What is working capital? Definition and Meaning

Working Capital is a measure of the operating liquidity of a business, organization, or other entity. It is the capital of a business that is utilized in its day-to-day trading operations.

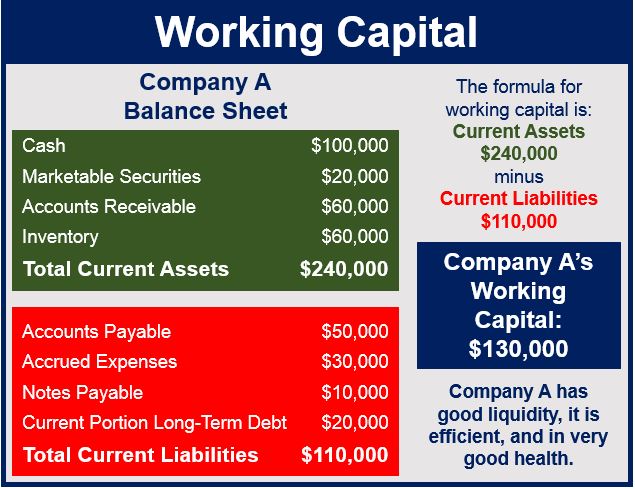

It is the difference between current liabilities and current assets.

Of all assets, current assets are the most liquid, i.e. that they can easily be converted to cash. Current liabilities are financial obligations that are due to be paid within a year.

Working capital represents what remains after subtracting current liabilities from current assets. It can either be a positive or negative amount.

Working capital is a measure of a company’s liquidity, efficiency and general health.

Working capital is a measure of a company’s liquidity, efficiency and general health.

It represents an entity’s margin of protection to pay short-term creditors.

Working capital ratio

This is calculated by dividing Current Assets by Current Liabilities. Anything below 1 indicates negative working capital while anything over 2 suggests that the company is not investing excess assets. The majority of economists believe that the ideal ratio is between 1.2 and 2.0.

A healthy company should have a positive working capital, while a negative one is a sign of severe cash flow problems. If current liabilities are more than current assets then the entity has a working capital deficiency, also called a working capital deficit.

A positive working capital cycle minimizes net working capital and maximizes free cash flow by balancing incoming and outgoing payments.

Businesses that are cyclical generally need to build up more working capital to remain afloat during the off season, to make sure they have enough ready money to meet their short-term obligations. Examples of seasonal businesses include ski resorts, gardening services, hotels, summer camps, selling Easter eggs, and aviation.

In such industries, effective working capital management is crucial to ensure the business can cover its costs during slower periods without depleting its resources, thereby maintaining operational stability throughout the year.

Difference between working capital and cash flow

Working capital provides a snapshot of the company’s current situation, while cash flow measures its ability to generate money (cash) over a specific period.

A business’ quarterly cash flow will be different from its annual cash flow.

Working capital is better at telling us how well a company can pay off immediate debts (liabilities). Cash flow, on the other hand, is forward-looking

A company might have insufficient working capital but adequate cash flow, i.e. given enough time it could generate enough cash. However, if creditors cannot wait, the business could be in trouble.

Moreover, effective management of working capital involves not only ensuring liquidity but also optimizing the timing of accounts receivable and accounts payable to maintain a healthy cash flow.

Compound phrases

There are many compound phrases in the English language that contain the term ‘working capital.’ Let’s have a look at some of the most commonly used ones:

-

Working Capital Management

Managing a company’s short-term assets and liabilities. For example:

“Effective working capital management ensures the company has enough liquidity to meet its short-term obligations.”

-

Working Capital Cycle

Time taken to turn working capital into cash. As in:

“A shorter working capital cycle indicates a more efficient business in managing its inventory and receivables.”

-

Working Capital Loan

Short-term loan for operational expenses. An example being:

“The company took out a working capital loan to finance its inventory purchase for the upcoming peak season.”

-

Working Capital Efficiency

A measure of how effectively a company utilizes its working capital to support sales and growth. As in:

“The firm’s improved working capital efficiency was evident from its increased ability to finance higher sales volumes without additional borrowing.”

- Working Capital Adjustment

Change in working capital during mergers or acquisitions. For example:

“During the acquisition, a working capital adjustment was made to reflect the actual value of the company’s current assets and liabilities.”

Video – What is Working Capital?

This video, from our YouTube partner channel – Marketing Business Network – explains what ‘Working Capital’ is using simple and easy-to-understand language and examples.