Yellow knight – definition and meaning

A yellow knight is the predatory company in a hostile takeover situation that then changes its approach – backs out of the takeover attempt – and proposes a merger instead. The term contrasts with a white knight, which is a third company that comes in and offers to buy the acquisition target – the targeted company likes the white knight much more than the hostile bidder.

A yellow knight is hostile bidder that the targeted company resists. When it looks increasingly unlikely that it is going to succeed, the bidder changes tactics and proposes a merger of equals instead.

A hostile bidder may get cold feet or switch strategy for a number of reasons, but mainly because it believes that a friendlier approach will yield a more favorable result.

The company making a hostile bid in a takeover attempt is known as the black knight. If this does not work, the bidder may decide to become a yellow knight, i.e. it will propose a merger of the two companies.

The company making a hostile bid in a takeover attempt is known as the black knight. If this does not work, the bidder may decide to become a yellow knight, i.e. it will propose a merger of the two companies.

According to Financial-Dictionary.theFreeDictionary.com, a white knight is:

“A company that offered a hostile takeover but has since changed its mind and decided to discuss a merger. A yellow knight’s management may decide that a hostile takeover would be too expensive or otherwise difficult but still believes that the target company would be advantageous.”

Yellow knight and other types

Yellow knight is a derogatory term. It implies that the hostile bidder got cold feet – went ‘yellow’. Investors and other businesses may view the yellow knight as weak.

In the world of mergers and acquisitions (M&A), there are four types of knights:

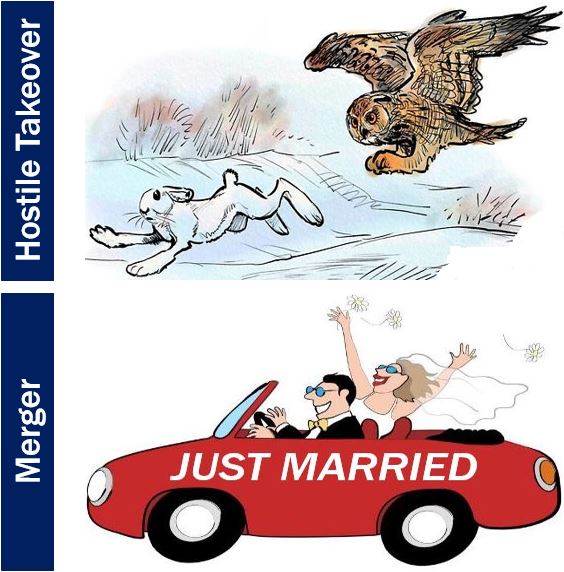

– Black Knight: a hostile bidder that does not change its strategy or approach. Like an eagle that swoops down to catch its prey – it does not suddenly try to become its ‘friend’.

– Gray (British: Grey) Knight: a second hostile bidder in a corporate takeover attempt.

– White Knight: a third company – that the targeted business prefers – that joins the bidding for the targeted firm.

– Yellow Knight: a hostile bidder that changes its approach and proposes a more friendly merger of equals.

When there is a hostile takeover, there is a company that wants to acquire – the predator – and the firm that does not want to be acquired – the prey. A merger of two companies, on the other hand, is like a marriage.

When there is a hostile takeover, there is a company that wants to acquire – the predator – and the firm that does not want to be acquired – the prey. A merger of two companies, on the other hand, is like a marriage.

Yellow knight – example

Let’s imagine that John Doe Inc. is interested in acquiring Mary Smith Corp. John Doe places a bid for Mary Smith, but Mary Smith feels that John Doe is a hostile bidder that will destroy the company.

Mary Smith’s directors go on the offensive and tell their stockholders (shareholders) that selling to John Doe would be a bad move.

John Doe sees mounting opposition to its bid, as well as an expensive and legal battle ahead – so it backs off. It transforms into a yellow knight. John Doe goes back to Mary Smith on much friendlier terms and proposer a merger.

Merger vs. Acquisition or Takeover: When two companies merge, it is like getting married. One one company acquires or takes over another, it is like a large fish eating a smaller one.