A Zombie Company, also known as zombie firm or living dead, is a term used for a firm that is unable to stand on its own feet – it either needs one or a series of bailouts, or is kept afloat by lenient creditors and below-market interest rates.

It may also refer to a firm that is unable to reduce what is owes but can repay the interest on its debts. However, if interest rates rose, it would probably cease functioning as a business.

Shares of zombie companies are typically called zombie stocks. The term zombie banks, which emerged in the late 1980s, refers to financial institutions that only exist thanks to government help.

Zombie companies attract resources that could otherwise be allocated to more productive enterprises.

Zombie companies attract resources that could otherwise be allocated to more productive enterprises.

The term dates back to the 1987 when Edward Kane, of Boston College, referred to American savings and loans institutions that had effectively been wiped out by commercial-mortgage losses, but were allowed to continue operating, because regulators had hoped there would be a market rebound. Unfortunately, things continued getting worse and zombie companies’ losses soon tripled.

Mr. Kane said:

“These institutions have very distorted incentives, just as the zombies do in the horror movies.”

The media gave the term renewed popularity following the 2007/2008 global financial crisis when several companies in North America and Europe received bailouts, and hundreds of thousands of others found themselves trapped in a seemingly bottomless pit of high debt.

Zombie companies undermine economic recovery

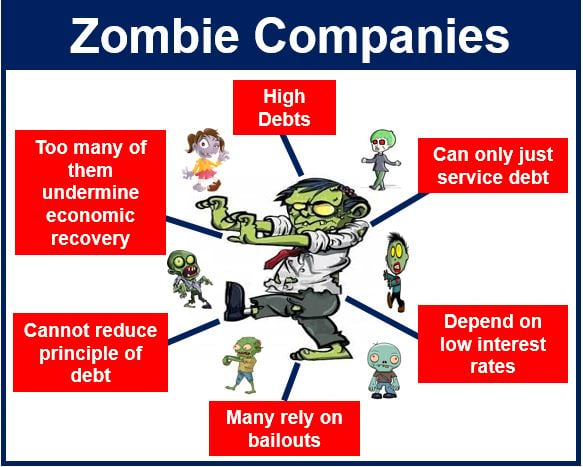

Economists say that too many zombie companies emerged after the global financial crisis, and their existence was holding back the economic recovery of many industrialized nations.

According to a Bank of England report at the end of 2012, approximately 30% of British companies were lossmaking in 2010, a higher percentage than in the 1990s recession, but corporate insolvency rates were lower.

Tom Papworth, a Senior Fellow at the Adam Smith Institute, one of the world’s leading think tanks, listed the following features common in zombie companies:

– they are heavily indebted,

– they generate enough income to pay the interest on their debts, but cannot reduce the principle,

– their ability to meet loan interest payments depends on continuing low interest rates,

– they are unable to restructure and become more profitable, because of the high costs in servicing their debts,

– “the above vitiates the need for the company to go into receivership, thus preventing the redeployment of capital and labor to more productive sectors.”

Zombie companies holding back the UK economy

In 2013, Mr. Papworth informed that more than 200,000 businesses in the UK were either struggling to pay their debts or were having to negotiate with their creditors, while 108,000 firms were only able to serve interest on their debt.

The UK’s ‘productivity problem’ is probably partially attributable to the existence of so many zombie companies that prevent capital and labor from reallocating to more productive activities, Mr. Papworth added.

Often, banks believe that zombie companies that are on their books still offer profitability to their bottom line, i.e. they think there is value in having them in their balance sheet.

Do venture capital incentives promote zombie companies?

Companies that manage to raise lots of money are not necessarily doing super well.

According to Sathvik Tantry, writing in TechCrunch “Venture capital funds’ incentives drive them to fund companies that should have folded long ago.”

Many startups are over-hyped, raise staggering amounts of money and then stagnate. Tantry describes them as money pits that divert precious capital away from high-growth enterprises that will actually drive the majority of returns.

“These zombies also hurt investor returns, reduce the value of employee stock options and mislead the public about the health of privately held businesses,” Tantry writes.