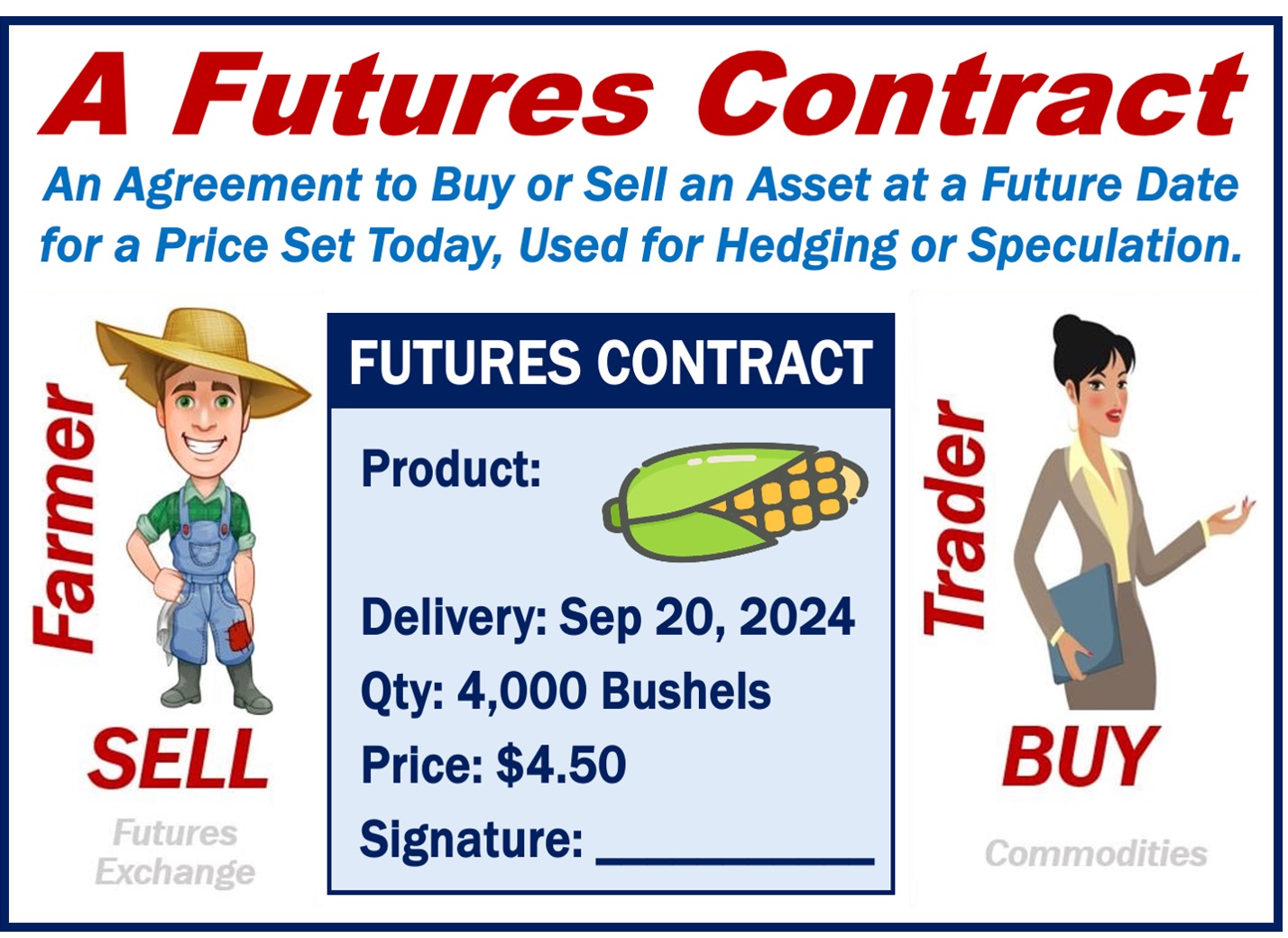

If you sign a contract to buy/sell an asset for a set price at a future date, you are involved in futures.

Futures are contracts to buy or sell an asset at a future date at a price agreed upon today. The asset may be a commodity, currency futures, interest rate futures, stock index futures, or even market indices. Commodities are raw materials or primary agricultural products that can be bought, sold, or traded, such as oil, gold, wheat, coffee, and copper.

The Cambridge Dictionary has the following definition of the term “futures”:

“Agreements to buy and sell particular shares, goods, etc. on a particular date in the future at a fixed price. Futures can be traded on financial markets.”

Why are futures important?

They serve many functions that are critical in the global economy. They allow producers and consumers to lock in prices for the goods they produce or purchase. This provides stability and predictability, two qualities that financiers, traders, businesspeople, and policymakers cherish.

Take, for example, farmers who grow wheat. By selling wheat futures, they fix a price for their future harvest, which protects them against a drop in prices.

Similarly, a bread manufacturer can buy wheat futures to secure a purchase price. The bread maker is thus protected against rising wheat costs.

Both the farmer and bread manufacturer need stability and predictability to operate in the marketplace and plan for the future.

Risk management

By locking in prices, producers, consumers, and investors can reduce uncertainty and the risk of financial loss caused by price fluctuations.

We refer to this practice as hedging. Businesses whose operations are sensitive to changes in interest rates, exchange rates, and commodity prices would find it much harder to survive without hedging.

Futures exchanges

Trading takes place on a futures exchange, which is also known as a futures market, which ensures the contracts’ integrity through standardization (defining the quantity and quality of the commodity or asset).

There are hundreds of such exchanges across the world. Examples include the New York Mercantile Exchange, the Chicago Mercantile Exchange, the London Metal Exchange, and the UK Futures Exchange.

Investments and speculation

Investors use futures to bet on the direction they believe the market or prices for a specific product will move, whether up, down, or remain the same. If they anticipate a price increase, they might buy futures, hoping to sell them later at a higher price for a profit.

Conversely, if they expect prices to fall, they might sell futures, aiming to buy them back at a lower price later, thus profiting from the price difference.

Conclusion

To recap, futures contracts are essential financial tools that enable participants to buy or sell assets at predetermined future dates and prices. They offer a mechanism for hedging against price volatility, speculating on market movements, and ensuring price stability for both producers and consumers.

Video – What is a Futures Market?

This video presentation, from our YouTube partner channel – Marketing Business Network, explains what ‘Futures Market’ means using simple and easy-to-understand language and examples.