What is a nonprofit organization? Definition and meaning

A nonprofit organization (NPO), also known as a non-business entity, is one that serves the public good and is tax-exempt. Its purpose is something other than making a profit. Typically, this type of organization is educational, scientific, charitable, literary, religious, a trade or professional organization, etc. The public is usually able to make donations to a nonprofit organization – in most cases, the donations are tax-deductible.

The term can be written with a hyphen (non-profit) or without one (nonprofit). A nonprofit organization does not declare a profit. It uses all revenue available after normal operating expenses for the public interest.

In the United States, nonprofits can be incorporated or unincorporated. An unincorporated nonprofit organization does not have the designation of being a 501(c)(3) organization and is not federal tax-exempt.

In the US, a donor will only receive a tax deduction for a gift if the nonprofit organization is tax exempt by the IRS (Internal Revenue Service). You can use a tool at the IRS website – EO Select-Check – to find out whether your intended donation recipient is tax exempt.

According to the Legal Information Institute, part of Cornell University Law School, a nonprofit organization is:

“A group organized for purposes other than generating profit and in which no part of the organization’s income is distributed to its members, directors, or officers. Nonprofit corporations are often termed ‘non-stock corporations’.”

There are many types of nonprofit organizations. According to Broadsource.com, in the US alone there are over 1.6 million of them. They provide a range of services to the public, from teaching children, providing scholarships, feeding the homeless, etc.

There are many types of nonprofit organizations. According to Broadsource.com, in the US alone there are over 1.6 million of them. They provide a range of services to the public, from teaching children, providing scholarships, feeding the homeless, etc.

Nonprofit organization has no shareholders

In most countries, the decision to have a nonprofit legal structure is one that will have taxation implications, especially where the nonprofit organization seeks income tax exemption or charitable status.

In the United States, the Internal Revenue Code defines over twenty-five types of organizations that are exempt from federal income taxes.

An incorporated nonprofit has many similarities with for-profit companies, except that there are no shares or shareholders. It uses its surplus revenues to further achieve its mission or purpose, rather than distributing its surplus income to shareholders as profits or dividends.

In the world of nonprofits, there are many different types of organizations. The majority of people associate a nonprofit organization with a charitable mission or objective. Most of them tend to be either community-serving or member-serving.

– Community-serving nonprofit organizations are focused on providing services to the global or local community. They may deliver aid & development programs, human services programs, medical & scientific research, health services, education, etc.

– Member-serving nonprofits include trade unions, credit unions, cooperatives, mutual societies, industry associations, retired serviceman’s clubs, sports clubs – organization that benefit their members.

Charitable organizations

A charitable organization differs from other types of nonprofit organizations in that its purpose must benefit the broad public interest, and not merely the interest of its members.

According to the IRS in the United States, charitable organizations must serve at least one of the following purposes: prevention of cruelty to children, animals, etc., religious, literary, testing for public safety, scientific, or fostering national or international amateur sports competition.

If you are considering whether to make a donation to a nonprofit organization, you should try to find out more about it first.

Kate Barr, CEO of the Nonprofit Assistance Fund in Minnesota, has the following advice regarding donations:

“For me it boils down to three questions: Do you care about the cause or the mission that the nonprofit is addressing; does the information you have give you confidence that the nonprofit is effective in their work; and do you believe that the people leading the nonprofit are capable and trustworthy?”

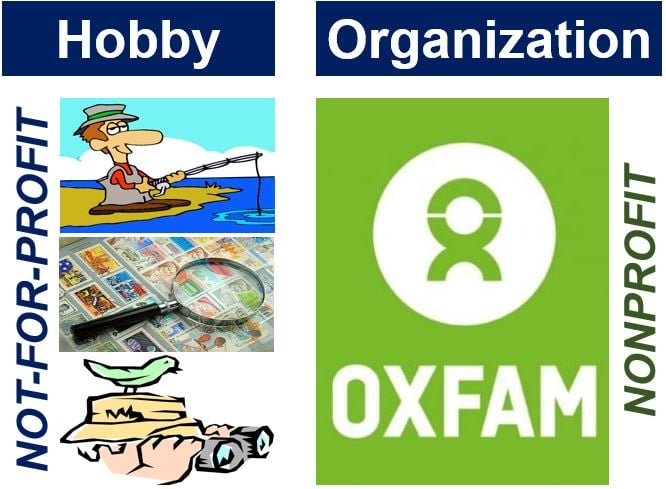

If you like fishing, bird-watching or stamp-collecting as a hobby, they are not-for-profit activities (not ‘nonprofit’ ones). An organization whose purpose is other than profit-making is called a nonprofit organization. The difference between ‘not-for-profit’ and ‘nonprofit’ is explained below.

If you like fishing, bird-watching or stamp-collecting as a hobby, they are not-for-profit activities (not ‘nonprofit’ ones). An organization whose purpose is other than profit-making is called a nonprofit organization. The difference between ‘not-for-profit’ and ‘nonprofit’ is explained below.

Nonprofit versus not-for-profit

In most cases, ‘nonprofit’ and ‘not-for-profit’ are used interchangeably, i.e. they have the same meaning. However, some countries’ tax authorities do make a distinction.

In the United States, the IRS says that ‘not-for-profit’ refers to a hobby, such as fishing or stamp-collecting, while ‘nonprofit’ refers to an organization that has been specifically set up for purposes other than making a profit.

An interesting article in Idealist.org advises people who are talking about possible employment with a nonprofit organization to avoid calling it a ‘firm’ or a ‘business’, unless they are completely certain that’s what people working in it say.

‘Agency, group or organization’ are the most commonly heard terms when nonprofit employees talk about their employer.

Video – Nonprofit organization vs. for profit

In this video, Evan Carmichael explains why you are more likely to have a bigger impact in the world if you set up a for-profit rather than a nonprofit organization.