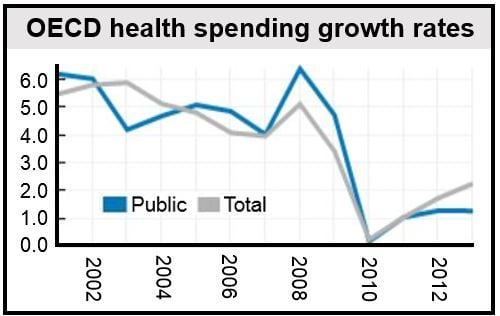

According to the OECD Health Statistics 2014 report, global health spending rose while pharmaceutical expenditure fell. Hospital and outpatient care spending in particular increased the most. Overall health spending has begun to pick up again in most OECD nations after either stagnating or falling since the financial crisis.

The authors pointed out, however, that growth rates are still far below the pre-crisis pace, especially in much of Europe.

European health spending down

Among the European countries, health expenditure continued declining in 2012 in Spain, Portugal Italy, Greece, the Czech Republic and Hungary. Health spending in real terms in Greece in 2012 was 25% below its 2009 level, mainly due to severe cuts in public expenditure. Expenditure means spending.

Contrastingly, many nations outside Europe, such as Mexico and Chile, reported strong health expenditure growth, at 8.5% and 6.5% respectively. Chile and Mexico are pushing towards universal health coverage and access.

South Korea reported an average annual growth rate in health spending of 6% since 2009, driven principally by a strengthening private sector.

The United States registered 2.1% increased spending in 2012, similar to 2010 and 2011, but above the OECD average.

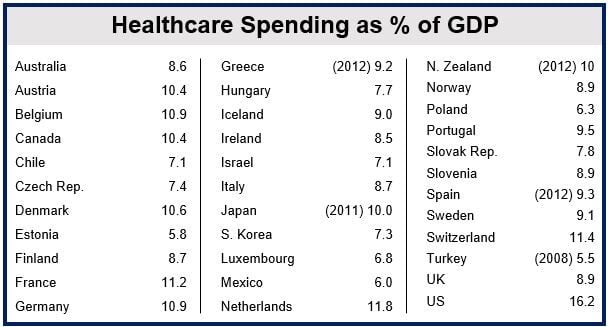

On average, health spending in 2012 accounted for 9.3% of GDP across the OECD nations, compared to 9.2% the previous year. Before the Great Recession, healthcare spending represented 8.5% of GDP.

(Source: OECD Health Statistic 2014)

Global pharmaceutical expenditure continues to fall

While spending on outpatient and hospital care rose in most countries in 2012, the majority of members reported real declines in pharmaceutical spending since 2009.

Outlay on pharmaceutical products has fallen mainly because prices have been slashed, in most cases through negotiations with drugmakers, and an increasing share of the generic market.

Several high-volume and more expensive brand name medications have lost their patent protection, which opened the door to a flood of cheaper generic products. Several countries have also adopted policies to promote the use of less expensive generic drugs.

The share of the generic market from 2008 to 2012:

- rose on average by 20% globally, reaching 24% of total pharmaceutical spending,

- increased by 100% in Spain,

- rose by 60% in France,

- expanded by 44% in Denmark,

- increased by 28% in the UK.

(Source: OECD Health Statistic 2014)

Healthcare spending in the United States

At 16.9%, healthcare spending in the US makes up the largest share of GDP across the OECD nations, over 7.5 percentage points higher than the OECD’s 9.3% average. Expenditure is split nearly equally between private and public sources, unlike most OECD countries.

Forty-eight percent of health expenditure was publicly financed in 2012, compared to 72% in the OECD.

Falling pharmaceutical and hospital prices kept overall health spending growth in the US down. The slowdown had already started before the financial crisis.

After years of strong growth, US pharmaceutical spending fell. In 2012, patent expiries of some blockbuster medications allowed cheaper generic to come in, which pushed prices down by 1.1%.