Buying property is, right now, more popular than it’s been in a long time. Whether you’re considering purchasing a new home or a commercial building for a new business, mortgages are more affordable, and there is an abundance of properties available.

In addition, current trends indicate that buyers are looking for an escape from the big city, which means more options and lower city prices.

But, of course, investing your money in a new property should only be an option if you have the finances available, as it can be the most significant commitment you ever make. Here’s what you need to remember if you’re planning to buy a property in 2021.

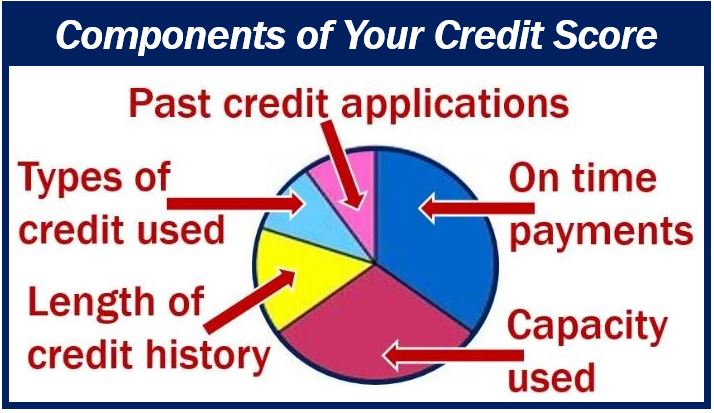

Improve your Credit Score

Your first step should always be to know exactly what your credit score is and always to be taking steps to improve it.

Your credit score will play a large part in determining the loans and interest rates that you will end up qualifying for. It also lets lenders know more about how high or low-risk you are when it comes to borrowing. In recent years, lenders and mortgage providers have become much warier of lending, so the higher your credit score, the better.

Unfortunately, too many people start taking steps to buy a property without checking their credit score. That will have an immediate effect on their ability to get a lender to agree to a sale.

Know your Savings

You will need to have enough cash reserves to cover your down payment on the property and all of the costs that come with closing the sale. Check the average down payments in the area that you’re looking to buy property in and have that as your baseline target.

The more that you can afford to put down on a property purchase yourself, the more that you can speed up equity building, reduce your monthly payments, and you may even be able to avoid paying additional insurance costs.

Finding the Right Property

Buying a property is a big commitment, so you need to make sure that you’re buying right. If you’re looking for a commercial property, you’ll have to consider location and how it affects your business model.

Footfall traffic, neighbors, and even store displays will all have an impact on your business success.

For buying a home, think about the needs of everyone in your household. Consider utilities like nearby stores, schools, and public transport. Many property sellers are using professional Oregon home buyers to make selling their property more straightforward and convenient, which means you can access a broader range of property types. It would help if you also looked at state taxes and laws so that you’re not taken by surprise.

Buying a property should always be an investment. Make sure that you choose the right size for your personal or commercial needs and don’t overreach your finances. Take the time to prepare for your property purchase and do research every step of the way. The more that you can learn about the property market right now and how best to take advantage of it, the more value you’ll be able to gain from your purchase.

Interesting related article: “What is my Credit Score?“