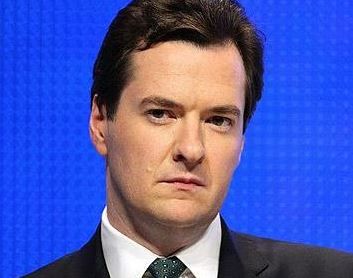

There is a serious risk that a miscalculation during the current Greece versus Eurozone standoff could have dire consequences for Europe and also the UK, warns British Chancellor George Osborne.

In an interview on Bloomberg Television on Monday in Istanbul, Turkey, Mr. Osborne said:

“It’s clear that the risks to the world economy, the risk to the British economy of this standoff between the Eurozone and Greece, is growing each day.”

“The risks of a miscalculation or a misstep leading to a very bad outcome are growing as well … There is no doubt that the UK would be affected by a crisis in the Eurozone, we know that from recent experience. That’s why we need to take steps to protect ourselves at home, and that’s why we need to step up our contingency planning.”

Mr. Osborne warns that an escalation of the Greek-EU impasse could harm Britain.

German politicians believe the only one that would come out suffering if things went bad would be Greece. They say the consequences for Greece exiting the Eurozone would be disastrous, the European Union (EU) would feel it slightly, while the rest of the world would hardly notice anything at all.

Cameron stepping up contingency plans

On Monday, Prime Minister David Cameron met with senior officials from the Treasury and the Bank of England to discuss preparations in case Greece exits from the Eurozone.

The risk of a so-called “Grexit” has increased considerably since the far-left Syriza party won a general election in Greece in January. Syriza did not win enough seats for an outright majority, so it opted to form a coalition with an extreme right-wing Independence party.

Greece’s new Prime Minister, Alexis Tsipras, has demanded concessions from the Troika – The European Central Bank, the EU and the International Monetary Fund.

Mr. Cameron will meet with Mr. Tsipras on Thursday at the European Council.

A spokesman for the British Prime Minister said:

“We need to be prepared to deal with uncertainities in financial markets. There do remain risks around contagion and uncertainties, and it is important to look at all of those.”

Uncertainty about Greece’s future has had a considerably negative effect on Greek assets. The Athens Stock Exchange was more than 6% down on Monday, while yields on 10-year bonds rose above 10%.

The UK Treasury and BoE both made contingency plans in 2012 for a possible Grexit.

Economists fear that a Greek exit could be just the beginning of the end of the euro, with Spain, Portugal and Italy soon following.

In an interview on BBC Radio 4 on Sunday, former Chairman of the US Federal Reserve Alan Greenspan said it was not a question any more of whether Greece would exit from the Eurozone, but when, given that nobody would risk lending the country money.

Mr. Greenspan said:

“I don’t see that it helps them to be in the euro and I certainly don’t see that it helps the rest of the Eurozone. I think it’s just a matter of time before everyone recognizes that parting is the best strategy.”