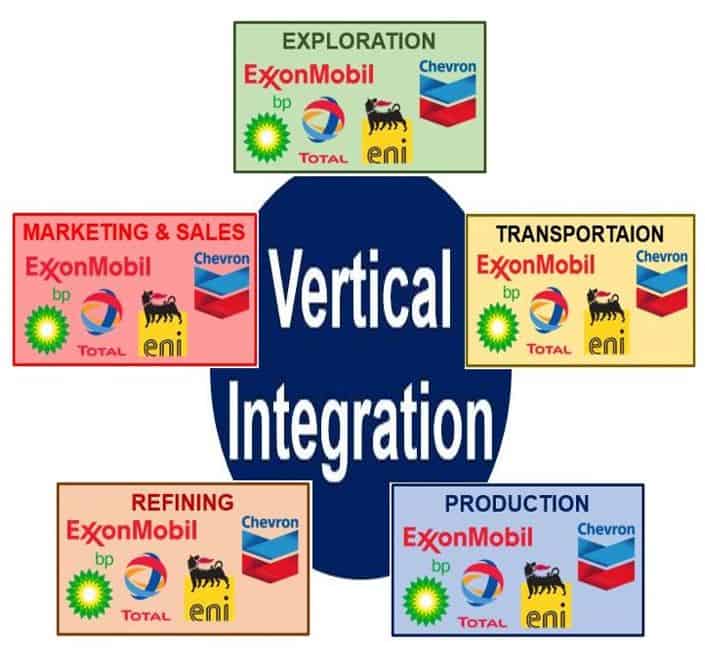

Vertical Integration refers to the merger of companies that are in the same business but in different stages of production or distribution.

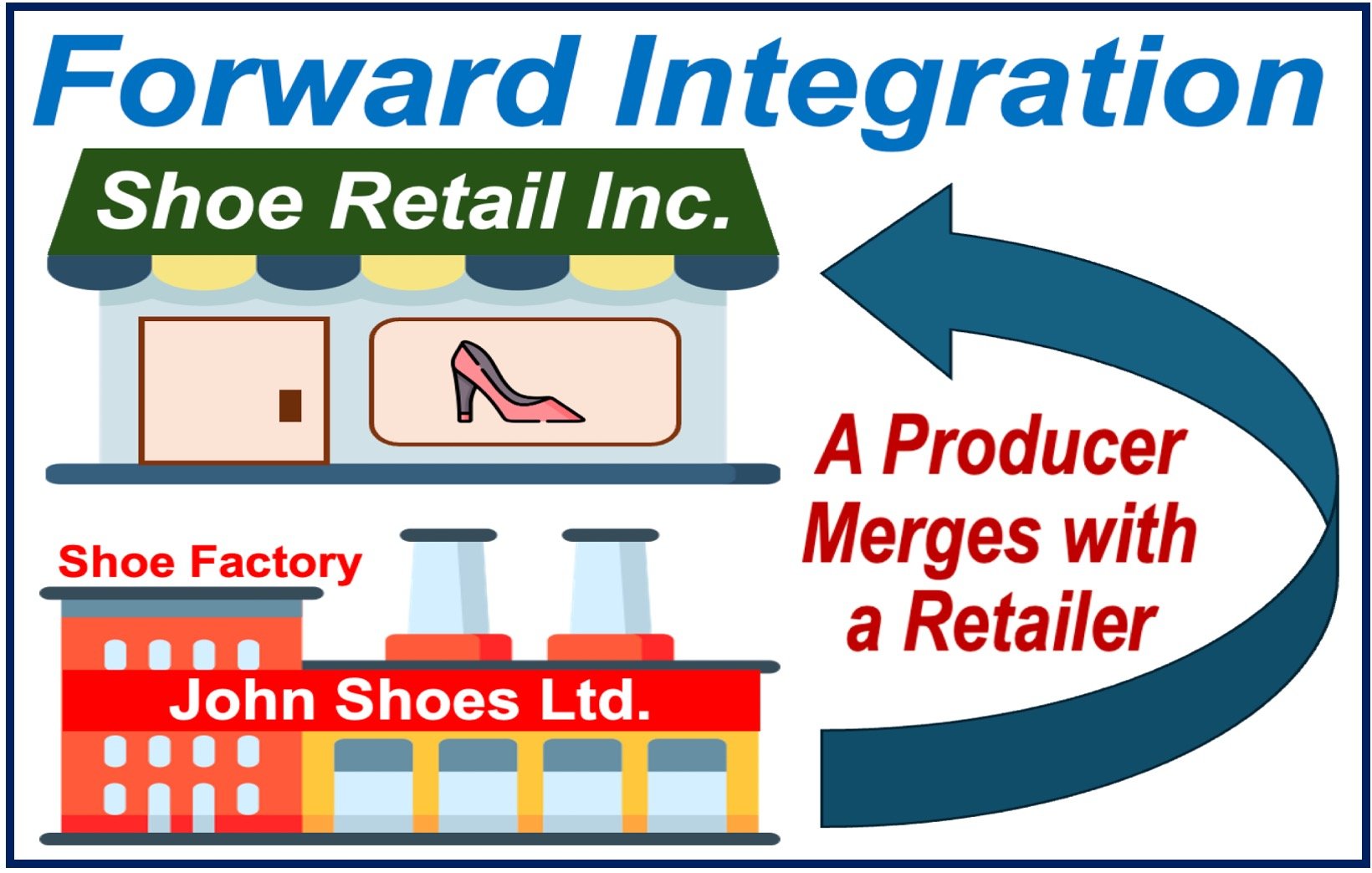

For example, imagine John Shoes Ltd., a major shoe manufacturer, merges with Shoe Retail Inc., a chain of shoe-shops – that is an example of vertical integration.

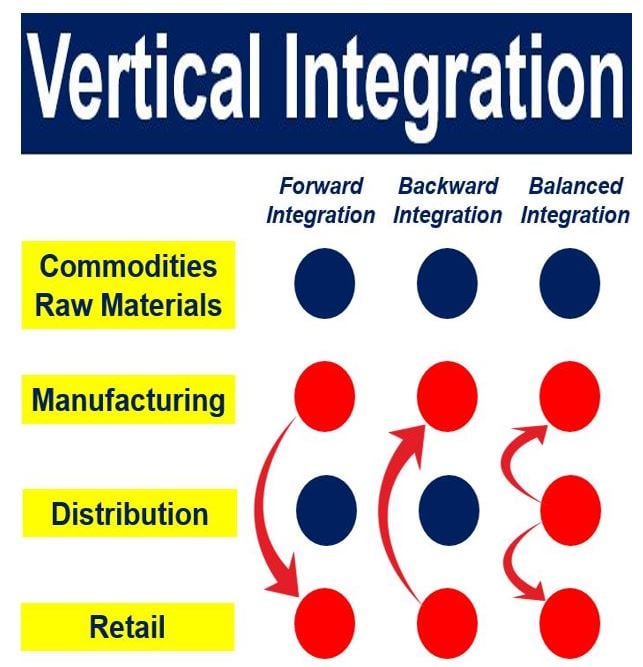

There are four stages in the supply chain: commodities (raw materials), manufacturing, distribution and retail. A merger of two companies in any of the four phases are examples of vertical integration – they must be different phases.

For vertical integration to occur, the company does not necessarily have to merge with another one – it may have moved further own or up the supply chain on its own. For example, Netflix, the California-based multinational entertainment company, started off just as a movie distributor, and then moved on to creating films as well. Target Corporation, the second-largest discount retailer in the United States, is also involved in the manufacturing and distribution of products.

The term contrasts with horizontal integration – when two companies in the same stage of the supply chain merge. Examples include Daimler Benz and Chrysler, Kraft Foods and Cadbury, Porsche and Volkswagen.

Conglomerate integration is when two companies that are in totally different lines of business integrate. Examples include Google and YouTube, Microsoft and Skype, and Proctor and Gamble and Gillette.

Three types

There are three kinds of vertical integration:

-

Backward Integration

When one firm merges with another one further back in the supply chain, such as when a chain of shoe-shops merges with a shoe factory. This is also called downstream integration.

-

Forward Integration

When one company merges with another further up in the supply chain, for example, when a shoe factory merges with a chain of shoe-shops. This is also known as upstream integration.

Retailers that are vertically integrated can offer goods like brand name products at very low prices because they have cut out the middleman.

-

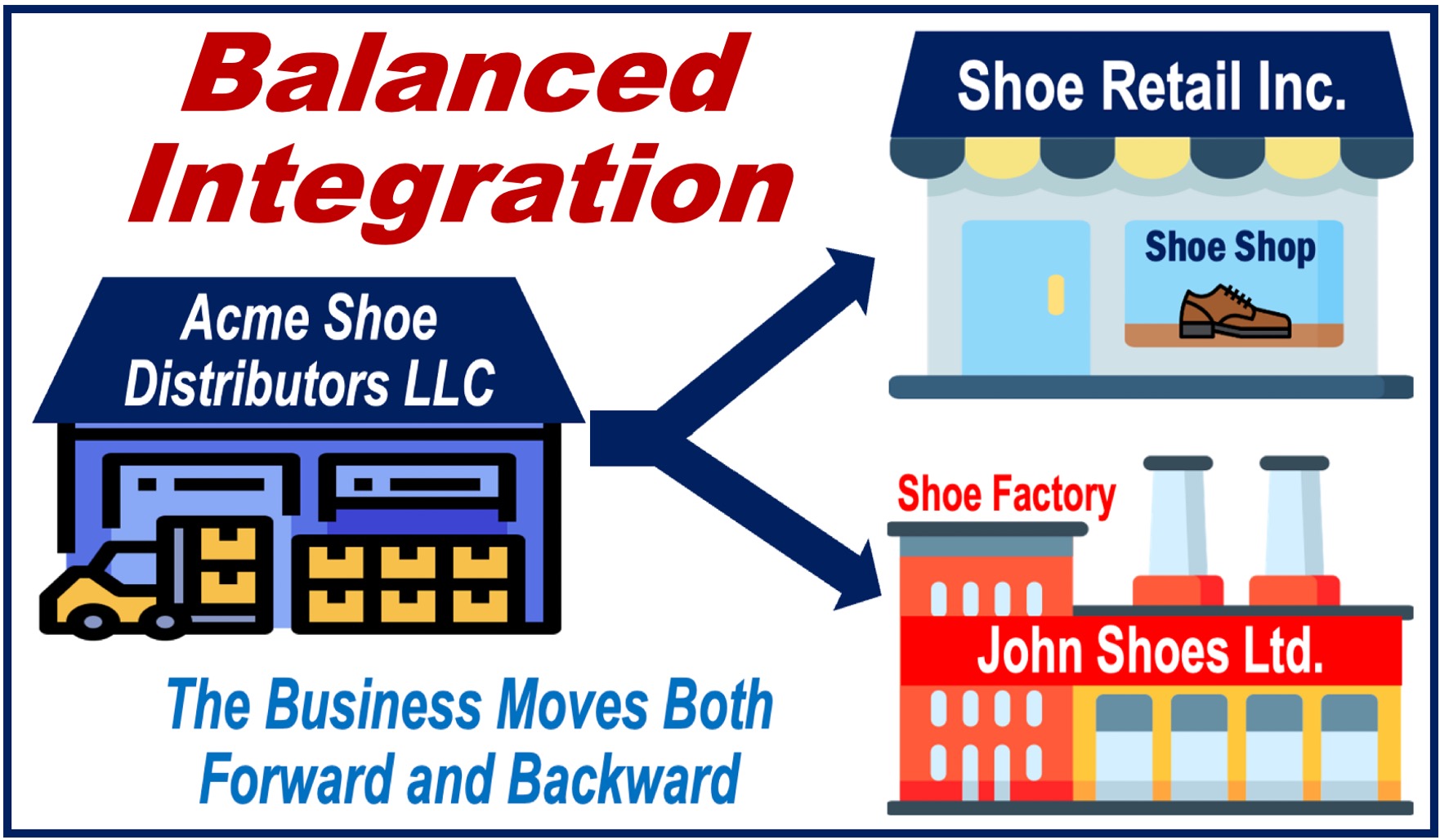

Balanced Integration

This type of integration occurs when the vertical move is in both directions – forward and backward.

Andrew Carnegie (1835-1919), a Scottish American industrialist who led the expansion of the American steel industry in the late 19th century, became involved in more than one stage of the supply chain. His example encouraged others to use the vertical integration strategy to promote efficiency and financial growth in their businesses.

Advantages of vertical integration

-

Independence

The integrated firm does not have to depend on other companies in the supply chain. Disruptions are less likely to occur. The company can monitor quality control more closely.

-

Market Power

If you are in control of at least two phases of the supply chain you have much more power and are more able to dictate terms.

-

Costs

By cutting out the middleman, the integrated company is able to offer products to consumers at lower prices, or at the same price as others but with greater profit margins.

-

Brand Image

Because the company or product brand name exists in more than one stage of the supply chain, its brand image will be stronger.

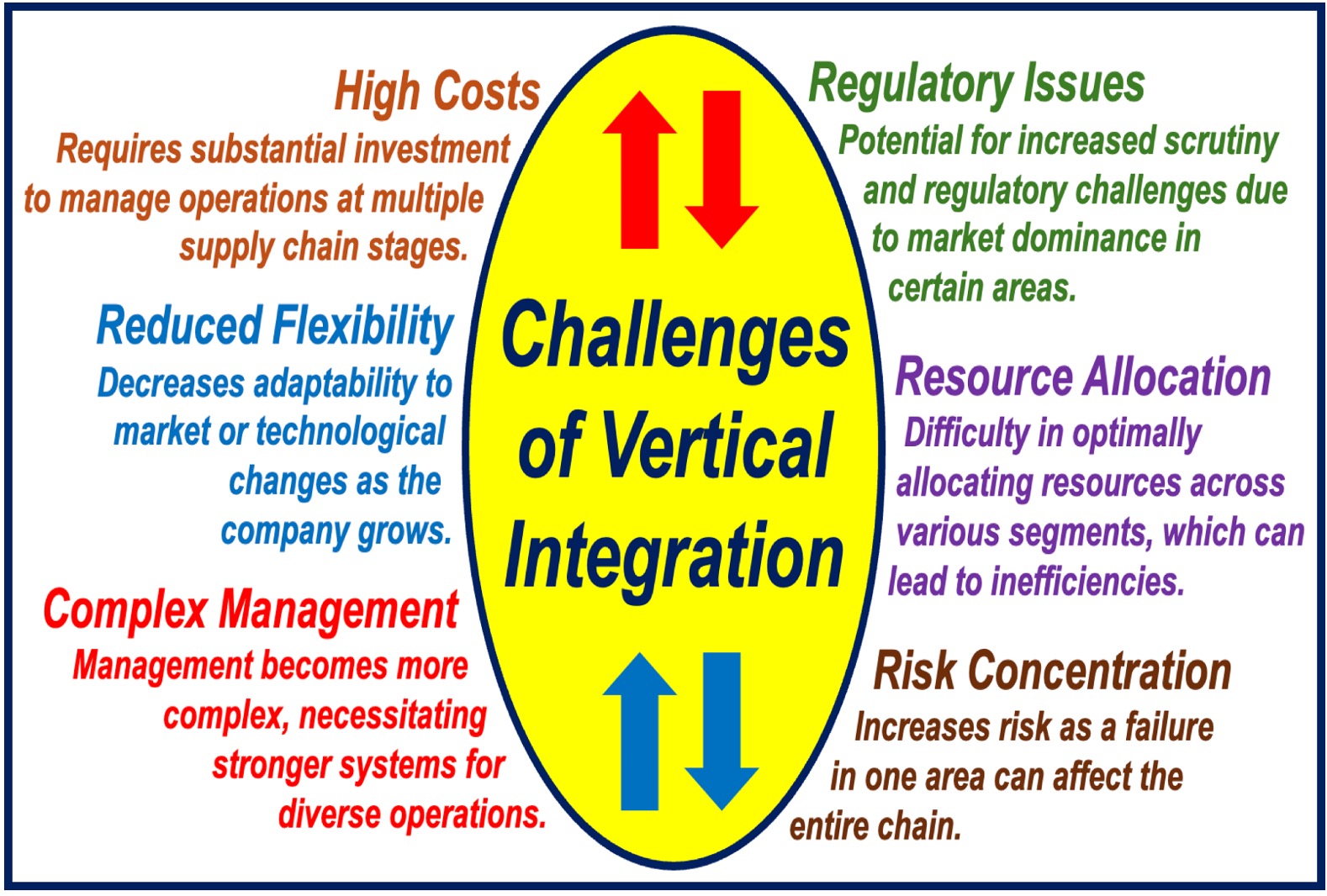

Disadvantages of vertical integration

-

Set-up Costs

Becoming a vertically-integrated company is expensive. They have to invest a great deal of money to buy or set up factories or a chain of retail outlets. In order to maintain efficiency and profit margins they must keep the plant running. Experts say that vertical integration is a strategy that is hard to reverse.

- Less Choice and Flexibility

It is more difficult to follow consumer trends or sudden changes in the marketplace. Companies involved in just one stage of the supply chain, for example retailers, can switch from one supplier to another. If their domestic currency suddenly rises in relation to those of other countries, they can seek out cheaper suppliers abroad.

-

Loss of Focus

Running a factory is totally different from managing a chain of shops. There is a risk that they end up doing both badly rather than one of them well.

-

Company Culture

A successful supermarket chain attracts sales and marketing types – this is not the case with a manufacturer. The integrated company will find it harder to have a culture that supports different phases in the supply chain. There is a risk of misunderstandings within the company because of a clash of cultures.

Peter Thiel is a German-American entrepreneur, hedge-fund manager, political activist, author and venture capitalist. His net worth, according to Forbes in 2016, was $2.7 billion. (Image: twitter.com/peterthiel)

- Goes Against the Trend

Since the late 1990s, the trend has been to specialize rather than diversify. Twenty years ago, consultants McKinsey & Company wrote:

“Whereas historically firms have vertically integrated in order to control access to scarce physical resources, modern firms are internally and externally disaggregated, participating in a variety of alliances and joint ventures and outsourcing even those activities normally regarded as core.”

Video – What is Vertical Integration?

This video, from our sister YouTube Channel – Marketing Business Network – explains what “Vertical Integration” is using easy-to-understand language and examples: