Wholesale Banking refers to banking services that are offered just to other institutional customers, huge companies with strong balance sheets, government agencies, local governments, and pension funds.

It contrasts with retail banking, also called consumer banking, which provides banking services to individuals.

Wholesale banking also includes lending and borrowing among banks and large financial institutions in the inter-bank market. In such cases, borrowing and lending are done on a vast scale.

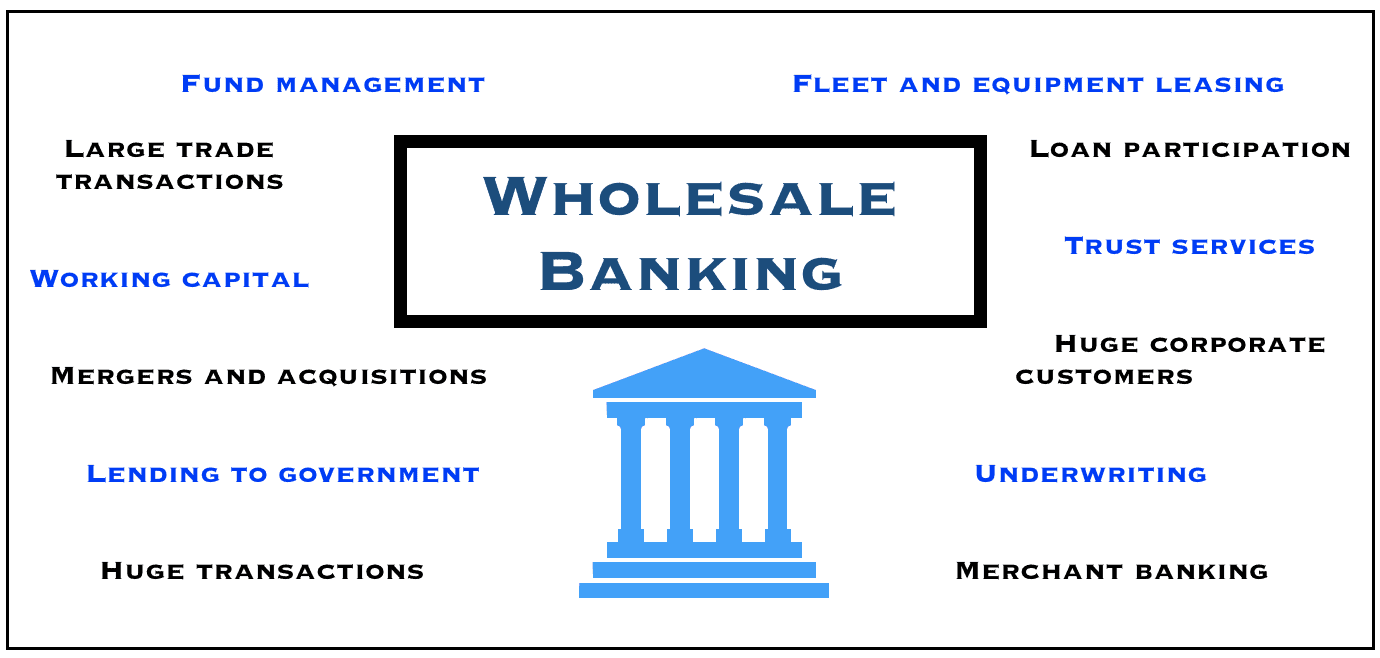

Wholesale banking services include large trade transactions, working capital, underwriting, M&A (mergers and acquisitions), currency conversion, fleet and equipment leasing, loan participation, merchant banking, and trust services.

Put simply, wholesale banking is the financial practice of borrowing and lending money between large institutions on a large scale.

Wholesale banking – huge sums

Wholesale banking is the practice of borrowing and lending money between large institutions. When we think of a bank, a local bank teller probably comes to mind, a person with whom we can carry out savings, checking, and borrowing needs.

We are thinking of a retail bank, which offers relatively small scale services to individuals or medium to small businesses.

For large institutions, government departments, local governments, and huge corporations with considerably larger financial needs, wholesale banking basically offers these same services, generally at a much lower base price compared to what is charged in retail transactions.

Giant corporations that carry out a very high number of financial transactions each day, with large sums of money in many of those transaction, need more than retail banks can offer.

For example, a person with a bank account in a retail bank may pay up to ten percent of his balance to maintain his checking account. There is no way a multinational company, with perhaps $10 million in its checking (current) account, is going to be happy about paying $1 million (10% of the total).

In exchange for depositing vast amounts of money with the bank, the financial institution offers the company a significant discount on its services.

Even if the bank charges less than one percent, it will still make a sizable profit, and the wholesale banking customer is happy.

Wholesale banking – disadvantages

The main disadvantage of wholesale banking is the risk it poses to the different parties involved.

If a company has a huge amount of cash – all in one location – it relies heavily on the stability of that location to make sure that its funds are safe.

Rigorous adherence to regulatory standards is crucial for wholesale banks to maintain trust and operational integrity in the financial markets.

These institutions often engage in stringent risk assessment procedures to preemptively identify and manage potential financial threats.

Understanding Wholesale Banking

To grasp the full scope of wholesale banking, it’s beneficial to see how the term is employed in various financial contexts. Here are seven sentences that showcase the usage of “wholesale banking” or “wholesale banks” in different scenarios:

- “The CFO decided to switch to wholesale banking services to secure better interest rates for the company’s significant cash reserves.”

- “Wholesale banks often engage in syndicated loans where multiple lenders come together to fund large-scale projects.”

- “Due to their expansive operations, wholesale banking institutions are pivotal in facilitating international trade and finance.”

- “The transition from retail to wholesale banking was a strategic move to accommodate the corporation’s growing capital requirements.”

- “In wholesale banking, the focus is not just on individual transactions but also on the overall financial health and strategy of corporate clients.”

- “Wholesale banks provided the bulk of the funding for the city’s new infrastructure developments.”

- “As a wholesale bank, they offer a suite of tailored services ranging from asset management to corporate advisory for their clients.”