Waterfall payment – definition and meaning

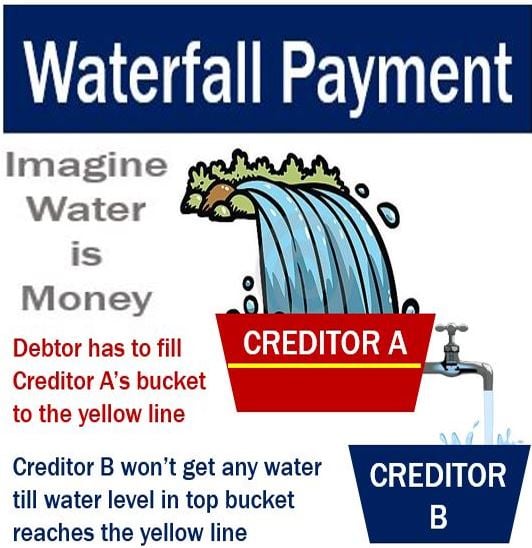

A waterfall payment is a system to repay debts in which senior lenders (higher-tiered creditors) receive principal and interest payments from a debtor first, while subordinate lenders (lower-tiered creditors) receive principal and interest payment after the senior lenders have been paid.

A debtor is the party that is in debt; they owe money.

In such schemes, the borrower will prioritize the highest principal loans first, because they are likely to be the most expensive.

Debtors will cascade their loans in a way that eliminates the more expensive loans with larger principal payments while making minimum interest payments to the less expensive loans.”

Waterfall payment system example

Imagine that fictitious company John Doe Inc. has borrowed $200 million from Creditor A and Creditor B. Creditor A is the higher-tiered lender, while Creditor B is the lower-tiered creditor.

If John Doe has to pay back using a waterfall payment system, Creditor A must be paid all its obligations in full before Creditor B gets a penny.

Let’s say that every year John Doe has to pay Creditor A $10 million in interest and $19 million in principal, and Creditor B $12 million in interest and $15 million in principal.

As long as John Doe is able to produce a minimum of $56 million in cash with which to meet its obligations with the lenders, everything is fine.

However, if in one year John Doe only generates $45 million, it has to pay Creditor A $29 million ($10 million in interest plus $19 million in principal) in full, leaving just $16 million for Creditor B.

In the waterfall payment scheme, Creditor B is further down the cascade. In such systems the lower-tier creditors are at greater risk of not being paid in full.

In a waterfall payment system, the cash – the ‘water’ – gets diverted to the higher-tiered lenders, which in this case is Creditor A, until John Doe’s obligations are met in full.

Waterfall payment suitable for some debtors

The waterfall payment scheme works for a debtor that has to repay more than one loan. Imagine a firm has three operating loans, each one with a different interest rate.

The firm makes principal and interest payments on the more expensive loan, and makes just interest payments on the other two loans.

As soon as the costlier loan is paid off, it can make all interest and principal payments on the second and third most expensive loans. This process continues until every loan is repaid.