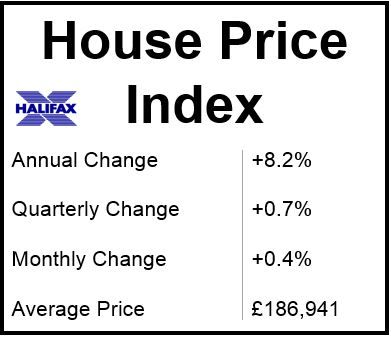

House price growth for the three-month period ending in November slowed to 0.7% over the previous three months, compared to the 0.9% increase recorded in the 3-month period ending in October, according to the latest Halifax November Index.

The prices of houses in the three months to November were 8.2% higher than in the same period in 2013. Halifax informs that house prices are now rising at their slowest rate since February 2014.

From October to November, prices rose by 0.4%, compared to the -0.4% decline in October versus September.

A total of 98,490 homes were sold in October, the first time this year the monthly figure was below 100,000. However, the total for 2014 is forecast to exceed 1 million, for the second successive year. This will be the first time since 2006/2007 that sales have been over 1 million for two years running.

Mortgage approvals in October fell to 59,426, which is 22% lower than January’s 76,574.

Private housing completions in Q1, Q2 plus Q3 were 10% higher than in the same first three quarters of last year. Halifax added “Whilst levels of housebuilding remain well below those required to keep up tie the pace of household formation, these latest figures show signs of a revival.”

Source: Halifax House Price November Index.

House price growth to slow in 2015

Halifax expects house price growth to moderate further over the next twelve months. An increase of 3% to 5% is predicted for 2015. Higher interest rates at some time in 2015, plus a deterioration in affordability over the past 12 months, will together undermine housing demand.

Halifax wrote in a statement:

“Housing demand should be supported by solid economic growth, higher employment, still low mortgage rates and the first gain in ‘real’ earnings for several years. We expect to see a more even regional pattern in house price growth during 2015.”

Martin Ellis, Halifax’ housing economist, said:

“House prices in the three months to November were 0.7% higher than in the preceding three months. The quarterly rate of increase has now declined for four consecutive months. Annual price growth in the three months to November slowed further, to 8.2% from 8.8% in October.”

“Receding buyer interest combined with a revival in private housing completions has brought supply and demand into better balance. These factors have in turn contributed to the easing in house price growth since the summer. But housing demand continues to be supported by a strengthening economy, rising employment levels, still low mortgage rates and the first gain in ‘real’ earnings for several years.”

“We expect a further moderation in house price growth over the next year with prices nationally expected to increase in a range of 3-5% in 2015.”