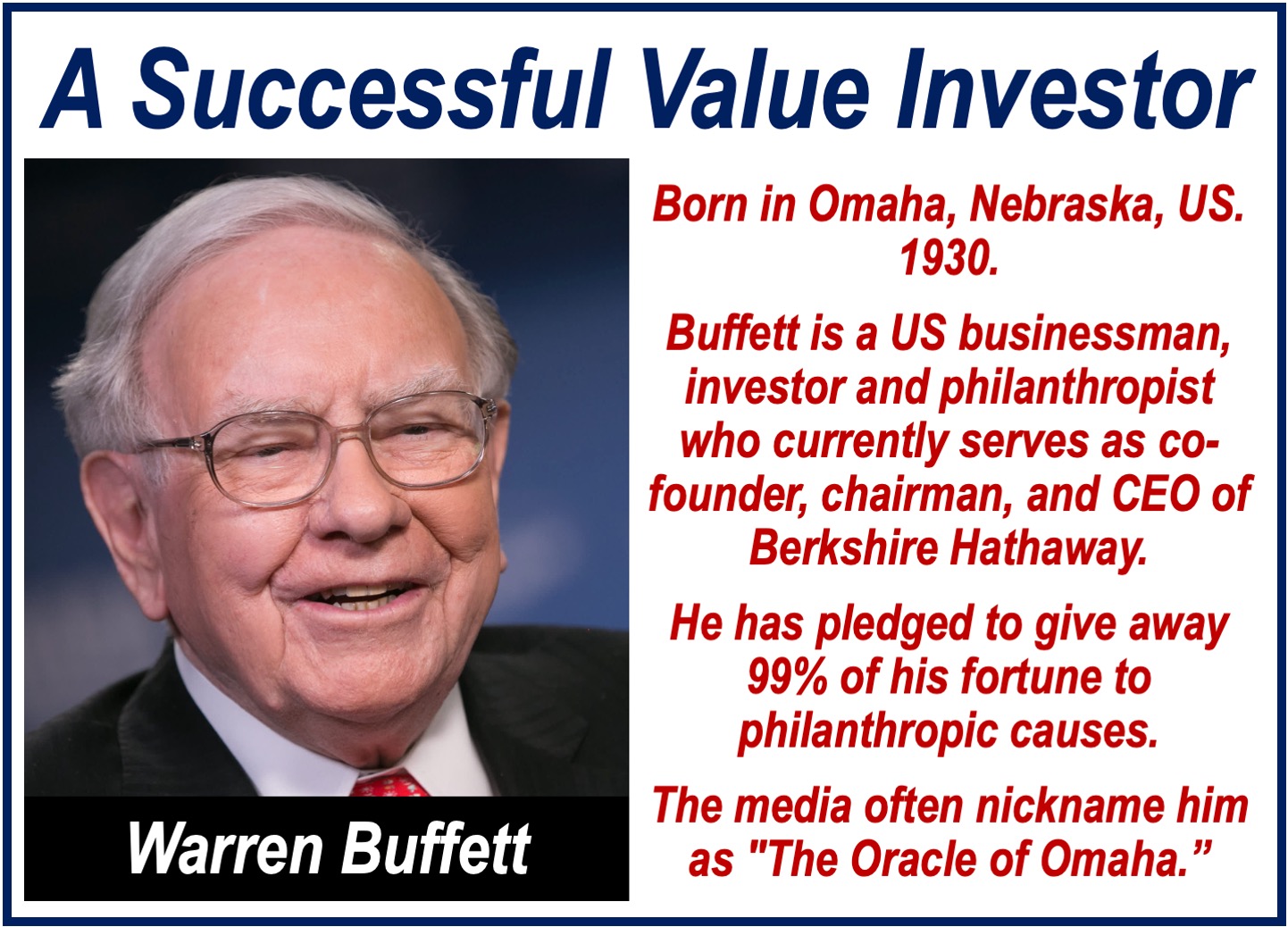

Many successful investors, such as Warren Buffet and Peter Lynch, are proponents of value investing.

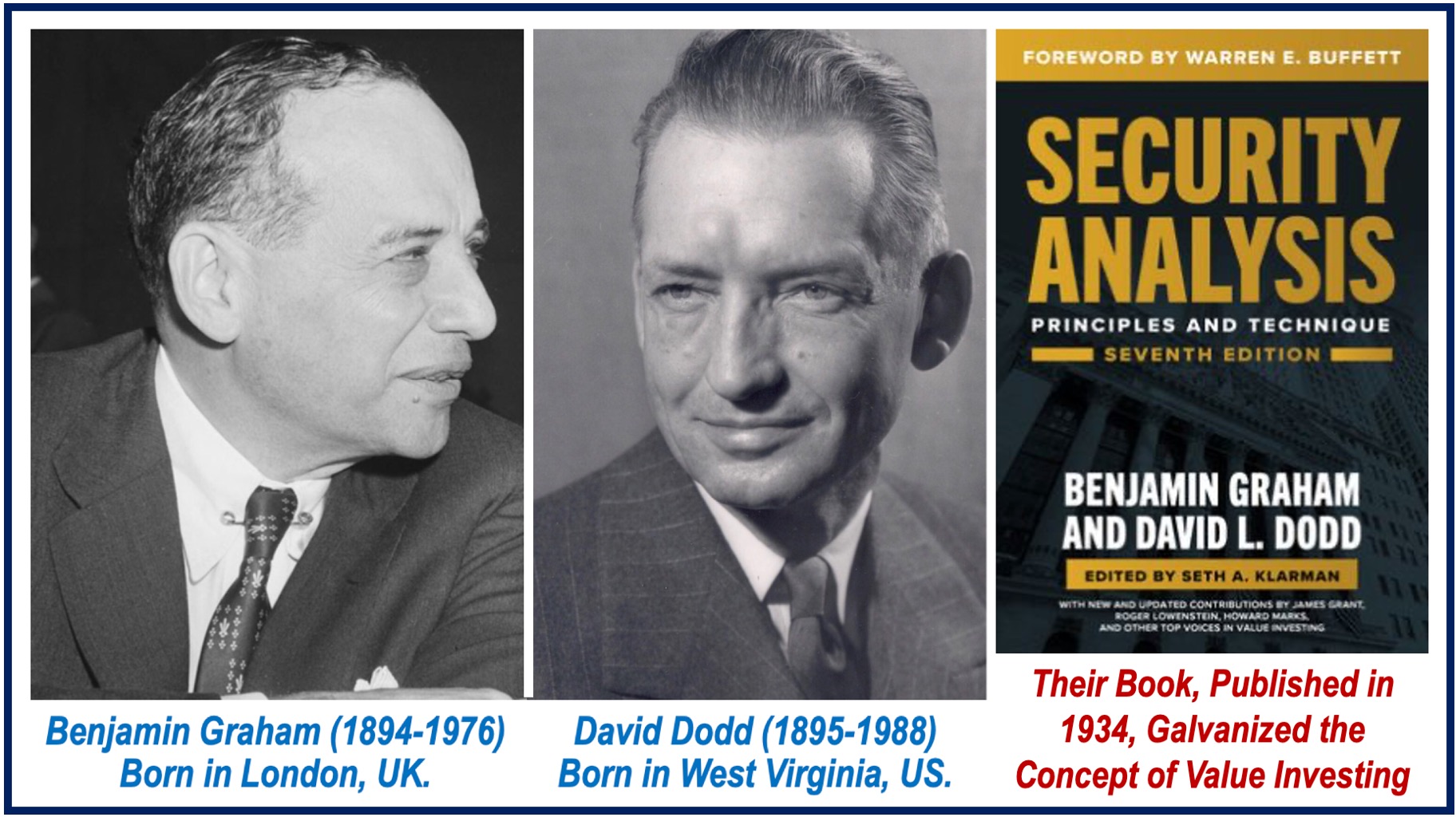

Benjamin Graham & David Dodd

The investment paradigm which we know of as value investing derives from the investment ideas of Benjamin Graham (1894-1976) and his protégé David Dodd (1895-1988), both from Columbia Business School.

The concept started to take off in a serious way after Graham’s and Dodd’s text ‘Security Analysis’ was published in 1934. Neither Graham nor Dodd coined the term ‘value investing’; the expression emerged later.

Since then, value investing has taken many forms, but they all include the basic idea of buying good-quality securities at knock-down prices, i.e. buying stocks that are intrinsically worth $1 for just 50 cents.

Such securities may include publicly listed company shares that trade at discounts to book value, have high dividend yields, and low price-to-book ratios.

Value investing contrasts with growth investing, where the focus is on capital appreciation, and stocks are often purchased at a high price.

It involves a 3-step process

In order to find truly undervalued stocks, the value investor follows a 3-step process.

-

Step 1

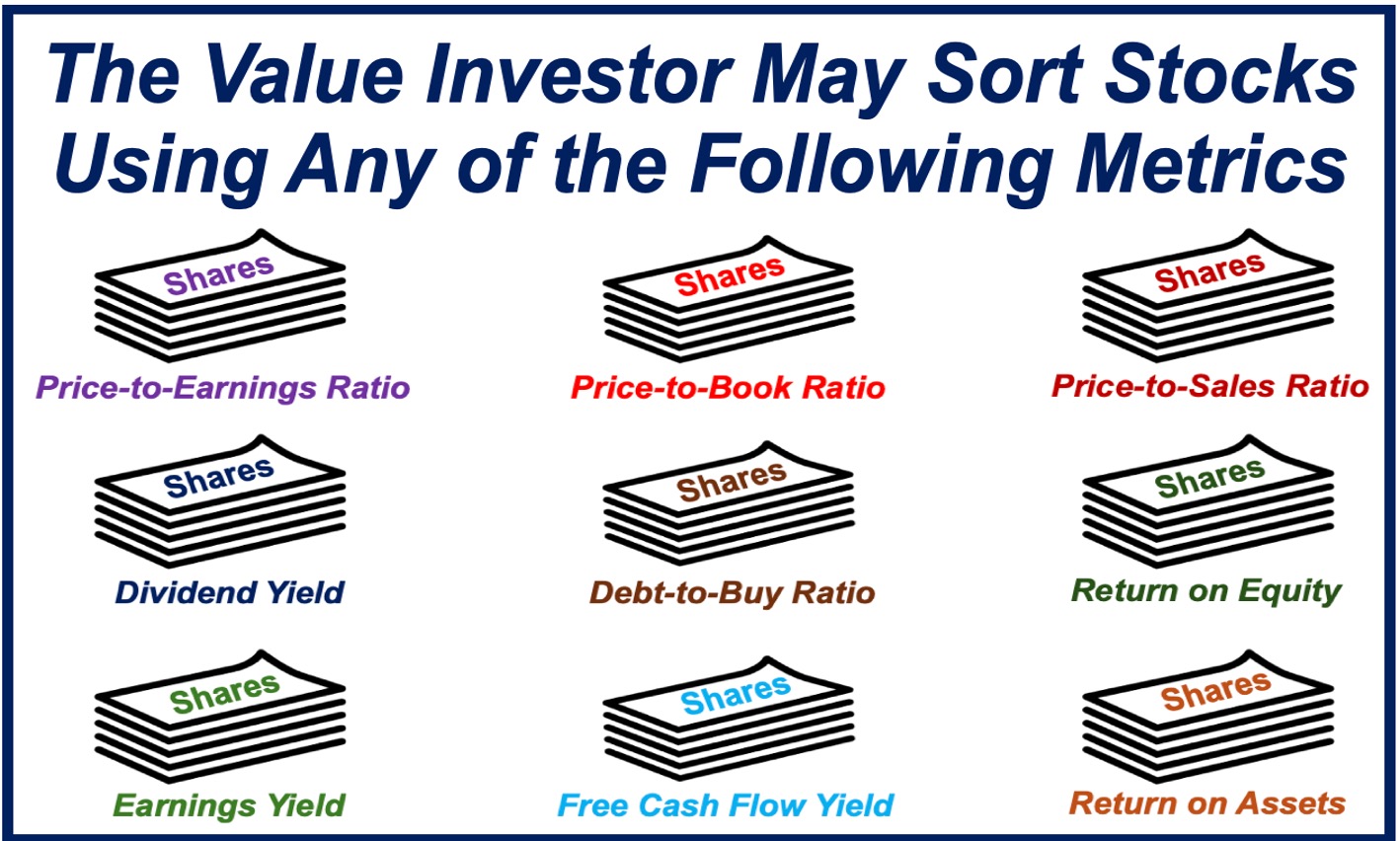

Sort the stocks according to a number of possible metrics, for example their price/earnings ratio (p/e). This significantly reduces the number of different stocks they will have to assess more closely.

-

Step 2

Sift carefully through each of the stocks with a low p/e, and find the ones that are truly undervalued. Filter our the bad stocks from good ones. The only way to do this is to value all those in the low p/e group.

-

Step 3

Compare each stock’s *intrinsic value to the market price. A stock is truly undervalued and worth buying if its price is lower than the intrinsic value by more than 33% (more than the margin of safety).

*A stock’s intrinsic value is what it is actually worth, really worth, rather than its book value or market price.

Warren Buffett and value investing

Billionaire investor Warren Buffett, the Chairman of Berkshire Hathaway, is an avid proponent of value investing. For the past two-and-a-half decades, Mr. Buffett has taken the value investing concept further by focusing just on ‘finding an outstanding company at a sensible price’ instead of generic firms at knock-down prices.

Mr. Buffett once said that it is “far better to buy a wonderful company at a fair price, than to buy a fair company at a wonderful price.”

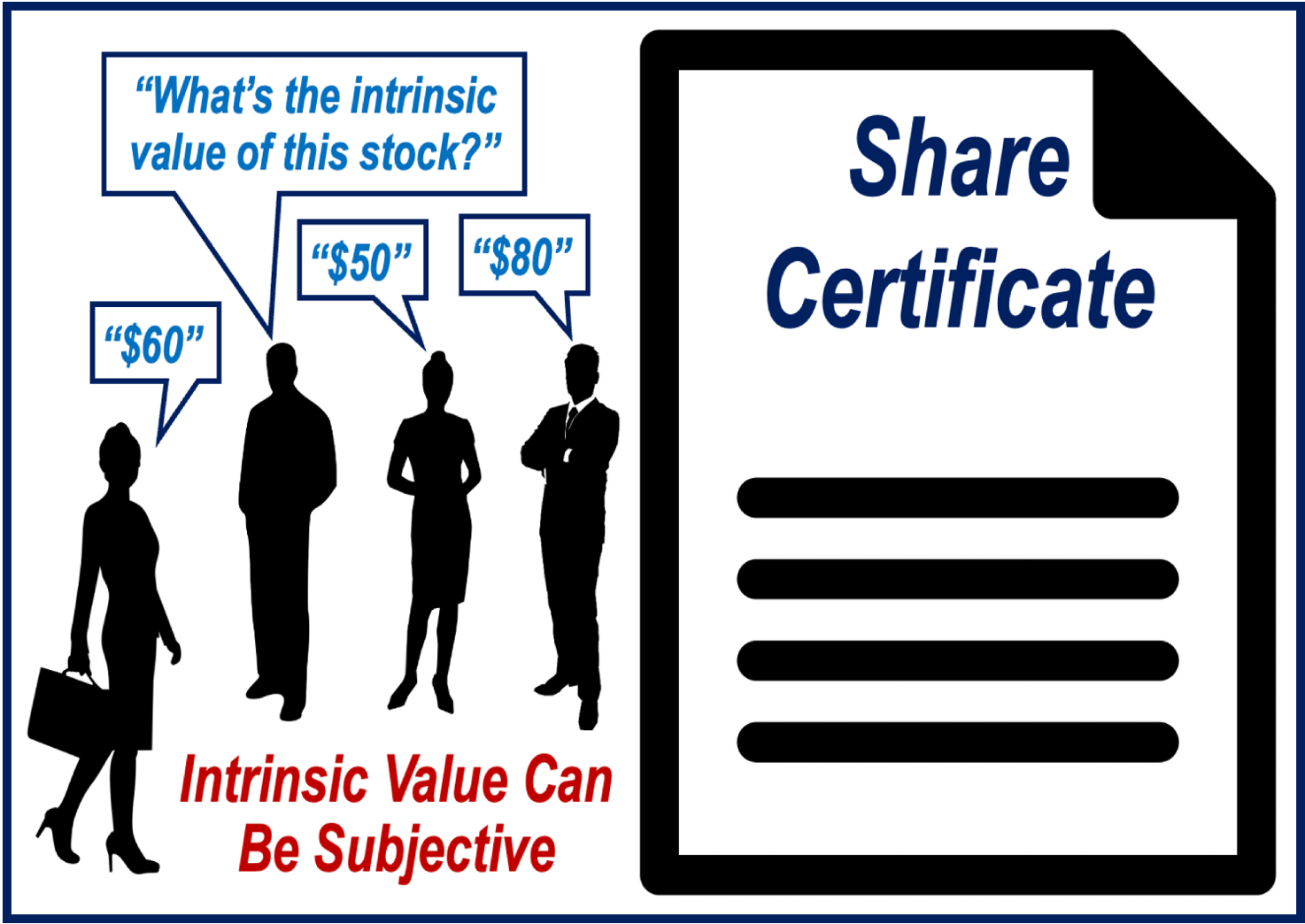

Intrinsic value – a subjective assessment

Critics of value investing say the system is flawed because calculating ‘intrinsic value’ is unreliable. They say that if you get two investors to look at the same information and calculate intrinsic value, they will often come up with different results.

Does this make value investing more of an art than a science?

Value investing is in some ways similar to contrarian investing in that the investor seeks mispriced investments, and tries to buy those that appear to be undervalued by the market.

Video – What is Value Investing?

This video, from our sister YouTube Channel – Marketing Business Network – explains what “Value Investing” is using easy-to-understand language and examples: