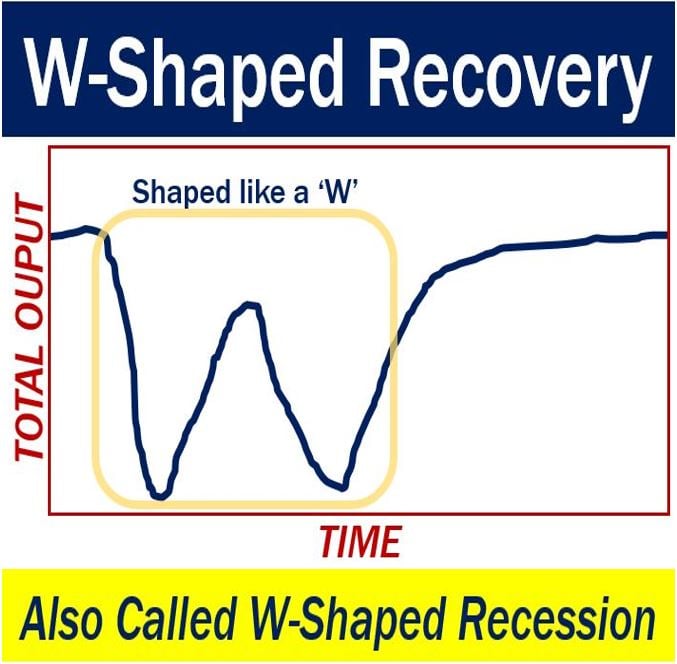

A W-shaped recovery describes a chart that shows two economic recessions and recoveries. There are two peaks and two troughs. In other words, back-to-back rises and declines in economic activity.

We commonly see a W-shaped recovery during periods of extreme volatile economic activity. This may occur when inflation or interest rates fluctuate widely.

We can observe a W-shaped recovery in an economic performance chart of the USA during the early 1980s.

The US economy came out of recession in 1981. Its central bank, the Federal Reserve, subsequently raised interest rates to control inflation. However, that measure triggered another slowdown in the economy.

When you read the term double-dip recession, it means the same as W-shaped recovery.

The term W-shaped recession has the same meaning as W-shaped recovery. The former points to the troughs while the latter points to the peaks in the letter ‘W.’

W-shaped recovery and other terms

There are many shapes for economic performance terms. A W-shaped recovery, in fact, is just one of them.

V-shaped recovery

A V-shaped recovery is one where there is a short, sharp period of declining economic activity. There is then a clearly defined trough at the bottom.

However, a strong recovery comes immediately after the trough. We also call it a V-shaped recession.

U-shaped recovery

With a U-shaped recovery, the trough is not as clearly defined. Simon Johnson made the following comment when he was the International Monetary Fund’s Chief Economist:

“You go in. You stay in. The sides are slippery. You know, maybe there’s some bumpy stuff in the bottom, but you don’t come out of the bathtub for a long time.”

We can say either U-shaped recovery or U-shaped recession.

L-shaped recovery

An L-shaped recovery or recession occurs when the economy has a severe and prolonged slowdown. In other words, it does not return to trend line growth for a long time.

In some cases, it can take more than a decade for strong growth to come back.

The steep decline precedes a long period during which the economy is flat. It is flat like the flat horizontal line at the bottom of a capital ‘L.’

Over the years, people have used a range of different terms to describe economic performance.

WW-shaped recession

Mike Shedlock, a financial blogger, used the term WW-shaped recession. He was describing a country that had been “slipping in and out of recession for a prolonged period, perhaps 3-4 years or more.”

Billionaire financier George Soros once described a recession as an ‘inverted square root sign‘ shaped recession. In an interview with Reuters news agency, Soros said:

“You hit bottom, and you automatically rebound some, but then you don’t come out of it in a V-shape recovery or anything like that. You settle down – step down.”