The term Vertical Equity refers to the principle that wealthy people should pay more in taxes to the government than individuals further down the socioeconomic ladder. The vertical equity method of collecting income tax is believed to be fairer, because those who are able to pay more. Some people argue that the system is unfair because it discriminates against people with more money and hard workers.

Even though this system is controversial, the vast majority of countries across the world have adopted some kind of income tax based on the idea that the better off should pay more than the middle class, who should contribute more than the working class, etc.

Vertical equity is the opposite of horizontal equity, in which everybody is given the same treatment in an identical situation, regardless of socioeconomic status.

According to The Economist, vertical equity is:

“One way to keep taxation fair. Vertical equity is the principle that people with a greater ability to pay should hand over more tax to the government than those with a lesser ability to pay.”

Two types of vertical equity and their meaning

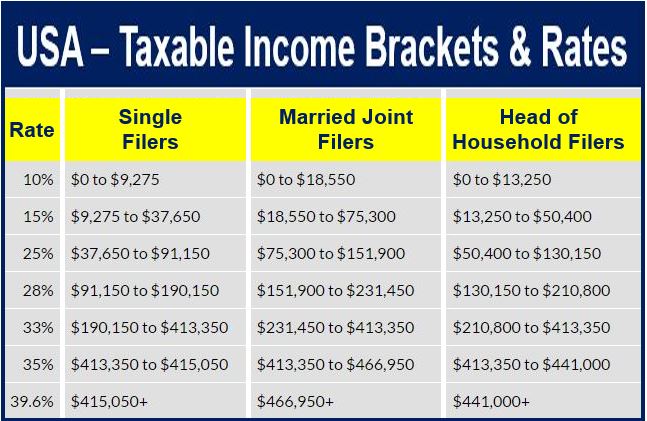

In the world of taxation, specifically income tax, there are two types of vertical equity: 1. Proportional taxation. 2. Progressive taxation.

-

Proportional Taxation

The amount people pay in taxes rises directly with annual income, but the percentage is the same. Also known as flat taxation or flat tax. For example, imagine a country where the income tax rate is a flat 5% – those earning $50,000 per year pay $2,500 while people earning $100,000 pay $5,000. It is a flat rate for everybody, however, rich people pay more in total, but not more as a proportion of their income; they do in proportional taxation (see below).

-

Progressive Taxation

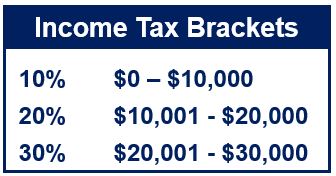

Citizens pay taxes based on the tax brackets into which their annual income places them. Each tax bracket has a different rate of income tax – those in higher brackets pay progressively more.

Imagine a country where there are tax brackets of 10%, 20% and 30% – with 10% applying on incomes up to $10,000, 20% on incomes from $10,001 to $20,000, and 30% for any income amount above $20,000.

A person earning $30,000 per year would pay $5,000 in tax, broken down as follows:

– $1,000: from the first $10,000 at 10%

– $2,000: from the $10,001 to $20,000 at 20%

$3,000: from the $20,001 to $30,000 at 30%.

The vertical equity controversy

Supporters of vertical equity in the world of taxation say it is the best way to mitigate income equality within a society, because the tax structure reduces inequality. Studies have shown that most citizens are in favor of richer people paying more tax than those with lower incomes.

Social psychology studies in several different countries have found that progressive taxation is positively linked to subjective well being.

By reducing inequality, progressive taxation helps maintain political and social stability in a country, many experts argue.

Those against it say that taxpayers should be charged according to the public services they use – a billionaire does not use up hundreds or thousands of times more miles of public roads or street lighting than a bus driver, so why should his or her income tax bill be hundreds or thousands of times greater?

We do not charge rich people more for goods in a shop, movie theater tickets, newspapers, etc., so why should they be charged more for public services?

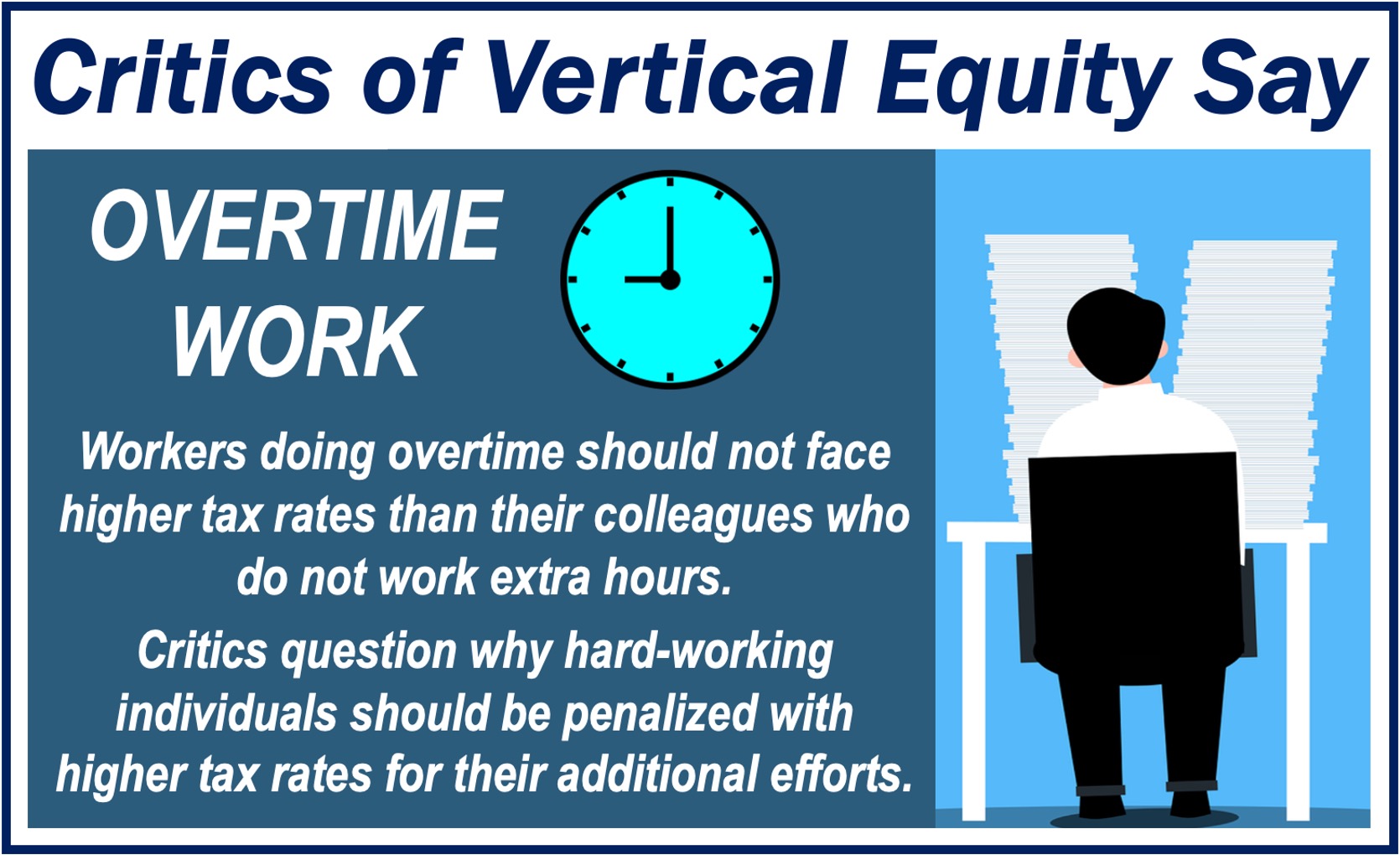

Others argue that the vertical equity approach punishes people who work hard and rewards those who don’t. By punishing hard work, many people are not working hard because they are motivated not to do so by the tax system, they add, this ultimately makes a country poorer.

Most politicians support progressive income taxation for two main reason:

- They believe it is fairer.

- There are fewer rich people than lower-income individuals in the country. In order to win elections, you need to focus on large population groups and give them things they like. For obvious reasons, people who are not well off favor a system which makes rich individuals pay more tax.

Vertical equity – a brief history

Income taxes have changed considerably since the early days of the Roman Republic, when public taxes consisted of assessments on the wealth and property people owned. Under normal circumstances, the tax rate was 1% on property value.

In times of war, tax rates in the Roman Empire could go up to as high as 3%.

By the year 167 B.C., Roman citizens in the Italian Peninsula paid no taxes at all, thanks to the wealth acquired from the empire’s conquered provinces.

The first modern example of vertical equity in the tax system was in 1798, when British Prime Minister William Pitt the Younger introduced a levy on people’s incomes to pay for weapons and equipment for the French Revolutionary War.

Pitt’s tax began at a levy of 2 old pence in every pound (there were 120 pence per pound then) on incomes greater than £60, which was equivalent to an income of £5,696 ($7,162) in 2015.

Income tax – as we know it today – began in the UK in 1842, introduced by Prime Minister Sir Robert Peele in the Income Tax Act, and in the United States when the Revenue Act was signed into law by President Abraham Lincoln in 1862.

Video – What is Vertical Equity

This video, from our sister YouTube Channel – Marketing Business Network – explains what “Vertical Equity” is using easy-to-understand language and examples: