Long COVID-19 disproportionately impacts lower-income groups, increasing their likelihood of experiencing food insecurity and having difficulty paying bills.

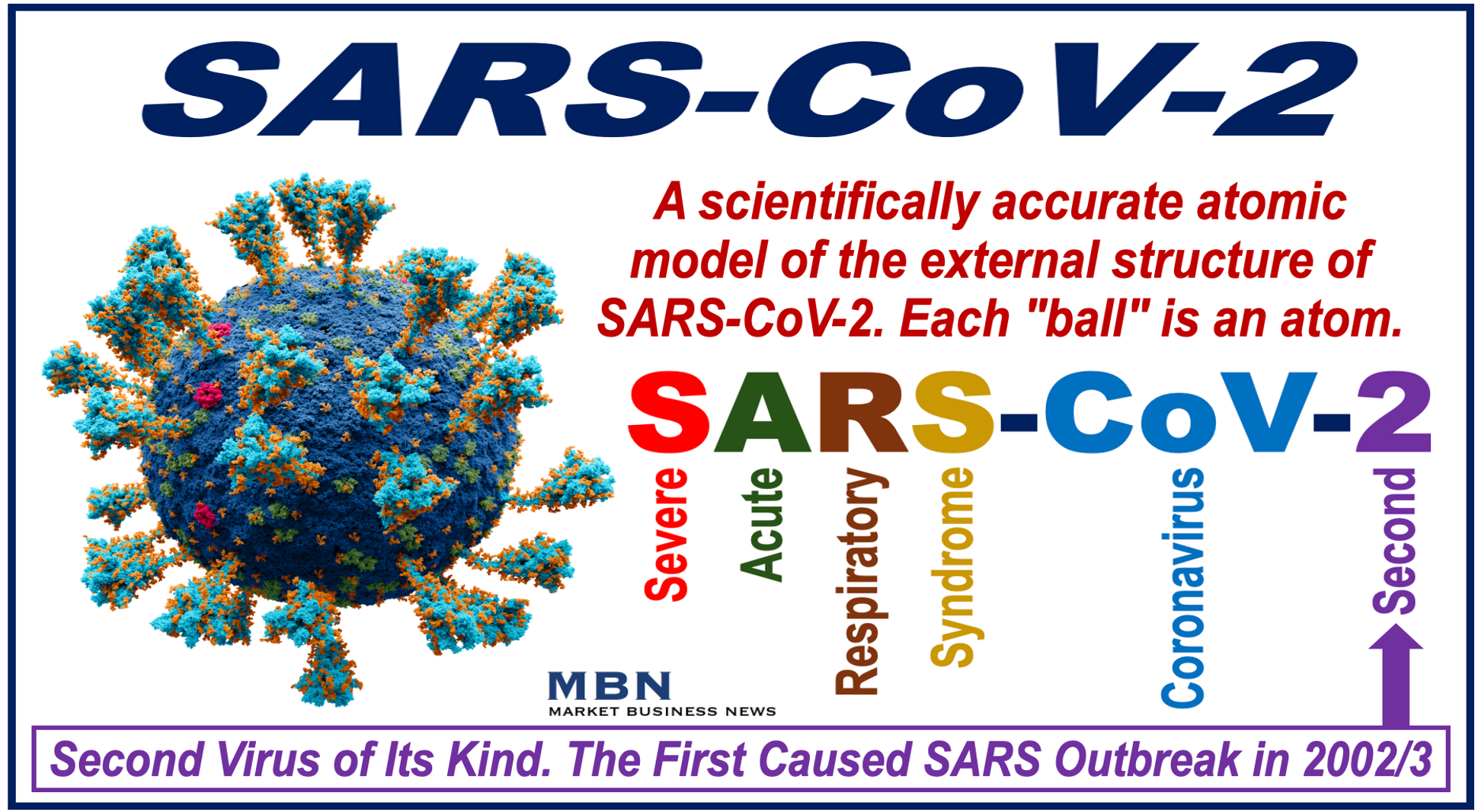

The COVID-19 pandemic, which started in December 2019 and ended in May 2023, may be gone. However, the virus that caused the pandemic, SARS-CoV-2, continues to financially burden some Americans, says a team of researchers.

The team, from the University of Georgia and Augusta University, in Georgia wrote about their study and findings in the peer-reviewed journal Health Services Research (citation below).

They found that long COVID-19 is making it more difficult for some people to pay for groceries, bills, and to keep their utilities going.

What is Long COVID-19?

The UK’s National Health Service (NHS) says the following regarding the health term:

“Most people with COVID-19 feel better within a few days or weeks of their first symptoms and make a full recovery within 12 weeks.”

“For some people, symptoms can last longer. This is called long COVID or post COVID-19 syndrome. Long COVID is a new condition which is still being studied.”

Wikipedia says that many people refer to the health problem simply as Long COVID or Long-Haul COVID.

According to KFF, a nonpartisan organization specializing in health policy research, polling, and journalism, about 17 million Americans were living with COVID in April 2024.

-

Signs and Symptoms

A symptom, such as a headache, is something only the patient is aware of, while a sign, such as a rash, can be detected by other people such as family members and healthcare professionals.

Signs and symptoms include extreme fatigue, chest pain, cognitive dysfunction (brain fog), memory loss, muscle pain, and post-exertional malaise (symptoms get worse after physical exertion/activity).

The Mayo Clinic says that some people continue having signs and symptoms of long COVID for years.

Lost Jobs and Working Hours

The researchers say that much of the financial hardship that some people experience is due to losing their jobs or having to work fewer hours.

They also found that long COVID-19’s negative impact is evident across all income levels and socioeconomic backgrounds.

Lead author, Ishtiaque Fazlul, an assistant professor in both the University of Georgia’s (UGA’s) School of Public and International Affairs and UGA’s College of Public Health, said:

“COVID is still going on. Long COVID is very much a problem that is affecting people’s lives right now. And it’s affecting people from all walks of life in terms of financial hardship.”

However, people with lower incomes are disproportionately affected financially by long COVID.

Long COVID-19 and People with Lower Incomes

Those on the lowest incomes had a ten-percentage-point higher risk of experiencing food insecurity if they had long COVID, the study found.

They were also more likely to have their most important utility services cut off because they couldn’t pay their bills.

However, (to a lesser extent) people in higher income brackets also faced similar difficulties due to long COVID.

About the Study

The researchers gathered and analyzed nationally representative data from a study by the Centers for Disease Control and Prevention which included over 270,000 American adults across forty states.

Among the participants, approximately 20,000 said that they were experiencing long COVID. The findings revealed that individuals with lower incomes and those without college degrees were affected more severely by the condition.

-

People With Lower Incomes

Fazlul said:

“If [low-income Americans’] income decreases even by a little bit, they may cross a threshold that makes them food insecure and makes it difficult to pay bills.”

According to previous studies, people on lower incomes were more likely to contract COVID-19 than the rest of the population. And when they did become infected, they experienced worse symptoms and died at higher rates than their wealthier counterparts.

-

People With Higher Incomes

Higher earners whose illnesses get in the way of work, especially when their symptoms last for months or years, are more likely to have savings they can turn to or be able to work remotely (from home). In other words, they have access to various safety nets to keep themselves afloat.

Low-income Americans, on the other hand, find it much harder to stay afloat.

Fazlul said:

“Lower income groups probably have less savings and less to fall back on if something happens with their job. Lower socioeconomic groups also tend to have more hands-on jobs that have less opportunity to work from home.”

“If their income decreases even by a little bit, they may cross a threshold that makes them food insecure and makes it difficult to pay bills.”

Policy Changes to Support Financial Stability and Job Security

Greater work schedule flexibility and remote work policies could help people living with COVID-19 and long COVID keep their jobs, and subsequently, their health care coverage.

Expanding access to health care services to help manage symptoms could further improve COVID and long COVID patients’ quality of life.

Greater job security and better access to credit could bolster their financial stability.

Fazul said:

“People’s financial well-being is being affected by long COVID. That’s something we should care about.”

Citation

Datta, B. K., Fazlul, I., & Khan, M. M. (2024). Long COVID and financial hardship: A disaggregated analysis at income and education levels. Health Services Research.

https://doi.org/10.1111/1475-6773.14413