New Jersey-based multinational conglomerate company Honeywell International Inc. posted a strong third-quarter profit, beating analysts’ expectations, driven partly by greater margins in its aerospace division.

The company also increased the low-end of its full-year outlook range for both revenue and profit, saying it is seeking out acquisitions. Honeywell says it plans to spend about $10 billion over the next five years buying other companies.

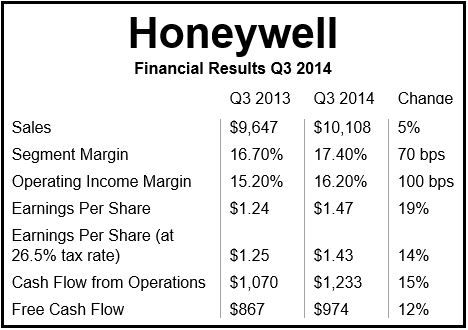

Q3 2014 sales increased by 5% to $10.1 billion, while earnings per share came in at $1.47 compared to $1.24 one year ago.

Dave Cote, Honeywell’s Chairman and CEO, said the firm’s organic sales growth and double-digit earnings rise highlighted the business’ impressive third quarter.

(Data source: Honeywell International Inc.)

Mr. Cote said:

“The continued integration and maturation of the Honeywell Operating System throughout our global portfolio is helping to drive sales, margin, earnings, and cash flow higher, and plenty of runway remains. We are committed to our ongoing seed planting investments to bolster our great positions in good industries and continuous process improvements to mitigate ongoing global macroeconomic uncertainties.”

The low-end of its 2014 proforma EPS (earnings per share) outlook increased by 11%-12% to $5.50-5.55, bringing it to the high-end of the original guidance issued nearly one year ago.

Despite a slow growth macro environment, Honeywell expects 2015 to continue delivering strong earnings growth.

Mr. Cole added:

“We’re confident that Honeywell will continue to outperform now and over the long-term driven by a relentless focus on new products and technologies, continued penetration of high-growth regions, and sustained implementation of our key process initiatives.”

Aerospace margins increased to 20.3% in Q3 2014 (ending September 30th), from 18.8% in Q3 2013.

Honeywell has focused on controlling costs, a strategy that has helped it perform well this year despite a weak global economy. In July 2014, its aerospace and transportation divisions were merged.

The company forecasts 2014 full year sales to be between $40.3 billion and $40.4 billion. Its initial forecast had been $40.2 billion to $40.4 billion.

On Friday, Honeywell shares rose 3.67 points (4.25%) to 90.06 on the New York Stock Exchange.