Hershey Co. announced plans to acquire the premium beef jerky maker Krave Pure Foods Inc. The purchase will allow the American candy company to make a presence in the emerging meat-snack market.

The announcement came after Hershey posted weaker-than-expected results for the last quarter.

The company gave a weak earning outlook for 2015, which the Wall Street Journal said joins “the chorus of U.S. companies saying the strong dollar is hurting their business.”

Hershey Co. is the maker of Reese’s, America’s number one selling chocolate brand, as well as its namesake candy bar.

However, sales have been rather lackluster sales in the US and some international markets. In addition to the unwelcome increasing costs of dairy of cocoa for the company.

Currently Hershey and its rival Mars Inc. have the largest share in the candy market. The market as a whole has consistently grown over the past few years and this latest acquisition will offer Hershey entry into a whole new growing sector – that’s grown even more quickly.

The WSJ pointed out that in recent years beef jerky has made a comeback, especially as Americans turn to higher-protein, lower-carbohydrate snacks.

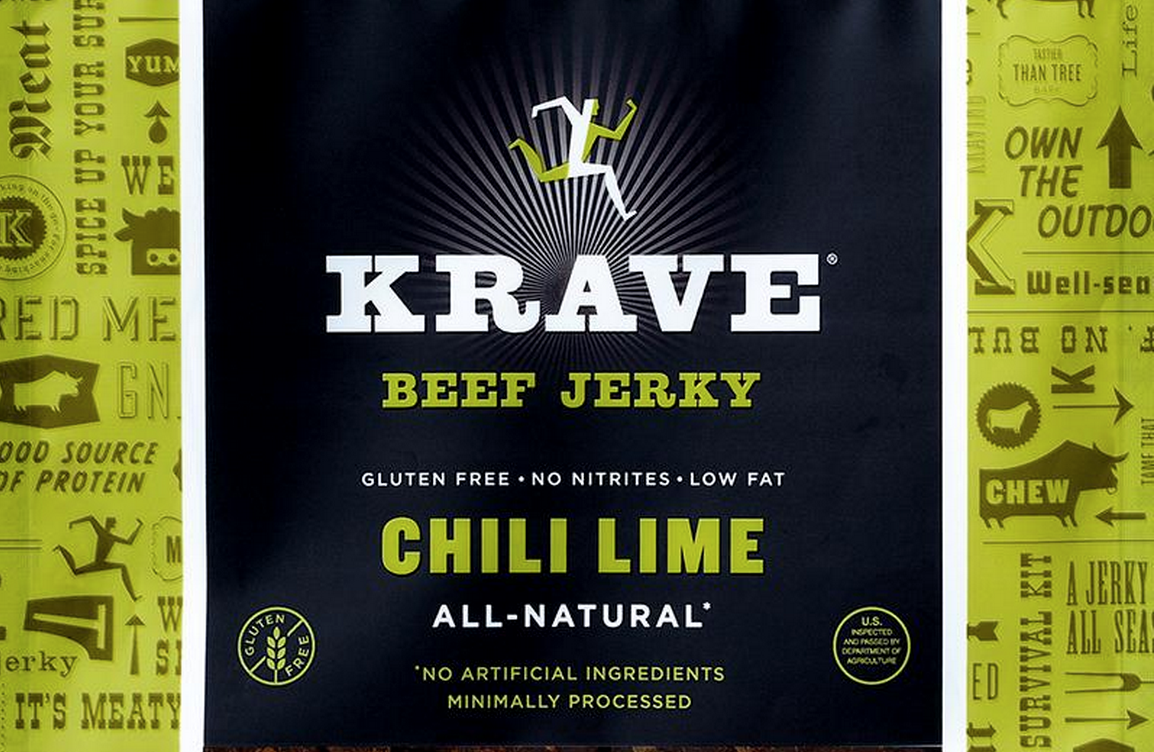

And companies such as Krave have helped beef jerky not be considered low-end junk food, but rather, a trendy snack.

Krave has helped transform the beef jerky industry into something a bit trendier.

According to Hershey, meat snacks are a $2.5 billion industry and it has grown by 10% a year from 2010 to 2014.

Once the acquisition is complete Krave will continue operating as a separate stand-alone business.

Krave has approximately $35 million in sales.

However, investors were not impressed with Hershey’s results on Thursday and the news of the acquisition did little to reassure investors of the company’s future performance.

Hershey shares fell by 8% in early afternoon trading.

In 2015 Hershey predicts per-share earnings of $4.30 to $4.38, which is lower than what analysts polled by Thomson Reuters expected of $4.46. The company expects sales growth of 5.5% to 7.5%.

But very recent drops in ingredient costs and the higher prices that candy makers will charge for its products in the US are predicted to help boost profit margins for Hershey this year.

Hershey’s gross profit margin increased by 0.3 percentage point from a year earlier to 44.1% in the latest quarter. However, this still felt short of Hershey’s expectations.

The company reported profit of $202.5 million (91 cents per share) for the period ended Dec. 32, compared with $186.1 million (82 cents per share), the year before.

Sales increased 2.7% to $2.01 billion and earnings, excluding special items, were $1.04 a share, which was below what analysts polled by Thomson Reuters expected of $1.06 on $2.07 billion in revenue.