In this age of credit cards and online loans, having a good credit score is essential. That’s not just because it helps increase your chances of qualifying for a loan, but also because you can leverage it for other purposes.

For example, some employers check your credit history to determine whether they can trust you to manage their finances. Then there are mortgage lenders, banks and auto loans—all which offer the best deals to people with impressive credit scores.

Speaking of which, what’s a good credit score? How do you get one? More importantly, how do you check your present score?

The FICO Score

FICO is an analytical firm responsible for producing the credit score most Americans use today. It provides a score that ranges from 300 to 850, 300 being the least score, and 850 being a perfect score.

- 300-579: Very Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

You need a credit score of 599 and above to acquire a loan in most places. Otherwise, your best option is to accept offers from credit cards for bad credit scores. You can get up to $3000 from many of these lenders but beware some might have inconveniently high APR rates.

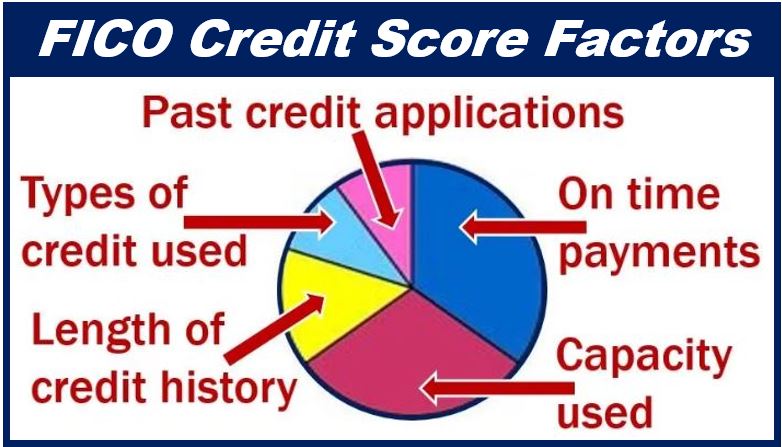

FICO calculates your credit scores using these metrics:

- Payment history—35%

- Amount of debt in comparison to your limit—30%

- Length of your credit history—15%

- Types of credits you’ve used—10%

- Recent Applications (and success rates)—10%

With the factors highlighted above in mind, your credit score determines your ability to acquire loans, mortgages and, in some cases, employment. As a result, not only is it essential to understand your score, but it also important to improve it.

How to Check Your Credit Score

Before 2013, checking your credit score involved spending some money through credit agencies such as Equifax, TransUnion and Experian. You can still use these companies to check your score if you are willing to pay for it.

However, you can also check your score free of charge from over 100 financial institutions in the US. This follows FICO’s groundbreaking decision to create an Open Access program where Americans could check their credit scores free in 2013.

Barclaycard US and First Bankcard were the first companies to sign up for the program immediately it launched. These other financial institutions have since joined them:

- Citibank

- Chase

- Digital Credit Union

- Ally Financial

- Bank of America

- Federal Credit Union

The best banks allow you to check your credit score online. As a result, you don’t have to worry about the inconvenience of visiting a physical bank office to check the score.

If your bank doesn’t offer the service, you have no reason to panic. Some websites can give you an estimate of your FICO Score free of charge. The best-rated sites that provide the service are credit.com, quizzle.com and creditkarma.com.

Of course, what they offer you is not an accurate score. Again, depending on the website, more s, unknown operators, you might have reasons to ask for a second opinion.

That’s because some sites are known to inflate your score to resemble a tier 1 credit score just to impress you. But when you visit a credit lender to acquire the loan, you leave disappointed.

So, should you pay money to get an accurate FICO Score? Not really, at least not when you have better alternatives. For example, you can acquire a free credit report and score from any company you’ve previously borrowed from.

How to Improve Your Credit Score

If you are young or have been paying bills and loans but don’t know your FICO Score, you will be impressed by the table below. CreditKarma.com compiled it to show that most people’s credit scores improve with age.

| Age | Credit Score |

| 18-24 | 638 |

| 25-34 | 652 |

| 35-44 | 659 |

| 45-54 | 685 |

| 55+ | 724 |

For clarity, the credit scores mentioned above are averages for people of different age groups in the US. As such, you could be 18 years and have a credit score above 700. Or you could be 60 years and have a poor rating.

Against that backdrop, consider adopting these routines to increase your credit score:

Pay Bills on Time

Your payment history contributes 35% of your FICO Score. That means you can’t afford to ignore your bills. Quite the contrary, form a habit of clearing your bills before you save or purchase anything else.

Keep Your Credit Low

Second to your payment history, your credit amount contributes 30% of your score. As a result, you want to keep it as low as possible. Experts recommend that you borrow not more than 30% of your credit limit yearly.

Crucially, avoid applying for multiple loans frequently. You’d better have one credit that solves your temporary financial needs that numerous small loans. Your score goes down if you keep applying for loans, especially if you fail to qualify for some of them.

Benefits of a Good Credit Score

A credit score of 670 and above come with exclusive benefits. Below are some of them:

-

Qualification for Auto Loans

If you are like most people, you might consider buying your next car with a loan. In that case, ensure you have a good credit score. You’ll receive the credit you need and probably at lower rates than most people.

-

For Your Employment

If you have an excellent credit report and qualify for a post, you could get priority over someone with a weak report. This mostly applies in finance jobs where employers also want to trust their finances to a financially responsible person.

-

Business Loans

Needless to say, you need a good credit score to acquire a bank loan. That’s not negotiable. If you have a poor score, you’ll struggle to find an institution willing to loan you a mortgage or business loan.

-

Improved Life Comfort

Having you a good credit score means you pay your bills in good time, you have limited loans, and you are financially responsible. Naturally, that makes your life more comfortable than you have had credit problems.

__________________________________________________________

Interesting related article: “What does Credit History mean?”