House price inflation in the United Kingdom declined further in June, according the UK Residential Market Survey released by the Royal Institution of Chartered Surveyors (RICS). The survey authors added that there is currently little encouragement for sales activity, with agreed sales weakening alongside new instructions and new buyer enquiries.

The medium term (12 months) sales expectations indicator has slipped to is lowest level since the immediate aftermath of the June 2016 referendum when Britons voted for BREXIT – BRitain EXITing the European Union. However, the indicator is still positive, with a net balance of +12%.

In a press release, the RICS informed that:

– Price growth (house price inflation) has lost momentum across the south of England.

– According to activity indicators, sales are flat, and are likely to remain so over the coming months.

– There is an ongoing supply shortage – average housing stock on surveyors’ books has hit a new low.

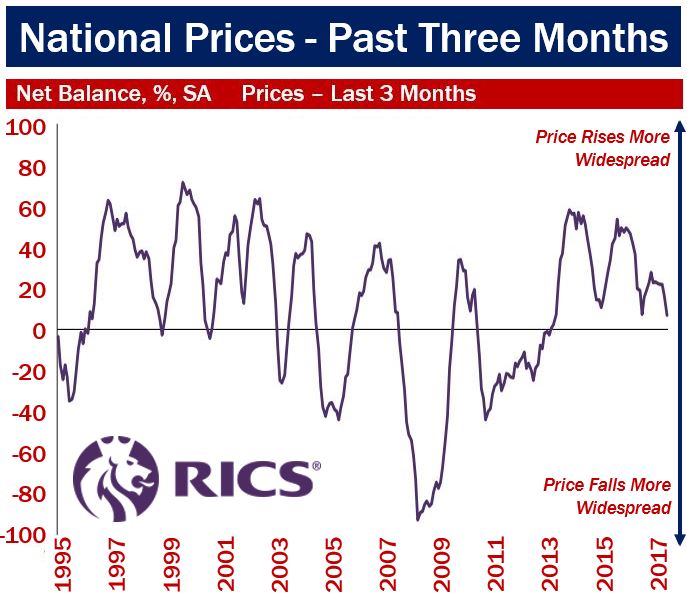

The net % balance of house prices is still in positive territory. However, since June 2016, when Britons voted to leave the European Union, the market has clearly weakened. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

The net % balance of house prices is still in positive territory. However, since June 2016, when Britons voted to leave the European Union, the market has clearly weakened. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

Political uncertainty undermining house price inflation

According to the survey, at a national level, forty-four percent of respondents (surveyors) identified domestic political uncertainty as the driving factor behind the current state of the country’s housing market.

Twenty-seven percent of surveyors believe that Brexit is weakening the current market.

Simon Rubinsohn, RICS Chief Economist, wrote:

“Significantly, most parts of the UK apart from the capital showed a fairly similar pattern to the headline numbers. However, in London Brexit and the changes in Stamp Duty were all equally citied as contributing to the lethargy.”

A net balance of +7% of surveyors across the country in June saw an increase rather than a decline at the headline level of inflation, compared to a net balance of +17% in May.

June’s balance is the lowest since July 2016. The report authors added, however, that this trend is not reflected across the entire country.

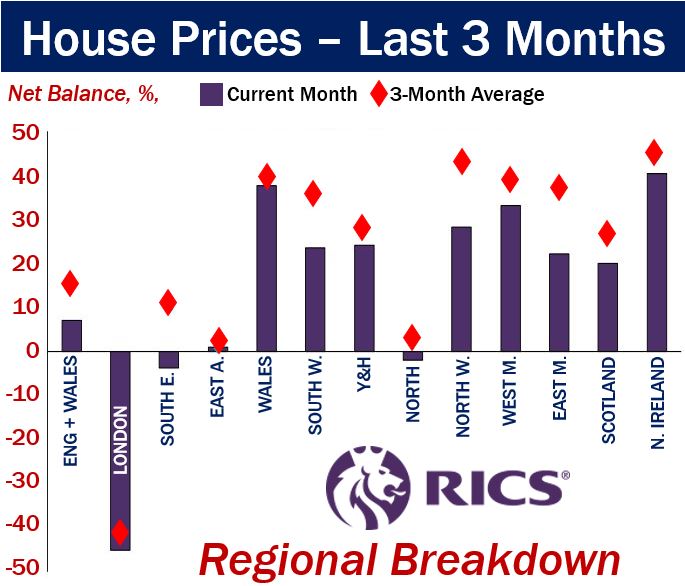

Ever since the Brexit referendum result last year, the London housing market has suffered, unlike most other parts of the country. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

Ever since the Brexit referendum result last year, the London housing market has suffered, unlike most other parts of the country. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

House price inflation by region in June

– Central London posted a continuing fall in house price inflation, with forty-five percent more respondents reporting a decline in prices, while in East Anglia and the South Eat the trend was flatter.

– In Northern Ireland, on the other hand, forty-one percent more surveyors reported a rise rather than a decline.

– In Wales, 39% more respondents saw an increase in prices rather than a fall.

– In the West Midlands and the North West, prices continue to rise, with a net balance of +33% and +28% respectively reporting rises.

Overall activity and transaction levels

Respondents once again reported a fall in newly agreed sales for the month of June, with five percent more respondents reporting weaker sales.

This is the fourth successive month with a negative reading, and reflects both the lack of housing stock coming on to the market and a more cautious stance from house purchasers over recent months.

Mr. Rubinsohn added:

“Newly agreed sales are predicted to remain broadly stable over the next three months but the twelve month sales expectations indicator reading, while still pointing to an increase in activity, has slipped to its lowest level since the immediate aftermath of the referendum [net balance of +12%].”

“Significantly for future activity, new instructions fell again and for the sixteenth month in a row, with 19% more respondents seeing a fall rather than rise in property coming on to the market. Against this backdrop, average stock levels have slipped to a new low.”

The national housing stock has declined considerably since the beginning of this century. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

The national housing stock has declined considerably since the beginning of this century. (Image: data sourced from ‘June 2017: UK Residential Market Survey’)

UK does not have a ‘single housing market’

The report authors said that the latest results demonstrate the danger of talking about a single housing market across the UK. RICS indicators, particularly regarding house price inflation and overall price trends, are pointing towards a rapidly diverging picture.

Upmarket properties are seeing prices slipping back, while in other segments of the market prices are either holding or going up.

Mr. Rubinsohn concluded:

“Perhaps not surprisingly in the current environment, the term ‘uncertainty’ is featuring more heavily in the feedback we are receiving from professionals working in the sector.”

“This seems to be exerting itself on transaction levels which are flatlining and may continue to do so for a while particularly given ongoing challenge presented by the low level of stock on the market.”

Video – UK Residential Market Survey

This RICS video contains some highlights of its Residential Market Survey for June 2017.