A Wolfe Wave is used by traders to predict future price movements. It is a price action pattern consisting of up to five different waves that show supply and demand as price moves towards an equilibrium price.

Multiple contours on a chart reveal the inherent pattern of price movements found in all markets. The waves represent a number of points of supply and demand equilibrium that occur over time. They are led by a dominant wave that can give us an indication of future price movements.

A Wolfe Wave pattern may develop in time-frames ranging from one minute to a monthly chart. They all have two things in common:

– The are used to predict where price is heading.

– They can tell you when the price will get to where it is heading.

According to ForexTradingStrategies4u.com, where the price is heading matters much more than when.

In the world of Forex (foreign exchange) speculation, traders first have to know how to spot a Wolfe Wave pattern when it is forming, and know at what point they have to trade, i.e. buy or sell, as well as what point they have to take profit and exit a trade.

Definitions.USLegal.com has the following definition for the term:

“Wolfe Wave is a naturally occurring trading pattern present in all financial markets. In technical analysis, it is a series of price movements with waves roughly analogous to waves found in nature.”

“The pattern is composed of five waves showing supply and demand and a fight towards an equilibrium price. A Wolfe Wave may occur in a very short or over a very long period of time.”

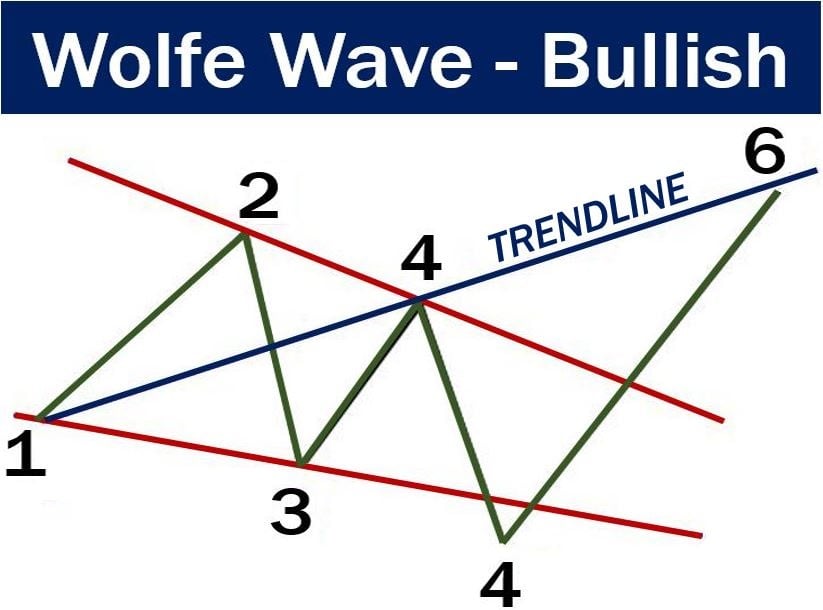

Securities and Forex traders are forever trying to detect a Wolfe Wave when attempting to forecast the future price of a security or currency. ‘Bullish’ means the price is expected to go up.

Securities and Forex traders are forever trying to detect a Wolfe Wave when attempting to forecast the future price of a security or currency. ‘Bullish’ means the price is expected to go up.

Wolfe Wave helps predict equilibrium price

When identified correctly, Wolfe Waves are used to forecast the equilibrium price of an underlying security. The equilibrium price is where the supply of goods equals demand.

When trying to identify a Wolfe Wave, look out for the following features:

– Wave 3-4 must remain within the channel created by 1-2.

– Wave 1-2 is the same as 3-4, i.e. there is symmetry.

– The interval (time) between each wave is irregular.

– Wave 5 is greater than the trendline that waves 1 and 3 created, and is the entry point.

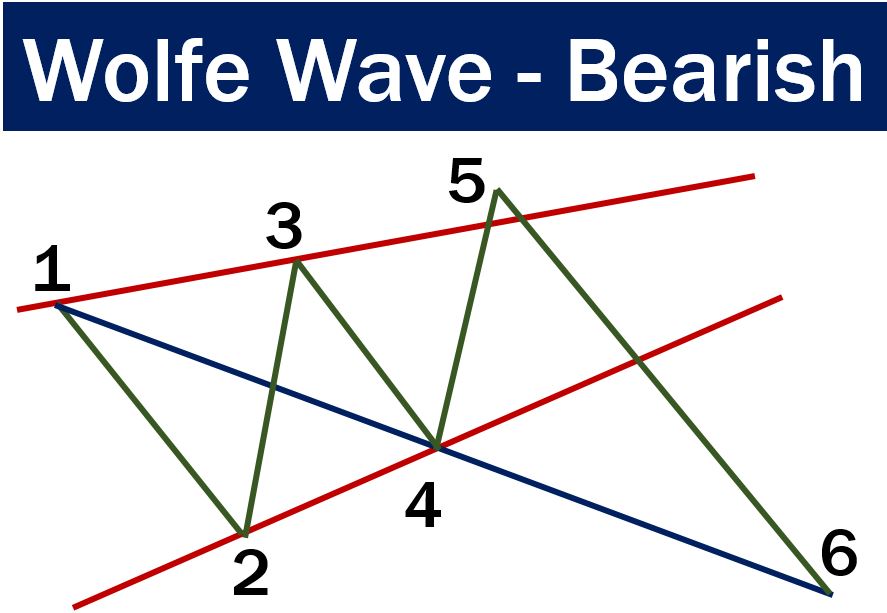

According to PZTrading: “Wolfe Waves are natural and reliable reversal patterns, present in all markets and timeframes. These waves can manifest having different amplitudes and are difficult to spot.” ‘Bearish’ means the price is expected to go down.

According to PZTrading: “Wolfe Waves are natural and reliable reversal patterns, present in all markets and timeframes. These waves can manifest having different amplitudes and are difficult to spot.” ‘Bearish’ means the price is expected to go down.

No psychology behind Wolfe Wave

The Wolfe Wave was discovered (not invented) by S&P trader Bill Wolfe twenty years ago. Mr. Wolfe suggests that the Wolf Wave is a naturally-occurring harmonic pattern that can be found all of the time, in all financial charts. There is no psychology behind it.

Regarding technical analysis in general, Best Forex Store says:

“Technical analysis is not an exact science and although these indicators and patterns can increase the probability of making the correct trade, many will go against you and large losses can be incurred.”]